OMG BZX WTH

A tough week in crypto.

DeFi protocol bZx suffered two assaults that enabled the attacker(s) to procure off with nearly $1 million entire. How did that happen? We dive into the info on this week’s episode of Unconfirmed with Lev Livnev, the programmer who learned that the most predominant assault had happened.

Also, this week we proceed the sequence of essays on Unchained with a idea-ghastly piece by Santiago Siri on how identification and governance commerce within the age of cryptography. I extremely recommend you give it a listen!

Meanwhile, there turned into once quite lots of crypto files, no longer quite lots of it giant for the enterprise: other than the bZx hacks, there had been vulnerabilities learned, crimes alleged, and a huge change insolvency. However for these of you who’re followers of Matt Levine, DeFi also made an look in his Bloomberg column, Cash Stuff.

This Week’s Crypto Files…

A Shut Peek at Coinbase’s Trade

Michael Del Castillo, my kinda sorta colleague at Forbes — he and I by no blueprint overlapped, nonetheless I wish we had! — revealed a giant pair of articles this week, one a characteristic on Coinbase, which dived deeply into the corporate’s enterprise. Michael and his co-creator, William 1st earl baldwin of bewdley estimate that Coinbase has been “solidly within the shaded for a couple of years,” and is heading in the right direction to high $800 million in income this year. Plus, they present that the company has 35 million accounts and “presides over” $21 billion in sources. In a related files piece, Michael reviews that Visa has granted Coinbase the vitality to distress cryptocurrency debit playing cards, with bitcoin, ether, XRP, Litecoin, Bitcoin Cash, BAT, REP, ZRX and Stellar Lumens because the cryptocurrencies available on the card. The cardboard will open later this year in 29 countries, nonetheless the US will no longer be one in every of them. Btw, the characteristic anecdote also says that, in keeping with Coinbase, it handled $80 billion of transactions closing year. Michael and William articulate that Binance’s every day volume annualizes to $1 trillion. So, talking of Binance …

Binance Proclaims Novel Crypto Replace Cloud Operation

Bloomberg reviews that Binance is launching a new service: lending its know-how and liquidity to these making an are attempting to open their have exchanges. CEO Changpeng Zhao predicted to Bloomberg that Binance Cloud will develop into the corporate’s ideal source of income in five years. Binance already has one fiat change which this can get a scheme to articulate within the coming weeks, plus has confirmed four diverse purchasers. And Binance will offer these purchasers access to the speak books of recent trading pairs on Binance.

FCoin Insolvent Attributable to $130 Million Shortage in Its Crypto Asset Reserve

FCoin, a crypto change that modified into identified for its controversial “trans-rate mining” model revealed that it turned into once bancrupt on account of errors in its interior machine. CEO Zhang Jian stated in a post that the change had been crediting customers with more in rewards than it must absorb. The change had issued an change token known as FT and when customers paid transaction fees in bitcoin or ether, the platform would reimburse the actual person 100% of the associated rate in FTs. Plus, FCoin disbursed 80% of the transaction fees in bitcoin to customers who held FTs at some stage within the day. Per Zhang, the machine started making a present more in mining rewards than customers must absorb earned starting in mid-2018 nonetheless didn’t perceive it unless a 2019 audit.

DOJ Indictment Calls Working a Bitcoin Mixer or Tumbler a Crime

Larry Harmon of Akron, Ohio — here’s where I’d robotically close a bawl-out to Akron, as here is the house I’m from, nonetheless it undoubtedly one scheme or the other feels cross to entire with this anecdote — turned into once arrested for operating Helix, which the Department of Justice alleges laundered over $300 million by transferring more then 350,000 bitcoin, with the ideal amount coming from darkish accumulate markets. It also alleges that Helix partnered with Darknet market Alphbay, which turned into once seized by laws enforcement in July 2017. His brother told CoinDesk that Helix, which also closed in 2017, did not straight partner with Alphbay and that the market instructed his mixer with out input or permission from Larry.

MIT Researchers Present Flaws in Blockchain-Based mostly mostly Voatz Balloting App

MIT researchers Michael A Specter, James Koppel and Daniel J. Weitzner learned that it’s possible to show screen and even commerce or block votes within the blockchain-primarily primarily primarily based vote casting app Voatz, V-O-A-T-Z. As well they articulate that the assaults would possibly even taint the paper path created by the app, which would, pointless to articulate, procure it no longer possible to audit.

DeFi and tBTC Fabricate It Into Cash Stuff!

Certain, the crypto individuals that geek out about Matt Levine’s columns on Bloomberg had been enraged when he wrote about an launched DeFi venture known as tBTC, which is a “trustless bridge” between Bitcoin and Ethereum. The tBTC websites says, “1) deposit BTC, 2) mint tBTC and 3) lend and accumulate ardour in your BTC.” Venture lead Matt Luongo calls this an remark on diverse Ethereum-primarily primarily primarily based tokens pegged to Bitcoin equivalent to wrapped BTC, which played a feature within the most predominant bZx assault and is an artificial. He told The Block, “Bitcoiners are making an are attempting so that you can procure support to the Bitcoin chain,” he stated. “For the asset to be regarded as legitimate and theirs, they want so that you can redeem trustlessly and an artificial doesn’t close that.” As Matt Levine wrote in his column, “within the event you opt to absorb to dwell in Ethereum nonetheless have Bitcoins, you would possibly perhaps. It’s like a stablecoin, which I have faith about as a technique to dwell in Ethereum nonetheless have dollars. Right here is proper a stablecoin pegged to Bitcoin. Why no longer.”

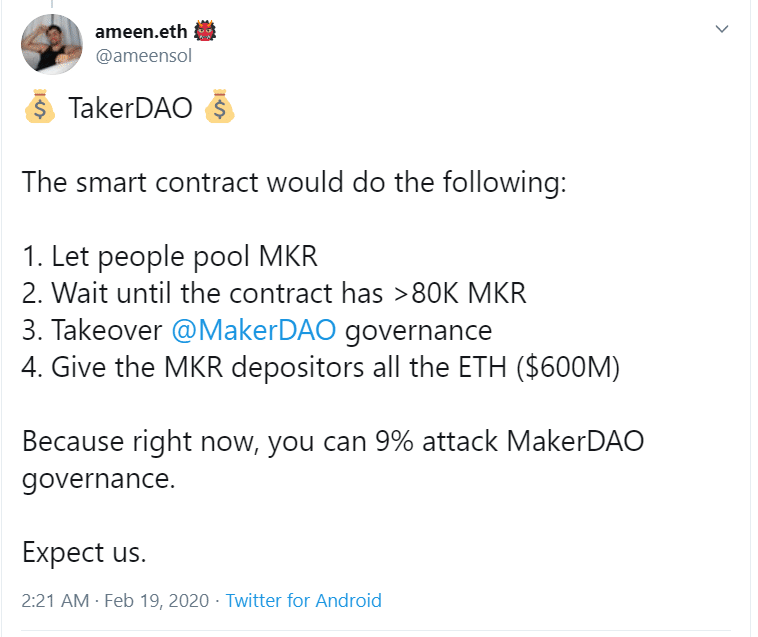

TakerDAO tells MakerDAO ‘Put a query to Us’

Mosey away it to Ameen Soleimani of Spankchain and MolochDAO to articulate his plans to code up a successfully-kept contract known as TakerDAO.

Sooner than I account for you all what Ameen’s plans are when it comes to TakerDAO let me proper level out a weblog post by Coinmonks from December known as Turn $20 Million Into $340 Million in 15 Seconds, which stated that on account of the amount of MKR wished to take management of MakerDAO governance, “the naive mark of doing proper about no topic you opt to absorb to the Maker contracts is ready 80,000 MKR.” (Also, let me present that, for proper this reason, individuals had been watching the amount of MKR in Uniswap upward push precipitously within the past couple weeks.)

With that context, here is Ameen’s description of the TakerDAO successfully-kept contract he plans to open except MakerDAO makes some changes.

Source credit : unchainedcrypto.com