Is Bitcoin in a Rut? These Three Numbers Mutter Yes

June 8, 2021 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

MicroStrategy intends to present $400M in notes to aquire extra BTC.

-

Bank of England mentioned stablecoins would possibly perchance restful “meet similar requirements as those offered by business bank money.”

-

Unchained Capital raised $25M, led by Stone Ridge and NYDIG.

-

A Goldman Sachs look confirmed Bitcoin to be the least licensed asset of CIOs.

-

China’s Ministry of Innovation and Files Expertise printed a blockchain intention.

- Broken-down US President Donald Trump mentioned Bitcoin “true appears to be like like a rip-off.”

What Form You Meme?

What’s Poppin’?

Federal Officials Recovered BTC From Colonial Pipeline Assault

The Department of Justice announced the day gone by that they had seized 63.7 BTC of the 75 BTC that Colonial Pipeline had paid as ransom to DarkSide, a hacking community.

The DOJ press start explains “by reviewing the Bitcoin public ledger” a laws enforcement agent changed into once ready to trace a pair of Bitcoin transfers to a selected tackle, for which the FBI had the personal key, or “the rough similar of a password wished to derive admission to property accessible from the actual Bitcoin tackle.”

Colonial Pipeline suffered a ransomware attack in Might perchance perchance additionally, which, in response to The Block, triggered a rapid shutdown and an East Lumber gas scarcity in a pair of states in that location. The initial ransom payment of 75 BTC had been payment $5M. Which skill that of BTC’s contemporary mark descend, the recovered 63.7 BTC is now payment $2.3M.

For a extra in-depth breakdown of this developing memoir, click here, here, or here.

Three Bitcoin Metrics You Deserve to Know

It appears to be like that Bitcoin is in a rut, caught muddling between $30K-$40K.

Three statistics paint a a exiguous bit dour image for BTC:

-

Primarily based totally on CoinShares, Bitcoin investment merchandise registered $141M in outflows over the final 7 days. In distinction, Ethereum investment merchandise saw $33M in inflows.

-

The Block stories that day-to-day Bitcoin transactions (aka community exercise) fell to 217,000 on Sunday — a quantity now not viewed since 2018. In greenback terms, here is roughly a $10B incompatibility in on-chain quantity for Bitcoin, which diminished from $17.3B per day to true $7.7B. Furthermore, day-to-day full of life addresses on the community and unusual addresses per day derive dropped.

-

Frank Chapparo of The Block renowned that Bitcoin tweet volumes “derive nosedived” since the center of Might perchance perchance additionally — which is a exiguous bit intellectual after the hype from the Bitcoin Convention.

Instructed Reads

- Jay Clayton and Brent McIntosh on why crypto would now not basically require wholesale regulatory alternate:

- Bitcoin as handsome tender??

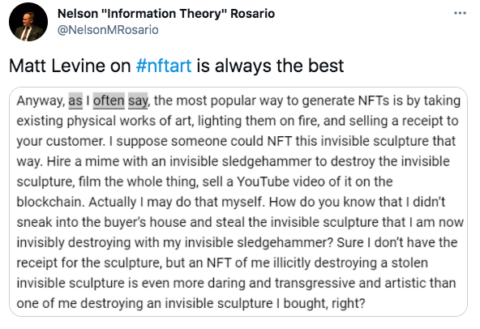

- Check up on this impossible NFT belief:

On The Pod…

June 14th is the 5-yr anniversary of Unchained. 🎉

On Tuesday, June 15th, we’ll submit a 5-yr anniversary episode with questions or messages from you listeners to me.

- document a video or audio message of 60 seconds or much less bringing up your name, the build you’re from and your demand or message.

- email it to [email protected] with “anniversary” within the topic line (or true respond to this email)!

The deadline to derive your submissions in is Thursday, June 10 by 5 pm ET/2 pm PT.

Thanks so great for supporting Unchained all these years! 🙏

Check up on the most contemporary episode of Unchained:

Will Bitcoin’s Tag Slide Up But once more? Yes, Primarily based totally on On-Chain Analytics

Willy Woo, on-chain Bitcoin analyst and creator of the Bitcoin Forecast, a market intelligence publication, and Rafael Schultze-Kraft, co-founder and CTO of Glassnode, focus on Bitcoin and what the on-chain metrics repeat us referring to the mark. Here to focus on is. Episode highlights:

-

what components pushed the mark of BTC down in Might perchance perchance additionally

-

why Elon’s Twitter memoir defend so great sway over the market

-

why Willy believes Bitcoin is factual for renewable vitality

-

who offered over the final month

-

which form of BTC investors stopped shopping in Feb/March

-

what traits Willy and Rafael derive noticed from cash transferring to/from exchanges

-

their thoughts on alternate-traded merchandise, like GBTC and Canadian ETFs

-

how derivatives shopping and selling has accomplished a characteristic in Bitcoin’s mark

-

why stablecoins had been shopping and selling above their peg within the months main as much as the Coinbase disclose itemizing

-

how Willy values Bitcoin (particularly the usage of NVT ratio)

-

whether the style of corporate treasuries investing in Bitcoin will continue

-

how they demand Ethereum’s adoption of a deflationary financial coverage to impression the mark of Bitcoin

-

when the market would possibly perchance maybe flip bullish all over again and predictions for the reduction of the yr

E-book Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Enormous Cryptocurrency Craze, is now readily accessible for pre-repeat now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-repeat it this present day!

It is likely you’ll perchance maybe comprise it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com