A $115K Bitcoin by August?

PLUS: The total lot you may presumably well well also very effectively be looking out to know about COIN

Happy Coinbase sing checklist week! Whereas you happen to continue to desire more Coinbase enlighten, I would counsel clicking here, here, and here — or genuine take a look at out this week’s Unconfirmed episode that comprises Gil Luria, director of evaluate at D.A. Davidson!

Whereas Coinbase took middle stage this week, crypto continued to cycle through headlines at a handy e-book a rough tempo. As bitcoin and ether hit all-time highs, the United States created a gamut of headlines that can presumably well well affect crypto for years to arrive help: Gary Gensler became as soon as confirmed as the contemporary chairman of the SEC, Biden’s administration expressed disclose over China’s head originate in digital currencies, and SEC Commissioner Hester Peirce unveiled a proposal to raised help a watch on token offerings.

In a form of data…

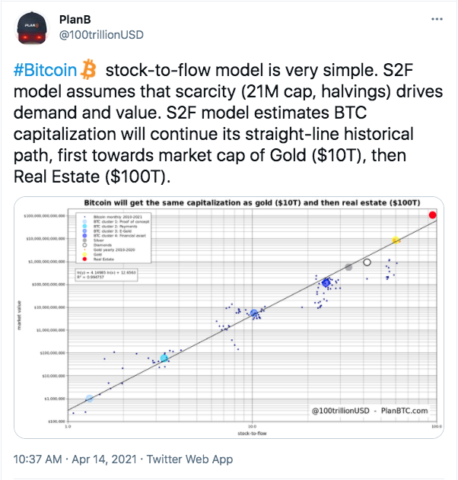

- PlanB’s stock-to-wander along with the circulate model predicts Bitcoin’s market cap surpassing gold at $10 trillion (and more)

- Binance now permits certain possibilities to change tokenized shares of Tesla… along with one a form of stock that can presumably well well shock you

- Ethereum’s Berlin fork went dwell on Thursday, inflicting a first-rate replace to temporarily suspend ETH withdrawals

- Michael Saylor became as soon as interviewed by a 3-three hundred and sixty five days-aged, and it’s far a must gaze (scroll the total scheme down for the hyperlink)

On Unchained, Peter L. Brandt, ancient trader and creator of the Ingredient Anecdote, alongside Willy Woo, prominent on-chain Bitcoin analyst and creator of the “The Bitcoin Forecast,” focus on all issues Bitcoin, in conjunction with Peter’s observation that the top probably time in historical past he’s viewed charts that investigate cross-test fancy Bitcoin’s upward push towards the greenback became as soon as when the worth of the German tag became as soon as collapsing, to the level where one USD equaled 4.4 billion marks. On Unconfirmed, Gil Luria breaks down Coinbase’s efficiency in its first couple of days as a public firm, plus gives us his deal with its future possibilities.

Listen to the Most trendy Episode of Unchained

Why Bitcoin’s December Imprint Target Is Now ‘Above $300,000’

In an interview I moderated at Valid Vision’s “Crypto Gathering,” Peter L Brandt, ancient trader and creator of the Ingredient Anecdote, and Willy Woo, prominent on-chain Bitcoin analyst and creator of the “The Bitcoin Forecast,” a market intelligence e-newsletter, focus on Bitcoin charts, trading, and how Bitcoin is evolving as an asset.

Listen to the Most trendy Episode of Unconfirmed

Gil Luria, director of evaluate at D.A. Davidson, talks about Coinbase’s efficiency on its first day as a public firm.

Thank you to our sponsors!

Download the Crypto.com app and gain $25 with the code “Laura”:

Test out InterPop, a superteam redefining the vogue forward for NTFs and fandom!

This Week’s Crypto Knowledge…

BTC Hits Yet some other All-Time Excessive Love Clockwork

Bitcoin surged to a file excessive of $64,899 on early Wednesday morning. Amidst the recent bull trot fueled by institutional funding, NFTs, and Coinbase’s sing checklist, it looks a brand contemporary Bitcoin height is barely even meme-great on Twitter anymore.

What is great, nonetheless, is that one crypto funding firm projected, a three hundred and sixty five days ago, that the worth of Bitcoin would break $62k this month. In its April 2020 investor e-newsletter, at a time when bitcoin traded at roughly 10% of its recent tag, Pantera Capital precisely projected Bitcoin would negative $62k this month.

Pantera conventional projections in accordance with a stock-to-wander along with the circulate model — which assumes that Bitcoin’s shortage drives demand of and fee. Pantera CEO Dan Morehead noted, “This Bitcoin rally is EXACTLY fancy old halvings. [Bitcoin is] Likely to be triumphant in $115k by August.” Pantera additionally precisely known as when Bitcoin would break $30k, $40k, and $50k in old months.

In a tweet, PlanB, a prominent stock-to-wander along with the circulate bitcoin analyst, estimated “BTC capitalization will continue its straight-line historical path, first towards market cap of Gold ($10T), then Valid Property ($100T).”

If S2F fashions must now not convincing ample for you, Michael del Castillo, anyone I take into memoir a Forbes colleague despite the indisputable truth that we didn’t overlap there, reported that 24% of Forbes’ Blockchain 50 Symposium attendees acknowledged their corporations will aquire bitcoin this three hundred and sixty five days; a fashion that can presumably well supply the institutional capital most important to continue bitcoin’s path toward a $115,000 tag in August and, additional down the motorway, gold’s $10T market cap as predicted by Pantera and PlanB respectively.

Gary Gensler Named SEC Chair

The U.S. Senate officially confirmed Gary Gensler as chairman of the Securities and Change Price. Beforehand, he became as soon as the inclined chairman of the Commodity Futures Shopping and selling Price and served on MIT’s college, where he taught classes on blockchain.

As SEC chair, Gensler’s knowing on crypto will likely affect the SEC’s lawsuit towards Ripple and the viability of a bitcoin ETF within the U.S.

Two a form of regulatory reviews stood out this week:

- IRS commissioner Charles Rettig admitted that fashioned crypto reporting tips would “entirely” help shut the tax gap — which is the quantity of U.S. taxes owed that have yet to be paid.

- Blockchain forensics firm CipherTrace, which, disclosure is a old sponsor of my shows, launched machine to help DeFi protocols follow the U.S. Treasury’s Place of job of International Sources Sustain watch over. CipherTrace’s contemporary instrument blocks OFAC-sanctioned blockchain addresses that can also very effectively be connected to terrorist funding. Very bizarre to hear what knowing DeFi protocol builders have of this machine.

Fears Over Shedding Ground to China Spark Bitcoin Conversation within the U.S.

- In accordance with a Bloomberg document, the Biden administration is skittish by the lengthy-time duration results the digital yuan can also have on the energy of the greenback. China has already created and disbursed its digital currency — a first for a first-rate economy. (If this matter interests you, gain certain to now not miss my interview closing summer season with historian Niall Ferguson and CoinDesk’s Michael Casey, which touched on this disclose.)

- As reported by Forbes, Michael Morell, a inclined CIA director who spent 33 years at the agency, printed an autonomous ask which concluded: 1) worries about bitcoin as a instrument for illicit finance are overstated 2) blockchain diagnosis is a highly effective instrument to mitigate crime. His conclusions can also score the glory of Treasury Secretary Janet Yellen, whose latest remarks have targeted on how crypto shall be conventional for money laundering or terrorist financing. He told Forbes, “we desire to ensure that the archaic wisdom that is evil in regards to the illicit use of Bitcoin doesn’t defend us help from pushing forward the technological adjustments which may also very effectively be going to enable us to help tempo with China.”

- On CNBC, when asked about Secretary Yellen and Fed Chair Jerome Powell’s formulation to Bitcoin, Congressman Kevin McCarthy had some powerful words: “They tried to ignore it to gain it wander away…. Of us that help a watch on, those who are in authorities that gain coverage better originate working out what it scheme for the future due to a form of countries are animated forward, especially China. I invent now not desire The US to drop within the help of.”

Binance Launches Tokenized Stock Shopping and selling

Particular Binance users can now comprise tokenized shares of Tesla. Possibilities can also aquire as miniature as 1/one hundredth of a allotment with zero commission prices — despite the indisputable truth that trading will be cramped to well-liked trading hours. Particularly, the tokens must now not shares; they top probably give exposure to the asset, in conjunction with dividends and stock splits. As of now, residents of the U.S., mainland China, Turkey, and a form of restricted jurisdictions are barred from buying for stock tokens on Binance.

In an act of goodwill, Binance announced it would additionally listing COIN as a stock token despite the indisputable truth that Coinbase doesn’t offer BNB, Binance’s native token, on its replace. However, on early Thursday morning, Binance launched an announcement that its tokenized COIN offering shall be postponed “resulting from market volatility.”

In connected data, WallStreetBets opened up its contaminated Reddit thread to crypto, allowing for discussion on bitcoin, ether, and doge.

Hester Peirce Releases Safe Harbor 2.0

SEC commissioner Hester Peirce unveiled an updated model of her Safe Harbor proposal on Wednesday. Peirce has been working to present blockchain builders more freedom to assemble in DeFi without caring in regards to the ramifications, unintentionally or otherwise, of making a token that runs afoul of U.S. securities law. Her proposal would give projects three years to uncover whether or now not a token must be deemed a security or now not. This would enable builders to assemble a token offering very similar in nature to a security and gradually evolve the challenge correct into a more decentralized entity, in desire to launching with all the pieces already buttoned up.

Moreover additional reporting necessities, in conjunction with an exit document and out of doorways counsel, Safe Harbor 2.0 remains such as the preliminary proposal presented in February 2020. In a nod to the initiating-supply ethos of crypto, Peirce posted the Safe Harbor Proposal 2.0 on Github, where anyone can present options by potential of pull ask.

Ethereum’s Berlin No longer easy Fork Is Are living

Ethereum’s Berlin laborious fork went dwell on Thursday, incorporating four Ethereum Enchancment Proposals (EIP) to slash help fuel prices and lengthen users’ transaction capabilities. The Berlin originate takes Ethereum one step nearer to this summer season’s London laborious fork and EIP-1559, the controversial proposal that can presumably well well likely have a deflationary create on ETH.

Fifty blocks after the fork, Ethereum’s community skilled a syncing error, disrupting main services. In response, Coinbase disabled ETH and ERC-20 withdrawals, whereas Ledger admitted its users’ ETH prices will now not change.

Syncing disclose aside, the Berlin strengthen looks to have been met with approval, as ether reached a brand contemporary excessive of $2,500 on the day the fork launched.

Along with the community strengthen and contemporary all-time excessive, two a form of headlines level towards a continued bull-trot for Ethereum:

1) CoinDesk studies the total tag locked on Ethereum 2.0 surpassed $8 billion earlier this month, making Ethereum 2 the fifth-excellent proof of stake community by staked tag.

2) On Tuesday, Ethereum-targeted endeavor studio ConsenSys raised $65 million from JPMorgan, Mastercard, and UBS to bridge the TradFi and DeFi gap.

Coinbase Pays Homage to Satoshi

Satoshi famously coded a message into the Bitcoin Genesis block. It reads,

“The Times 03/Jan/2009 Chancellor on brink of 2nd bailout for banks”

Bringing the origins of crypto plump circle, Coinbase embedded the same message on the Bitcoin blockchain to commemorate its checklist day. It reads,

“TNYTimes 10/Mar/2021 Residence Presents Last Approval to Biden’s $1.9T Pandemic Relief Invoice”

NYSE Mints an NFT… and No one Cares?

In per week where Coinbase listed at $50 billion+ whereas bitcoin and ether hit all-time highs, the Fresh York Stock Change, seriously satirically, launched a assortment of NFTs commemorating a firm’s first replace, pronouncing: “Innovation is what we invent at the NYSE.”

Hayden Adams, the founder of Uniswap, save that “innovation” – air quotes – in context, tweeting:

Lily, 3-three hundred and sixty five days-Oldschool Reporter Extraordinaire, Interviews Michael Saylor

Whereas you happen to haven’t viewed the video of the 3-three hundred and sixty five days-aged Lily interviewing MicroStrategy CEO Michael Saylor, I judge it’s top to peaceable strive it out. As a journalist, one ask I became as soon as especially impressed by, and, take note, here is a 3-three hundred and sixty five days aged lady, became as soon as when she asked Michael:

“My next ask is… investing $2 billion [in Bitcoin] is a ballsy switch, what’s next for you?”

Source credit : unchainedcrypto.com