Solana Is Ripping. However Are the Economics of the SOL Token Sustainable?

The Solana blockchain has lately experienced a surge in utilization, essentially driven by a wave of memecoin process. This uptick has introduced the platform’s excessive transaction throughput and low expenses into the spotlight, attracting main attention and active users.

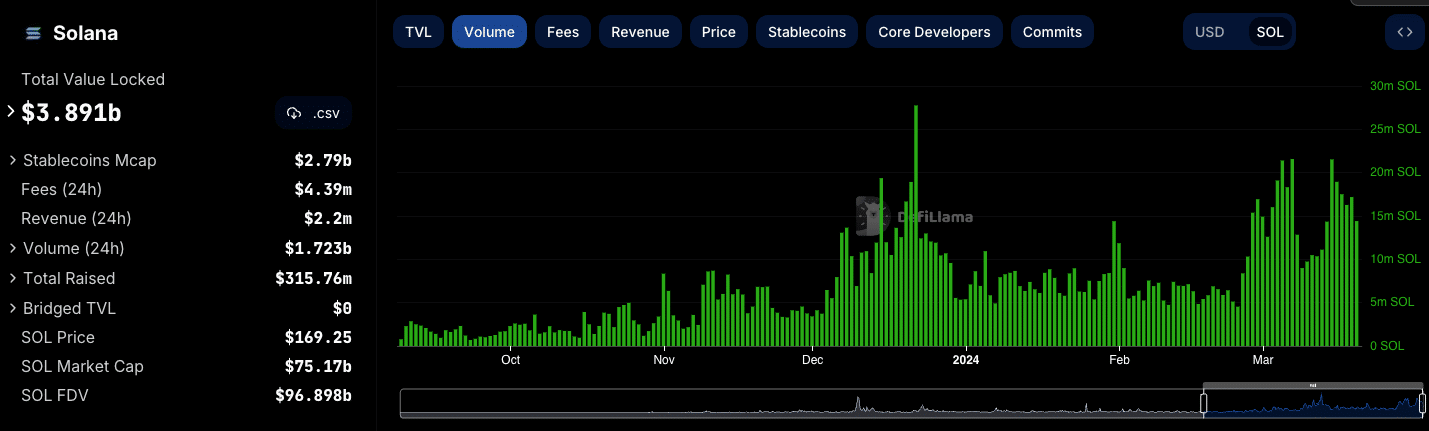

The splendid 30 days were a length of excellent dispute for Solana, with community expenses nearly tripling to around $50 million from splendid month, in accordance with data from Token Terminal. Moreover, the expenses paid by users in March 2024 are higher than the total Twelve months of 2023 mixed. This surge shows the blockchain’s rising appeal and its means to facilitate a excessive quantity of transactions successfully.

Surprisingly, nevertheless, with out reference to this heightened process, Solana is tranquil a long way from economically sustainable, which becomes apparent when examining the steadiness between community expenses and token incentives.

Financial Sustainability

The memecoin frenzy has examined no longer handiest Solana’s technical capabilities but additionally its financial model. The crux of the discipline lies in the costs linked to declaring and securing the community, which earn ballooned to $371.9 million from ethical $37.7 million in September 2023, mainly attributable to the tag better in the price of SOL.

These costs are predominantly constituted of token incentives disbursed to validators. Validators play a pivotal feature in the blockchain ecosystem, declaring the integrity and security of the community by validating or rejecting transactions. In return for their services, they are rewarded with token incentives, a follow that is main to the Proof of Stake (PoS) model that Solana employs.

The gigantic amount paid in token incentives raises questions on the financial sustainability of the SOL token. While it’s main to compensate validators for their contributions to community security adequately, the disparity between the income generated from transaction expenses and the costs incurred by token incentives is stark.

Be taught more: What Is Tokenomics? A Newbie’s Manual

The difficulty is further complicated by the character of the memecoin phenomenon itself. While memecoins can power a fast-term spike in community utilization and expenses, they on the total plan no longer provide a stable or sustainable foundation for financial dispute.

The difficulty in Solana stands unlike the financial devices of Ethereum, which is one of many few winning blockchains. Its profitability is attributed to the income generated from excessive transaction expenses and the relatively decrease token incentives paid to validators, especially after its transition to Proof of Stake (PoS). Moreover, Ethereum has turn into deflationary after The Merge, in accordance with the ultrasound.money dashboard.

For more context, Ethereum users pay $12.5 million a day in expenses, whereas approximately $9 million are paid in token incentives to validators.

Within the intervening time, Bitcoin is in a identical space, with token incentives to miners in the in the intervening time standing at over $50 million a day in contrast with handiest $2.5 million in income from expenses.

A Silver Lining

Then all once more, data exhibits that SOL is no longer decrease than improving. The label-to-expenses (P/F) ratio, which assesses the circulating market cap relative to annualized expenses, provides a telling explore into the financial standing of blockchains. According to Token Terminal, Solana has seen a major adjustment to this ratio, which dropped from 375x on March eighth to 123x—a marked enchancment in the community’s means to generate price income relative to its market valuation throughout the memecoin frenzy.

This change signifies a favorable shift in direction of financial sustainability, although Solana’s P/F ratio tranquil trails in the assist of Ethereum’s more tough standing at 52x. Ethereum’s decrease P/F ratio signifies a stronger correlation between its market capitalization and the expenses it generates, hinting at its more resilient financial model in comparability to Solana’s.

Having a stare forward, Solana’s roadmap entails buy in token issuance, with its fresh annual inflation rate of 5.394% slated to decrease by 15% every epoch-Twelve months. This is in a position to amount to a decrease of $55 million a month, or $667 million a Twelve months. This adjustment is designed no longer handiest to curb inflation over time but additionally to toughen the rewards for these staking SOL, guaranteeing community security stays tough. Moreover, the community employs a transaction price model where half of of every price is burned, lowering the total provide, whereas the relaxation rewards validators.

This kind, coupled with the anticipated tag better in transaction volumes, would possibly maybe well well potentially space Solana to offset the inflationary pressures and function financial steadiness, but as of this day, that will almost definitely be considerably overly optimistic.

Be taught more: Ethereum and Solana Supporters Lock Horns on Social Media Over Scalability and Memecoins

Source credit : unchainedcrypto.com