Alameda Withdrew $204M From FTX US in Closing Few Days Sooner than Give method: File

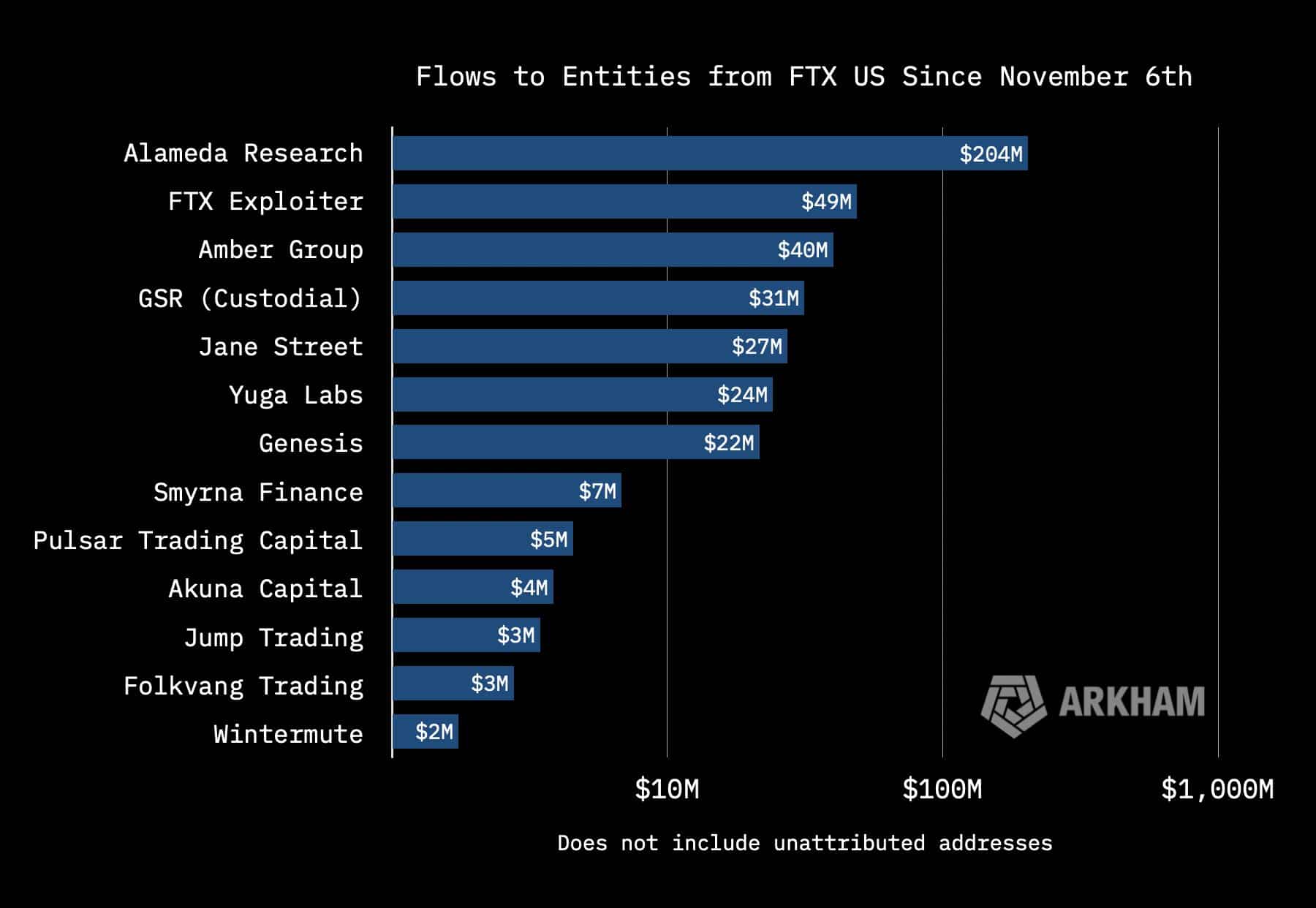

A novel narrative inspecting fund flows from FTX US has learned that Alameda Study withdrew essentially the most funds from the change within the days main up to its give method.

In accordance to prognosis from Arkham Intelligence over the weekend, Alameda withdrew $204 million from FTX US to eight diverse wallets after Nov. 6.

Arkham learned that in relation to 70% of these funds, charge around $142.4 million, had been despatched to wallets owned by FTX World. In accordance to them, this might maybe well maybe doubtlessly again as evidence that Alameda change into running a bridge between the 2 entities.

Rumors of FTX’s insolvency first started circulating after a CoinDesk article on Nov. 3 outlined how Alameda’s balance sheet change into closely reliant on FTX’s native change token FTT.

On the time, worn FTX CEO Sam Bankman-Fried tried to dispel rumors of FTX’s insolvency in relation to its ties to its sister-firm Alameda. “FTX is incandescent. Resources are incandescent,” stated Bankman-Fried in a now-deleted tweet.

After Nov. 6, Arkham learned that Alameda withdrew easiest U.S. dollar-pegged stablecoins and wrapped variations of Bitcoin and Ethereum from FTX US. Alameda withdrew $38 million charge of BTC, $49 million charge of ETH and $116 million charge of stablecoins.

“The withdrawn wBTC change into despatched to the Alameda WBTC Merchant wallet, and then bridged in its entirety to the BTC Blockchain,” acknowledged Arkham.

In the intervening time, the company despatched $35.5 million ETH to FTX and $13.8 million ETH to a enormous active trading wallet. This wallet is restful making transfers this day.

“It’s unknown whether the nearly 14M in ETH change into despatched to 0xa20 as fragment of an commerce, or as an interior fund switch within Alameda,” stated Arkham.

Source credit : unchainedcrypto.com