A ninety nine% Tumble in Charge

Plus two 51% attacks, extortion, an exploit, and an exit scam.

As prices swell and traction begins to create in the entirety from Bitcoin purchases to DeFi exercise, there’s also rather a shrimp little bit of exercise going on within the underbelly of crypto — hacks, attacks, scams. Leading the week’s news used to be the arrest of Graham Ivan Clark, the alleged mastermind of the Twitter hack, who grew to change into out to be a 17-year-ragged self-proclaimed “tubby time crypto trader dropout.” There were also two 51% attacks on Ethereum Classic, an exit scam on a Korean fork of YFI and an exploit on Opyn. But there used to be particular news too, with Square’s Cash App better than doubling its Bitcoin gross sales earnings from Q1, and Ethereum launching the testnet for Ethereum 2.0. And, it looks lawmakers are having a phrase to provide protection to future proof-of-stake validators from huge IRS complications.

On Unchained, CipherTrace’s Dave Jevans and X Reg Consulting’s Sian Jones discuss about doubtlessly the most consequential global crypto law that will be rolled out over the subsequent few years — the shuttle rule. And on Unconfirmed, Michael Sonnenshein of Grayscale talks about its submitting of a Construct 10 for the Grayscale Ethereum Belief, which is able to enable it to change into an SEC-reporting firm.

Twitter Hack Mastermind Became once 17-Year-Old

Graham Ivan Clark, a 17-year-ragged Tampa resident, used to be arrested closing Friday for allegedly being the brains within the aid of closing month’s Twitter hack, valid thru which the accounts of Barack Obama, Jeff Bezos, Joe Biden and other prominent of us were taken over. As The Fresh York Cases put it, “His arrest raised questions about how someone so young may well penetrate the defenses of what used to be supposedly one in every of Silicon Valley’s most sophisticated technology corporations.”

Clark had a afflicted family life and spent noteworthy of his time on-line, where he developed a standing for “scamming” of us out of money, photos and records, based mostly fully totally on of us that, for occasion, done video video games equivalent to Minecraft with him and obtained swindled for $50 or $100. He later obtained inquisitive about cryptocurrencies and joined an on-line discussion board called OGUsers, where he described himself as a “tubby time crypto trader dropout,” but used to be later banned by the neighborhood after failing to pay Bitcoin to an individual. From OGUsers, he entered a hacker neighborhood that targeted on SIM swapping of us’s phone numbers so as to acquire obtain entry to to take their cryptocurrency. That neighborhood targeted a Seattle tech investor and drained his accounts of 164 bitcoins, then price $856,000 — now price $1.9 million. The extortion present used to be signed by “Scrim,” which is allegedly one in every of Clark’s on-line aliases. In April the Secret Provider seized 100 bitcoins from Clark and the Seattle tech investor bought a letter from the Secret Provider asserting the agency had recovered 100 of his Bitcoins. Moreover, The Block reports that Clark currently has 300 BTC ($3.5 million). A chum of Clark’s said the traipse-in with the Secret Provider worried him, but within two weeks, based mostly fully totally on the manager affidavit, he contented a Twitter employee that he worked within the social media firm’s IT department — and from there the hack began.

Square’s Cash App Bitcoin Gross sales Extra Than Double to $875 Million

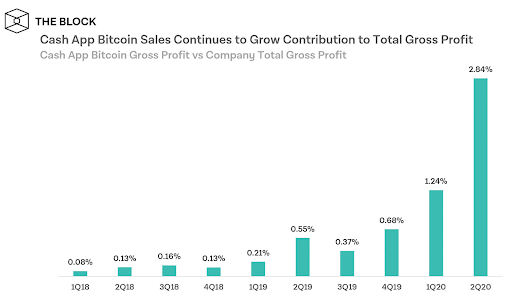

In the 2d quarter of 2020, the Square Cash App noticed earnings of $875 million, which, because of it’s per the acquisition designate, also reflects the runup in BTC. On the other hand, even the Cash App’s noxious earnings has also better than doubled, from $7 million in Q1 to $17 million in Q2. Earnings is up 600% year over year and the bitcoin noxious earnings is up 711% year over year. And based mostly fully totally on this chart by The Block, as a percentage of the firm’s total noxious earnings, it shot up from 1.24% in Q1 to 2.84% in Q2.

On a linked present, after the bitcoin and ether prices both rose dramatically within the previous couple of weeks, they also both noticed a transient break within six minutes on Sunday — with bitcoin losing by 12% and ether by 20% — as better than $1 billion in futures used to be liquidated. On the other hand, the prices hold mostly recovered since.

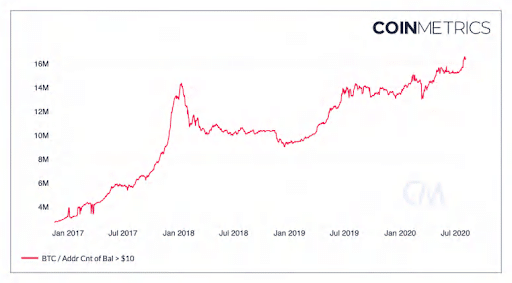

And within the period in-between, based mostly fully totally on Coin Metrics, Bitcoin addresses with at least $10 or more of cryptocurrency hold hit a brand novel all-time high of 16.6 million, up 14.5% from the outdated peak of 14.5 million from January 2018.

Ethereum 2.0 Testnet Goes Are residing

The final testnet forward of the open of Ethereum 2.0 went survive Tuesday, with 20,000 validators staking 650,000 ETH. The testnet also substances five possibilities: Teku, Prysm, Nimbus, Lodestar and Lighthouse.

Whereas you’re shopping for an correct overview of the suppose of Ethereum at the novel time, Delphi Digital launched the major of its month-to-month reports on Ethereum, going over somewhat noteworthy every major discipline on the network, at the side of the entirety from whether Ethereum’s proof of stake arrangement can compete with yield in DeFi to the particulars of Ethereum Impart Proposal 1559. It reveals how DeFi is main Ethereum’s momentum, gives an analysis of demand for Grayscale’s Ethereum Funding Belief, and breaks down the quite lots of points of interest of DeFi in areas equivalent to decentralized exchanges, yield farming as a token distribution mechanism and what the growth of Bitcoin on Ethereum manner for the safety of the Bitcoin blockchain. Undoubtedly one of the most more intriguing charts reveals that 58% of ETH has no longer moved in over a year. One other reveals that the DeFi protocols that introduced liquidity mining noticed mercurial boost among customers, though Uniswap, which would now not hold a token, peaceful has doubtlessly the most customers overall.

Ethereum Effect of abode and Future Volumes Increasing Sooner Than Bitcoin’s

The Block reports that Bitcoin’s market cap is roughly five situations that of Ethereum, but shopping and selling volumes for ether within the placement and futures market is rising faster. Since September 2019, on the placement markets, the ETH/BTC designate ratio has better than doubled, and the shopping and selling volume of ETH is about half of that of BTC, whereas in September, it used to be at 19%. The ratio of ETH futures shopping and selling volume to BTC futures shopping and selling volume has elevated from 8% in September to 29% at the novel time.

Two 51% Attacks on Ethereum Classic: The First Nets Attacker $5.6 Million

After plenty of days, what used to be at the initiating thought to be an innocent mistake on Ethereum Classic grew to change into out to be a 51% attack by a malicious miner. In the crash, the attacker double-spent 807,260 ETC, ($5.6 million) while spending correct 17.5 BTC ($192,000) to crash it. The capability this individual carried it out used to be by sending ETC from an substitute to his or her hold wallets, then aid to the factitious on the ETC blockchain. The attacker then historic what amounted to bigger than 51% of the ETC hash energy to mine thousands of blocks, valid thru which he or she despatched ETC from those wallets to other wallets he or she managed as a replacement of aid to the factitious. The attacker then broadcast those blocks, which reorganized the chain, replacing those blocks containing the transactions to the factitious with the transactions to the other wallets. It looks OKEx may well were the factitious targeted.

And if that isn’t loopy ample, on Thursday, Ethereum Classic experienced a 2d 51% attack with a reorganization of better than 4,000 blocks. CoinDesk reported that the massive majority of Ethereum Classic miners are persevering with to mine the shorter version of the chain, though the reorganized blockchain is currently longer.

4 Dwelling Participants Quiz IRS No longer to Tax Proof-of-Stake Block Rewards

Four individuals of the Congressional Blockchain Caucus wrote a letter to the Inner Earnings Provider soliciting for that stakers no longer obtain taxed for receiving block rewards, but most productive on their positive aspects after they promote. Representatives David Schweikert of Arizona, Bill Foster of Illinois, Tom Emmer of Minnesota, and Darren Soto of Florida wrote, “It is you can think in regards to the taxation of ‘staking’ rewards as earnings may well overstate taxpayers’ actual positive aspects from taking part on this novel technology. It also can lead to a reporting and compliance nightmare, for taxpayers and the Provider alike.” Undoubtedly one of the most troubles is that staking protocols may well release novel tokens every quick time, which may well create hundreds of taxable events yearly. One other is that positive aspects enact no longer consistently replicate earnings, because of an individual staker’s tokens may well kind bigger by 6% but that would be due to provision of tokens on the network has elevated 5%. Coin Center advocates that block rewards no longer be taxed as earnings, but “bask in flowers, minerals, cattle, artwork and assembly widgets: they must peaceful be taxed after they’re sold, no longer after they’re created.” The advocacy neighborhood says validating on a proof-of-stake network isn’t bask in being paid earnings, but insead, bask in creating a treasured merchandise thru labor, the capability one may well “[grow valuable] flowers on one’s hold land or [extract] minerals from one’s hold mines.”

DeFi Hacks, Scams and Blunders Roundup

Some customers of DeFi alternatives issuance platform Opyn lost 371,000 USDC attributable to an exploit on its ETH put contracts. The attacker used to be ready to take the collateral of some puts by “double exercising” oTokens.

Equally, the creator of Asuka token, a fork of YFI, allegedly exit scammed. Korean crypto news shops reported that Jongchan Jang shut down the token’s internet pages and social media accounts; the Asuka token plummeted from $1,600 to $19.

yVault, a brand novel product put out by yEarn, used to be a shrimp bit luckier when Wander of Bits caught a malicious program forward of any exploit took place that may well hold allowed an attacker to drain most if no longer the total pool’s yUSDC sources.

Meanwhile, The Block reports that the SEC is having a phrase to buy a blockchain forensics arrangement to back it show screen tidy contracts to detect the contract arrangement, token sale specifications, permission management, and security and vulnerability management.

For These Who Keep in mind the Days of the DAO …

Dan Robinson of crypto VC agency, Paradigm, tweeted, upon hearing the news that the Ethereum Classic chain had been 51% attacked, “I used to be informed that this used to be the immutable chain.”

Source credit : unchainedcrypto.com