A Binance ‘Decoy’ for US Regulators?

Banks ❤️ Bitcoin

After years of skepticism, JPMorgan despatched out its rationale for why Bitcoin can also double or triple in a research level to despatched out to its buyers. It furthermore has been reaching out to crypto-native companies in the hopes of enlisting sub-custodians to present crypto custody. And Michael Del Castillo of Forbes printed an intensive see at what would possibly possibly possibly possibly well be the actual motive of Binance’s U.S. arm, Binance.US.

There’s hundreds bank-connected files this week, alongside side a crypto-friendly bank that reported strong earnings in the third quarter, with much of the success credited to digital currency exercise. In other files, on-chain metrics are pointing to what would possibly possibly possibly possibly well be the most critical Bitcoin breakout but. And but but one more DeFi project has fallen prey to a manipulative attacker. Moreover, Coinbase has announced plans to originate a Visa debit card in the U.S. subsequent one year, and we’ve bought some hilarious suggestions from my Twitter followers on techniques to beget an even time the 12th anniversary of the Bitcoin white paper.

On Unchained, performing comptroller of the currency Brian Brooks discusses the future of crypto banks, internal most blockchain-based mostly fully transactions and how regulators admire the OCC would possibly possibly possibly possibly well manner DeFi. And on Unconfirmed, Matt Hougan of Bitwise explains how institutional buyers in crypto beget changed since 2017 and why the JPMorgan research level to on Bitcoin is so valuable.

This Week’s Crypto Recordsdata…

JPMorgan Is Lastly Bullish For Bitcoin

After years of skepticism, JPMorgan is now projecting Bitcoin’s trace can also query a “doubling or tripling,” assuming fresh inclinations maintain. A research level to printed by the bank says the cryptocurrency is a sound replacement to gold among millennials while aloof cautioning that Bitcoin is overbought in the advance timeframe. In addition to to demographic inclinations, the company cites obvious developments for Bitcoin such because the most up-to-date announcement by PayPal to present Bitcoin to potentialities as well to companies corresponding to Square alongside side the asset to their balance sheets.

JPMorgan furthermore had other crypto-connected files this week. The Block reports that the bank has been in talks with crypto-native companies as it explores the blueprint it’ll offer cryptocurrency custody. The conception would seemingly be for JPMorgan to enlist sub-custodians to produce services and products, and it has reportedly reached out to Fidelity Digital Sources and Paxos, among others. Amidst all of this JPMorgan blockchain files, the firm’s digital currency, JPM Coin, is being worn commercially for the first time this week to send funds worldwide. It furthermore rebranded its banking network to the name Liink and invited its 500-plus financial institutions to originate building on the platform. The head of that product, Christine Moy, known as it “the muse of an endeavor mainnet.” All these blockchain and digital currency efforts beget now been housed below a brand new alternate known as Onyx, which on the moment has bigger than 100 staffers.

Used to be Binance.US Predicament Up as a Decoy for US Regulators?

Michael Del Castillo at Forbes did an intensive see into Binance’s manner to US laws — and in grunt its motive on the inspire of building the regulatorily compliant Binance.US. Michael obtained a 2018 doc that detailed its plans for the originate of the entity that would possibly possibly possibly possibly well sooner or later turn out to be Binance.US but used to be on the time known as ‘the Tai Chi entity,” which Michael says is, “an allusion to the Chinese martial art whose manner is constructed across the precept of ‘yield and overcome,’ or utilizing an opponent’s beget weight against him.” He says, “While the then-unnamed entity plan up operations in the US to distract regulators with feigned interest in compliance, measures would possibly possibly possibly possibly well be set apart in establish to trek earnings in the produce of licensing prices and more to the parent company, Binance.”

One of the crucial more startling revelations from the doc are a valorous bullet level that says, “Key Binance Personnel proceed to operate from non-U.S. areas to manual clear of enforcement dangers.” The doc then furthermore says, “License and restore prices paid by the US Service company to Binance are functionally US-sourced shopping and selling prices.” Then Michael writes, “But not like an accurate subsidiary whose parent company shall be held accountable for regulatory violations, the Tai Chi entity would beget runt bigger than a contractual relationship, extra ‘insulat[ing] Binance from U.S. enforcement,’ in line with the doc.” Michael writes, “Indubitably, it would be a decoy.”

This article is presumably the most thorough see into how Binance is taking part in regulatory arbitrage, in grunt with US regulators. It’s for certain price a learn and for certain supplies arguments to folks that mediate Binance is taking part in mercurial and loose in phrases of US laws, as well to those that mediate US laws concerning crypto are too stringent.

Crypto-Friendly Monetary institution Silvergate Reports Solid Earnings

After the OCC’s letter this summer season giving banks the authority to custody crypto sources, there’s moderately a couple of obvious crypto files from banks, alongside side those that beget long been concerned with the alternate. As an instance, Silvergate Monetary institution, which has long been friendly to crypto companies, printed an ideal third quarter with much success connected to digital currency exercise. CEO Alan Lane stays bullish on the bank’s payment platform, the Silvergate Commerce Community, after seeing $36 billion in transfers over the final quarter, which surpassed the quantity transferred in all of 2019. The assortment of digital asset potentialities has furthermore risen by 23% to over 900. Lane furthermore says the entry of JPMorgan, which furthermore banks Silvergate buyer Gemini, into the sector hasn’t resulted in any loss of alternate.

Avanti Granted Monetary institution Charter

A Wyoming assert regulator has voted unanimously to grant Avanti Monetary institution & Believe a bank structure, which supplies the firm the same powers as national banks in its licensed alternate traces. Avanti is licensed to present various merchandise and services and products, most particularly a tokenized U.S. greenback known as Avit. Calling this token a “stablecoin disruptor,” Avanti says it is designed to clear up issues in legacy payment systems that beget long plagued merchants, buyers, and company treasurers. “Avanti’s mission is to produce a compliant bridge between the usual and digital asset financial systems, with the strictest stage of institutional custody requirements,” acknowledged Caitlin Long, Avanti’s founder and chief executive officer.

On-Chain Metrics Level to Bitcoin Breakout

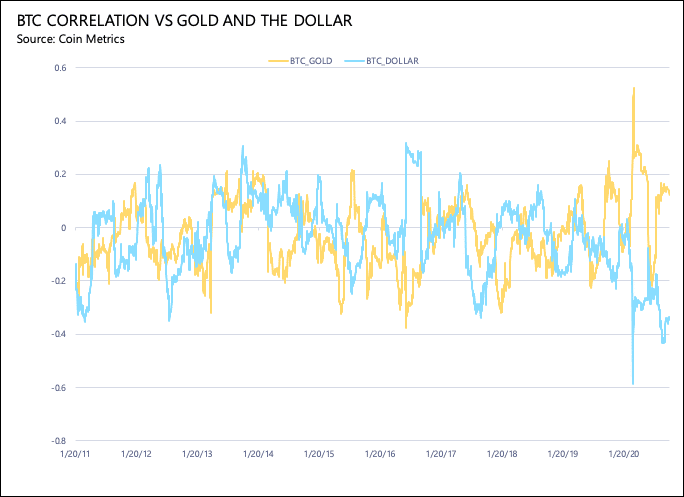

The Bitcoin trace has been growing gradually for the reason that March crypto atomize, and, in line with Coin Metrics, the knowledge suggests BTC shall be making ready for its most critical breakout but. Bitcoin’s correlation with gold has been at advance all-time highs since March, while its correlation with the greenback has been at all-time lows, extra supporting the thesis that Bitcoin serves as a digital model of gold.

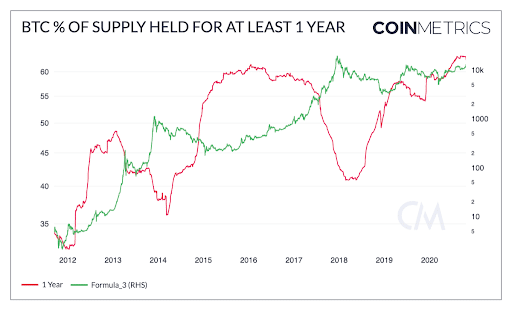

In addition to to these correlations, on-chain holding is growing. As of October Twenty fifth, terminate to 62.5% of all BTC has been held for not decrease than a one year — advance all-time highs.

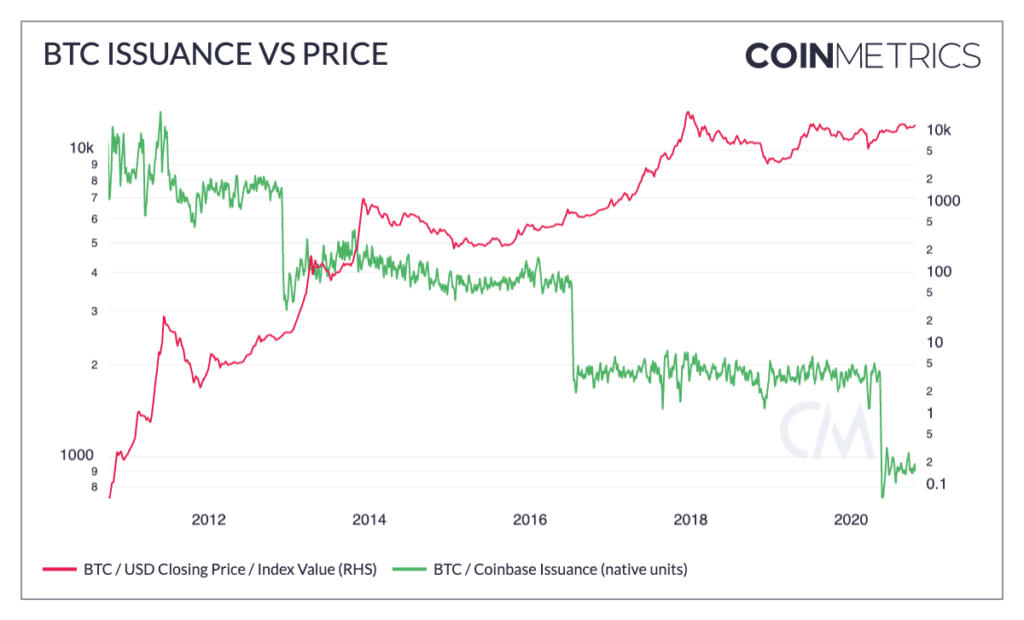

As holders amplify, trek is at all-time lows, furthering Bitcoin’s pattern in direction of a store of price moderately than a medium of replace. Bitcoin is furthermore being moved off of centralized exchanges in growing numbers, suggesting more Bitcoin owners prefer corpulent regulate of their keys. As the assortment of holders continues to grow, the Bitcoin present inflation decreases with every halving, continuing to force the price upward.

$33.8 Million Drained From Harvest Finance At some level of Assault

An arbitrage alternate exploited feeble ingredients in the Harvest Finance DeFi protocol on Monday, allowing an attacker to originate off with $33.8 million. The exploit despatched Harvest’s native FARM token tumbling 65% in decrease than an hour, and the total price locked in the protocol plummeted due to this. The attacker returned $2.5 million, for unknown causes, quickly after the attack.

Utilizing a flash loan, the attacker used to be ready to take on wide leverage with zero blueprint back in enlighten to manipulate the USDC:USDT ratios in the Y pool of Curve, which allowed them to generate a profit.

Promising to put into effect UX adjustments to forestall such incidents in due direction, Harvest claimed to know the attacker’s identification, announcing they’re “neatly diagnosed in the crypto neighborhood.” Harvest then provided the bitcoin addresses of the attacker containing what they known as “a valuable quantity of in my conception identifiable knowledge” and they set apart up a $100,000 bounty for the first person or crew to get dangle of the attacker to come inspire the funds to the deployer take care of.

Though the attack is devastating, folks beget stopped short of calling it a hack. A twitter thread by crypto lawyer Gabriel Shapiro makes a case as to why this must always be viewed, at most, as “a manipulative gadget, plan or artifice to defraud” and even as “commodities topic market manipulation.”

The Harvest incident isn’t the one most up-to-date attack that would possibly possibly possibly possibly’t be viewed as a usual hack. On Monday, somebody worn a flash loan of MKR to pass a governance vote on MakerDAO, prompting the stablecoin project to space a warning. The event furthermore highlighted the influence flash loans can beget on DeFi, on this case, being utilized by an exterior occasion that wished its proposal passed.

In connected files, OpenZeppelin has launched OpenZeppelin Defender, a platform for building on Ethereum with security supreme practices in-constructed. Optimistically, with more merchandise admire this, we’ll query fewer and fewer of these DeFi exploits.

Coinbase Launching Crypto Debit Card

Coinbase plans to originate a Visa debit card in the U.S. subsequent one year that will offer 1% inspire in Bitcoin or 4% inspire in Stellar. (Disclosure: Stellar has been a sponsor of my podcasts.) The company, which plans to originate distributing the cards in the first half of of subsequent one year and has opened a waitlist for U.S. potentialities, sees the cardboard’s originate as a “valuable milestone” to crypto’s mainstream adoption.

A Week’s Crypto Recordsdata in 46 Seconds

Girl Gone Crypto, who I admittedly chanced on staunch earlier than penning this, printed a hilarious vlog of per week in crypto, which begins, “$13k — that’s it, that’s the video,” and touches on the PayPal files, pokes fun at CBDCs, Filecoin and Ethereum 2.0, and furthermore drinks to Microstrategy CEO Michael Saylor. Positively price sorting out — especially for shots of her vacation in what appears to be like to be like admire Southern California!

https://twitter.com/girlgone_crypto/web site/1320108909097406464

Chuffed 12th Birthday, Bitcoin White Paper!

When you happen to’re looking for to procure fun pandemic-friendly suggestions to beget an even time the 12th birthday of the Bitcoin white paper being printed, I already solicited some for you from my Twitter followers. My celebrated says, “I’m going to beget a #bitcoin cocktail. One thing with orange, no melting ice cubes, and restricted present.”

And my NSFW, but since we’re all working from home anyway, runner-up celebrated retort to the question, “What are you doing to beget an even time the 12th anniversary of the newsletter of the Bitcoin white paper?” used to be this by @crypto_rand: “Coke.”

Coke

— Crypto Rand (@crypto_rand) October 29, 2020

Source credit : unchainedcrypto.com