A Brazen Bitcoin Heist on Twitter

Plus ERC-20 > ETH?

The large news this week used to be the mass hacking of illustrious Twitter accounts, ostensibly to perpetrate a Bitcoin rip-off. Coinbase declares an upcoming Investor day whilst it faces flak from the crypto community for promoting blockchain analytics software to authorities companies. Plus, Grayscale sees file inflows, PayPal confirms its crypto plans and Abra settles with the SEC and CFTC.

On the Unchained podcast, the “˜Why Bitcoin Now’ sequence continues with authors Michael Casey and Niall Ferguson talking about how Bitcoin suits within the ancient previous of cash, how Bitcoin behaves admire an option on digital gold, and when this would possibly perchance well behave admire digital gold and extra. And on Unconfirmed, we watch on the upward thrust of stablecoins since Sunless Thursday.

This Week’s Crypto News…

Twitter Hack Breaches VIP Client Accounts to Perpetrate a Bitcoin Rip-off

A coordinated attack hacked rather loads of high-profile Twitter accounts, corresponding to those of Elon Musk, Bill Gates, Kanye West, Jeff Bezos, Joe Biden and Barack Obama, to spin a Bitcoin rip-off. The corporate accounts of Apple and Uber had been compromised, as had been those of a host of influential gamers within the crypto home – Binance, Gemini, Coinbase, CoinDesk, Charlie Lee and others.

Larry Cermak, Director of study at The Block, compiled your complete high-profile Twitter hacks in a chronological list.

He says, “The takeaway is that the hacker began with enormous crypto accounts and caught to most productive just a few codecs and addresses. The hacker then moved to non-crypto celebrities two hours after the key hack. They most productive aged three BTC addresses … it’s entirely unacceptable that it took Twitter to act so long as it did. At 4:17 PM ET it used to be entirely sure to anybody that used to be paying attention that Twitter is compromised. It took Twitter 2 hours (at 6:05 PM ET) to commence performing”

Before the full lot, these hacked accounts promoted a Bitcoin giveaway rip-off associated to a firm dubbed “Crypto For Health.” Later, the hackers posted tweets with a Bitcoin contend with along with messages corresponding to – “I’m giving relieve to the community. All Bitcoin sent to the contend with below will doubtless be sent relieve doubled. Ought to you ship $1000, I will ship relieve $2000. Ideal doing this for half-hour. Revel in”

While Twitter reacted quick to eliminate many of the messages, the same tweets had been sent as soon as more from the the same accounts, indicating that the hackers had totally overwhelmed Twitter’s safety infrastructure. The usual social media platform had to finally disable some of its services quick to prevent the rip-off from spreading additional. On Thursday, the Federal Bureau of Investigation said it had opened an investigation into the hours-long hack.

In accordance to reports, the Bitcoin wallets promoted within the tweets got over 300 transactions and Bitcoin worth over $100,000 indicating that some Twitter users fell prey to the rip-off. A Twitter investigation printed that the hackers had compromised employee accounts in a “coordinated social engineering attack”.

Security consultants absorb urged that the blame for the incident squarely rests with Twitter resulting from safety flaws in its provider. On the other hand, a contemporary remark by VICE even suggests that hackers can absorb convinced a Twitter employee to reduction coordinate these takeovers.

Following these hacks, the social media platform is now limiting posts containing crypto addresses. It has disabled the ability to fragment strings of numbers and letters on its scheme, in general aged in crypto addresses. In accordance to tests performed by The Block Analysis, Litecoin, XRP, Monero, Bitcoin and Ethereum addresses couldn’t be shared thru tweets.

Grayscale records largest quarterly inflows in Q2, 2020

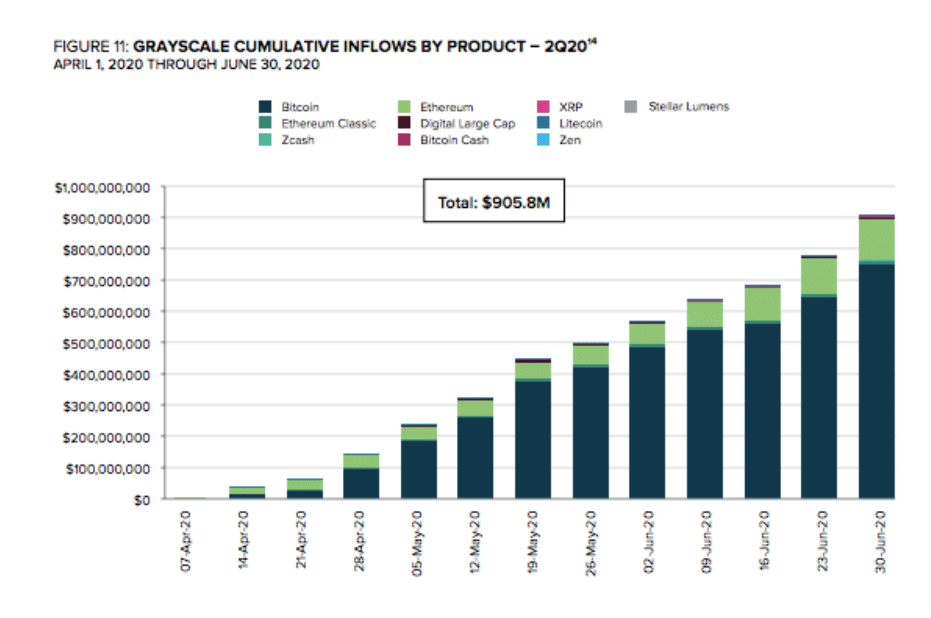

Digital asset supervisor Grayscale has recorded its largest quarterly inflows ever in Q2 2020. The firm raised $905.8 million in that quarter, a virtually 100% leap from its outdated highs of $503.7 million in Q1, 2020.

The firm said in a remark, “For the key time, inflows into Grayscale’s products over a 6-month duration crossed the $1 billion threshold, demonstrating sustained demand for digital asset exposure despite a backdrop characterised by economic uncertainty.” Following a winning quarter, cumulative investment across Grayscale’s digital asset products has now reached $2.6 billion. Its products – Grayscale Bitcoin Believe and Grayscale Ethereum Believe – both experienced file quarterly inflows of $751.1 million and $135.2 million, respectively.

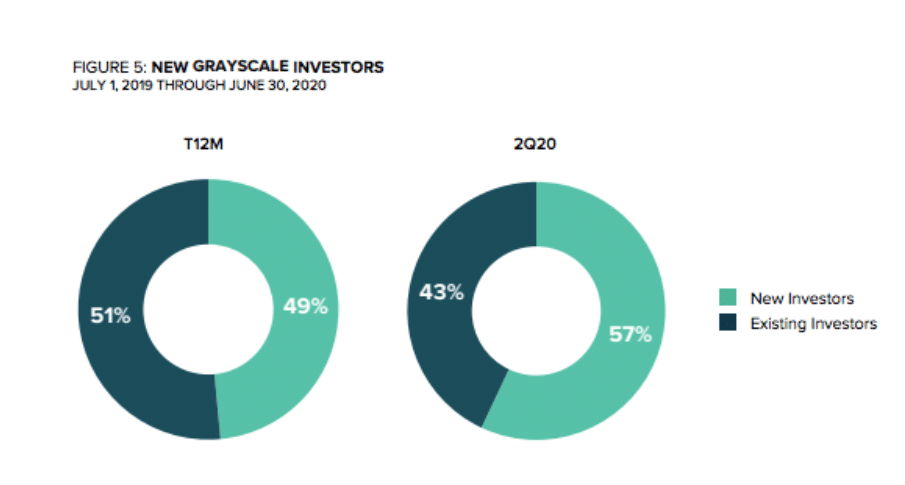

Grayscale’s products additionally saw interest from contemporary traders who accounted for 57% of the investor disagreeable in Q2, 2020. In the the same duration, 81% of the reward institutional traders distributed their investments in direction of a few products.

Grayscale’s complete AUM now stands at $4 billion.

Whenever you are at it, hear to Barry Silbert, founder and CEO of Digital Forex Team – the mummy or father firm of Grayscale, focus on his firm and extra, on the Unchained podcast.

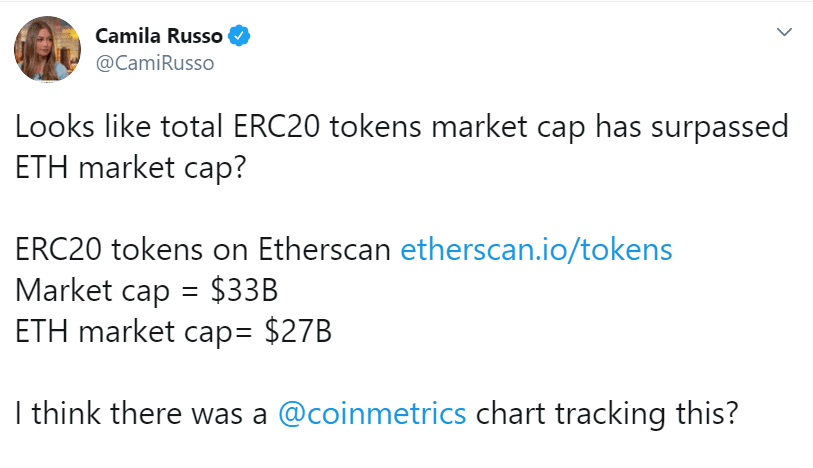

ERC-20 tokens market cap surpasses Ethereum

As Ethereum inches nearer to ETH 2.0, the ERC-20 ecosystem looks to be having its receive enormous second. In accordance to data compiled by Camila Russo, founder at crypto media newsletter The Defiant, the ERC-20 tokens running on the Ethereum community had a cumulative market cap of $33 billion whereas its native token ETH used to be at a market cap of $27 billion.

Most of the usual ERC-20 tokens are aged in DeFi, and in accordance with Decrypt, DeFi tokens are rising at a sooner payment when put next with Bitcoin. Interestingly, Camila tweeted, “The Ethereum economy is now extra famous than the asset securing it. This challenges the fat protocol thesis, which says blockchain protocols capture extra payment than their apps.”

Coinbase plans first ever investor day

Coinbase has deliberate its first-ever investor day on August 14th, fuelling rumors that the alternate is exploring alternate options to head public. A Coinbase spokesperson said that the upcoming assembly is meant to “to facilitate a powerful broader figuring out of cryptocurrencies and blockchain expertise.”

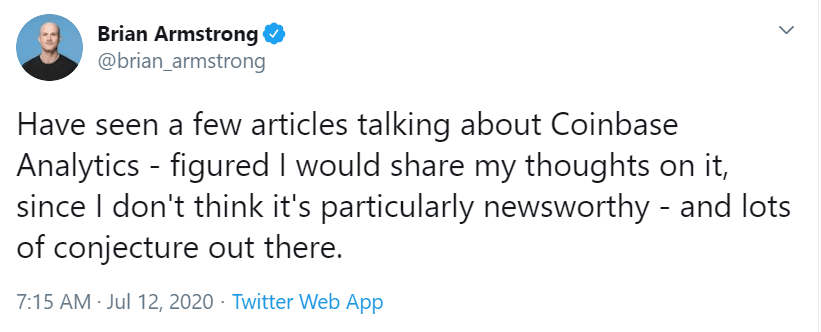

Final week, there had been reports that the alternate shall be planning a inventory market listing later this yr. The announcement of the investor day comes at a time when Coinbase is facing flak from the crypto community for providing its blockchain analytics software to the US Secret Service. Coinbase CEO Brian Armstrong wrote a tweet thread to shield his firm’s decision of licensing analytics software to authorities companies. He argued that blockchain analytics software has been around for an extraordinarily very long time and other folks nonetheless had the option of the usage of privacy coins if they considerable ‘magnificent privacy’.

On the other hand, on Twitter, Larry Cermak of The Block identified the rather loads of inconsistencies in Brian’s tweets, asserting, “What’s nonetheless no longer sure is whether or no longer Coinbase is giving authorities companies rating admission to to the stout cluster of all of their addresses. Coinbase has steadily had a notoriously annoying space of addresses to cluster. That data is most productive ever probabilistic unless you are Coinbase. … Do not put out of your mind that in 2018, Coinbase served client data of 13,000 users to the IRS. Whenever you mix client data exports with supreme data of the cluster, it creates a brand contemporary (unhealthy) dynamic.”.

PayPal confirms it’s establishing crypto capabilities

PayPal has confirmed that it’s monitoring the crypto home intently and establishing crypto capabilities. The funds giant had written a letter to the European Commission in March the build it said, “PayPal is consistently monitoring and evaluating global developments within the crypto and blockchain/distributed ledger home,” and said it’s taking “unilateral and tangible steps to additional develop its capabilities on this scheme,” confirming earlier reports this would possibly perchance well supply procuring and promoting of crypto.

Abra hit with $300k in Penalties by SEC, CFTC over ‘Illegal’ Swaps

The SEC and CFTC filed and settled expenses against crypto app Abra (disclosure, a outdated sponsor of my reveals) for a product that enabled other folks to “rating artificial designate exposure to the payment actions of shares and alternate-traded fund (“ETF”) shares that alternate within the US.” The SEC charged Abra and its Philippines-basically basically based mostly accomplice firm Plutus Applied sciences for “providing and promoting safety-basically basically based mostly swaps to retail traders without registration and for failing to transact those swaps on a registered nationwide alternate.” On the other hand, the CFTC charged both companies for “entering into unlawful off-alternate swaps in digital sources and foreign substitute with U.S. and foreign prospects and registration violations.” Even supposing the Abra products had been technically no longer securities, the SEC said that these swaps had been alternatively subject to US securities licensed pointers.

Will this delivery a can of worms for other DeFi products? Blockchain consultant Maya Zehavi completely thinks so. She tweeted, “me thinks the SEC & CFTC are initiating to signal they don’t admire DeFi. … the magnificent originate Abra aged in these swap contracts is definitely the associated to those underlying most DeFi products. hence, they’ll potentially face the the same staunch expenses”:

Meet Amiti Uttarwar – the First Confirmed Female Bitcoin Core Developer

Forbes ran a characteristic on Amiti Uttarwar, the key confirmed girl developer of Bitcoin Core. She’s an ex-Coinbase employee and Chaincode Labs alumna, and her talk titled “Attacking Bitcoin Core” is one the most complete presentations on the Bitcoin community. Her work specializes in two main areas of the community — privacy and take a look at coverage. No doubt study out this profile!

Source credit : unchainedcrypto.com