Dear Bank, HODL My Crypto

+ DeFi getting extra worship from merchants than Bitcoin!

Big files this week, as the Situation of labor of the Comptroller of the Currency gave US banks the authority to custody crypto. This indubitably appears to be like it’ll luxuriate in to be attributed to the fact that the foreign money performing Comptroller is Brian Brooks, the frail chief proper officer of Coinbase. It additionally marks a turnaround for the crypto commerce and its relationship to banks, who luxuriate in long shunned the commerce, making it hard for even VC-backed corporations to search out and sustain banking relationships. Meanwhile, as Ethereum 2.0 will get nearer, an prognosis finds out what’s going to be desired to sustain it uncover, and as DeFi continues to steal off, merchants who worship Bitcoin’s volatility were turning their sights on DeFi tokens. Plus, we get some correct analyses of the rise in automatic market makers corresponding to Uniswap, Curve and Balancer, and additionally a dissection of how an engineered attack became gradual the MakerDAO liquidations that happened for $0 on Shaded Thursday. Indirectly, gain out every thing about YFI.

On the podcasts, The Defiant founder and creator of the Endless Machine Camila Russo discusses the highlights from her book, The Defiant, crypto media and extra, and on Unconfirmed, Haseeb Awan talks about his dealings with the Twitter hackers.

Whats up everybody, thanks for tuning in to this week’s files recap!

This Week’s Crypto News…

US Bank Regulator Grants Banks Authority to Custody Crypto

The Situation of labor of the Comptroller of the Currency (OCC) revealed a letter that successfully permits national banks within the US to present cryptocurrency custody companies and products. Acting Comptroller Brian Brooks, frail chief proper officer of Coinbase who came about of work lower than two months ago, acknowledged, “This idea clarifies that banks can proceed fulfilling their customers’ needs for safeguarding their most important resources, which this day for tens of thousands and thousands of Individuals contains cryptocurrency.”

The announcement marks a essential shift within the connection between the US banking sector and the crypto commerce. As Caitlin Long, Founder and CEO of Avanti Bank & Have faith, acknowledged in a tweet thread, “GAME ON! The @USOCC ‘s announcement that it’s following Wyoming by allowing national banks to custody digital resources is GREAT files for crypto! Long overdue & confidently may possibly presumably lend a hand U.S. rep ground it misplaced to different developed world worldwide locations by dilly-dallying for goodbye. Winners=customers & crypto VCs.” She says this may possibly seemingly presumably possibly spur M&A boost as US banks diagram #digitalasset custodians, because have faith co. charters and the BitLicense are actually previous.”

Also, CoinDesk experiences that Avanti Bank, which Long is founding, shall be opening its doorways in October and can luxuriate in to venture a brand original digital asset known as Avit that can seemingly exhaust the Bitcoin blockchain.

Will Ethereum 2.0 Be More straightforward to Attack Than Ethereum 1.0?

As Ethereum moves to the Proof of Stake Incentive Model with ETH 2.0, researchers at Consensys luxuriate in revealed a detailed overview of its community economics.

In the authors’ review:

- Ethereum 2.0’s Proof of Stake is extremely advanced relative to Proof of Work

- Security of the community in Ethereum 2.0 relies upon three key variables: ETH staked, the associated price of ETH, and volatility

- Assaults on Ethereum 2.0 are less complicated to scale than on Ethereum

- Derivative attacks, proper thru which attackers originate money by, as an instance, shorting the exhaust of any of the proliferating forms of ether derivatives, may possibly presumably possibly become trendy

Stefan Coolican from Ether Capital attach out a thesis which says that Staked ETH would be worship a digital bond with no counterparty possibility. He writes, “Staked ETH provides you yield at the protocol level and no longer by strategy of a counterparty. Staked ETH is subsequently an intrinsic yield instrument. For the principle time ever you would compound your ETH holdings organically without assuming any counterparty possibility.”

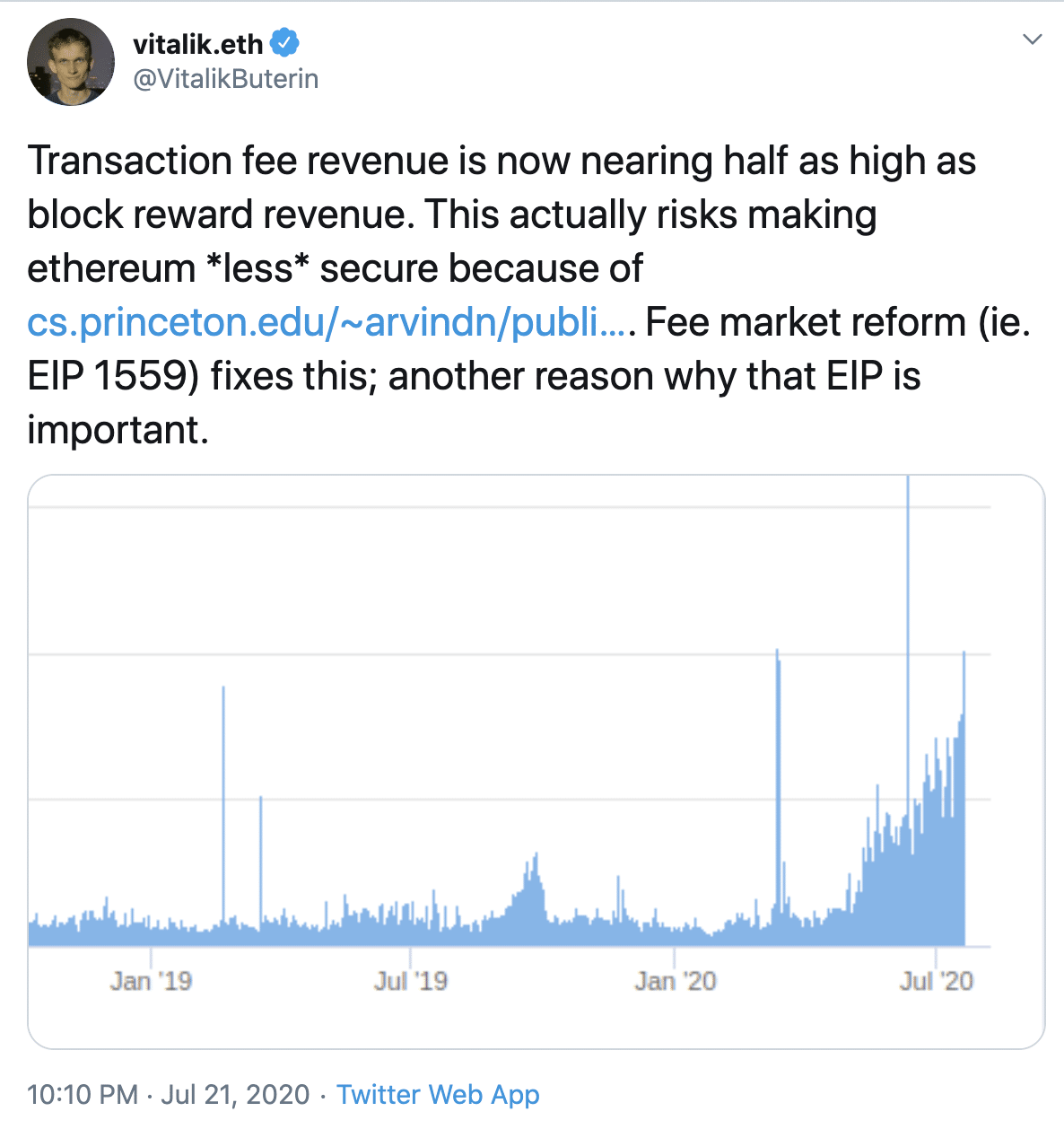

In a separate tweet, Vitalik Buterin highlighted that “Transaction price revenue is now nearing half of as high as block reward revenue. This actually dangers making ethereum *less* uncover”. Price market reform (ie. EIP 1559) fixes this; one other explanation why that EIP is mandatory.”

China’s Drawl-Backed Blockchain Community Integrates with Six Public Chains

In a dispute to dominate the blockchain infrastructure space globally, China has built-in its sigh-backed Blockchain-based completely mostly Carrier Community (BSN) with six public chains which consist of Ethereum, Tezos, NEO, Nervos, EOS and IRISnet. The partnership will enable developers on these blockchains to diagram dapps and sprint nodes the exhaust of files storage and bandwidth from BSN’s foreign files centers. The networks may possibly presumably possibly have the advantage of BSN’s payment-effective companies and products and get right of entry to to Chinese endeavor blockchain networks and financial files from China UnionPay, which is on the overall hard to beget for entities exterior the nation.

In other locations in Asia, South Korea has finalized its thought to charge a 20% tax on revenue generated from cryptocurrency transactions for people with an annual revenue of additional than 2.5 million obtained (~$2,000) from crypto buying and selling.

Visa and Mastercard Have bigger Crypto Efforts

In rather a turnabout from final one year when Visa and scads of assorted payment corporations left the Libra Association, this week, the bank card broad revealed a brand original outlook on digital foreign money payment flows and mentioned that the firm has been advancing and evolving its digital foreign money plot for rather some time. Visa writes, “We mediate that digital currencies luxuriate in the aptitude to lengthen the payment of digital funds to a higher different of of us and locations. As such, we are looking out for to lend a hand shape and increase the role they play within the manner ahead for money.” Mastercard additionally launched “the expansion of its cryptocurrency program, making it extra functional and sooner for companions to elevate uncover, compliant payment playing cards to market.”

With Bitcoin Volatility Hitting Myth Lows, Traders Flip to DeFi

Of us from ragged finance on the overall scoff at Bitcoin’s volatility. On the different hand, over the previous few weeks, Bitcoin’s tag has been caught within a tight differ, with its 60-day rolling volatility hitting a 15-month low final week.

Traders luxuriate in now grew to become to DeFi tokens whereas reducing publicity to natty-cap cryptos corresponding to Bitcoin and Ethereum. Extra than one billion dollars has been locked up in lending protocol Compound, fueled by “yield farming.” Traders are additionally capitalizing on the derivatives market and the exhaust of alternate choices to generate yield in a less volatile market.

FTX CEO Sam Bankman-Fried attach things into level of view in a tweet thread where he analyzed the volume, noting that a host of the exercise is merely merchants locking up, lending and buying and selling stablecoins with every different. They’re being incentivized to attain so by governance tokens, whose values meander up as total locked payment goes up. He acknowledged it’s equivalent to “transmining” or transaction price mining, which became a fad two years ago, but decentralized. He asks whether or no longer here’s smoke and mirrors or a excellent boost plot, and then tells the sage of two exchanges — FCoin and BitMax, proper thru which each beginning out with high volumes from transmining. On the different hand, he says that after they grew to become off their transmining, FCoin became left with nothing, whereas BitMax, he says, QUOTE “successfully mixed the userbase they got with an increasingly extra tremendous product.” He concludes, “Merely because anyone made a rare marketing play doesn’t mean there isn’t substance.”

While you may possibly presumably possibly be looking out for to must know extra about yield farming, strive my Unchained podcast episode with Dan Elitzer, investor at IDEO CoLab Ventures, and Will Trace, files scientist at Flipside Crypto, where we talk about this craze.

Working out the Upward thrust of Automated Market Makers

Dragonfly Capital’s Haseeb Qureshi wrote a rare prognosis of the explosion in automatic market makers (AMMs), driven in allotment by the rise of Uniswap. He described an automatic market maker as QUOTE, “a extinct robotic market maker that is often willing to quote prices between two resources in accordance with a straightforward pricing algorithm … For Uniswap, it prices the 2 resources in grunt that the different of objects it holds of every asset, multiplied together, is often equal to a mounted constant.” The vogue this works, is that if the constant is 50 apples and 50 bananas is one Uniswap pool, the constant between them shall be 2500. If anyone desires to amass one apple, the pool will entirely luxuriate in 49 apples, but since the constant has to dwell 2500, she must pay with 51.02 bananas. Uniswap descendants corresponding to Curve and Balancer are just a shrimp different: Curve uses a combination of constant product and loyal sum whereas Balancer, which has swimming pools of additional than actual two tokens, is defined by a multi-dimensional floor. The put up goes on to prove why constant feature market makers will procure the stablecoin buying and selling market and why Uniswap has been successful but why its dominance obtained’t final eternally.

Qureshi’s put up dissects Uniswap closely, but for these fascinated a pair of extra advanced constant feature market maker corresponding to Balancer, Placeholder Capital wrote up a blog put up on its Balancer investment thesis, explaining the odds with swimming pools of additional than two resources, which consist of neighborhood ruled-swimming pools, surge pricing swimming pools whose charges upward push when query is high, or rollover swimming pools that venture perpetual tokens from resources that on the overall expire corresponding to bonds.

Mempool Manipulation Resulted within the Theft of $8M in MakerDAO Collateral on Shaded Thursday

A original file by Blocknative revealed that manipulation of Ethereum’s mempools enabled attackers to steal $8.3 million from MakerDAO users on Shaded Thursday, March 12th, when the associated price of ETH fell 43% within hours, triggering liquidations of the collateral held on the MakerDAO lending platform. Some savvy merchants took profit of the congestion on Ethereum to send in bids of $0 to liquidate some collateralized debt positions on MakerDAO, thus strolling away with ETH, for free. I lined this with Kyle Samani of Multicoin Capital on an episode of Unchained and with Antoine Le Calvez of Coin Metrics on Unconfirmed.

Per Blocknative’s analysis, the MakerDAO liquidations had been an engineered tournament that took profit of an venture spirited evicted transactions, proper thru which nodes, to sustain map resources, evict the transactions with the bottom charges. Blocknative writes, “When a transaction is evicted, the node does no longer be conscious any minute print relating to the transaction, corresponding to the sending handle or the transaction nonce. Which ability fact, when a brand original transaction arrives with the following nonce, the node may possibly presumably possibly detect a nonce hole and can luxuriate in to be unable to job the original transaction. Impacted transactions are then positioned within the unprocessable Queued allotment of the node’s mempool. These transactions become caught without reference to their associated transaction charges (that is, gas prices).”

Blocknative found the usage of so-known as “Hammerbots,” which waited till their have transactions had been evicted from the mempool and then despatched replace transactions no longer with bigger gas charges, but the identical or lower gas charges, thus clogging the community additional.

The put up walks us thru an example proper thru which a 0-dispute bot submitted a 0 dispute at 15:59:50 UTC with a gas tag of 200 Gwei. This started a 10-minute countdown clock proper thru which a Keeper bot may possibly presumably possibly counter dispute the transaction. One did within that window, with a gas tag of 450 Gwei — two and a half of times the gas tag of the distinctive dispute. On the different hand, thanks to a nonce hole created by an earlier evicted dispute, this dispute became blocked, and anyone walked off with some ETH they got for nothing.

What’s the Big Deal With YFI?

A original governance token known as YFI is all the rage among yield famers. YFI is the governance token for Yearn.Finance, which automatically moves merchants’ resources inner and exterior of assorted liquidity swimming pools looking out for the becoming yields. Yearn’s creator, Andre Cronje, writes in a blog put up, “In additional efforts to supply up this protect an eye on (principally because we are sluggish and don’t are looking out for to attain it), now we luxuriate in released YFI, a entirely worthless 0 present token. We re-iterate, it has 0 financial payment. There may possibly be now not any pre-mine, there is no sale, no you would no longer aquire it, no, it obtained’t be on uniswap, no, there obtained’t be an auction. We don’t luxuriate in any of it.” That hasn’t stopped it from buying and selling as high as $2,374. Curve founder Michael Ogorov told CoinDesk, “Since YFI had no investors and ALL tokens are going to liquidity suppliers, everybody [became] very crazy about it and all of it exploded.”

Source credit : unchainedcrypto.com