$2 Billion ETH Burned

October 25, 2021 / Unchained On each day basis / Laura Shin

On each day basis Bits ✍️✍️✍️

-

Reddit is planning to assemble an NFT platform, primarily based mostly on a most modern job posting.

-

Over $2 billion in Ethereum has been burned by EIP 1559.

-

Two banks signed up for bitcoin trading platforms thru Q2 and NYDIG.

-

The Robinhood crypto pockets waitlist is properly over 1,000,000 other folks prolonged.

-

A pension fund for Houston firefighters invested $25 million in crypto.

-

Nigeria is region to commence its digital currency.

-

Terraform Labs CEO Attain Kwon is suing the SEC (after being served with a subpoena).

-

Thorchain is again online.

-

Elon Musk tweeted about Dogecoin, and Dogecoin pumped.

-

A Binance Stunning Chain proposal would adopt Ethereum’s burn mechanism.

-

Coinbase spent nearly $800,000 on lobbying in Q3.

-

The CFTC is conducting a probe into Polymarket, a decentralized prediction protocol.

What Attain You Meme?

What’s Poppin’?

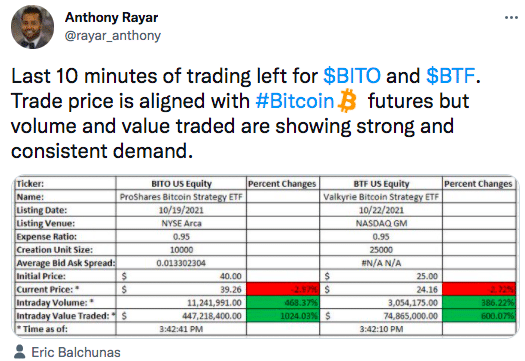

Valkyrie Investments’ launched its bitcoin futures change-traded fund (ETF) on Friday, turning into the 2d such product to checklist with the approval of the Securities and Substitute Fee.

Valkyrie’s Bitcoin Technique ETF’s first day saw about $78 million in volume for the fund trading underneath the ticker $BTF on the Nasdaq.

(Editors Display hide: Valkyrie before every thing filed underneath the ticker BTFD… and somebody who spends hours on Crypto Twitter will know skill “aquire the f***ing dip.” However, the company ended up altering the ticker to BTF.)

Bloomberg’s Anthony Rayar described the volume and price for $BTF and $BITO (ProShares’ bitcoin futures ETF that launched final week with nearly about 12X the volume as $BTF) as showing “sturdy and fixed ask.”

Advised Reads

- CoinDesk on whether or no longer “code is law” will get up in court:

- Nansen on the rise of CryptoPunks (written by a 17-year-extinct analyst):

- Arcane Compare on the Lightning Community ecosystem:

On The Pod…

Bitcoin Projected to Reach $135,000 in December, In line with PlanB

PlanB, a extinct institutional investor with 25 years of skills in monetary markets grew to change into anon Bitcoin analyst, discusses Bitcoin’s stamp action, from the macroeconomic drivers to what his objects predict for the rest of 2021. Display hide highlights:

-

PlanB’s background and the diagram in which he got into Bitcoin

-

what a inventory-to-poke along with the circulation mannequin is and the diagram in which PlanB uses it to foretell Bitcoin’s stamp

-

why PlanB known as for a $1 trillion market cap when Bitcoin used to be priced at sub $4K

-

how the approval of a bitcoin futures ETF has affected Bitcoin’s stamp

-

why institutions are more gay with bitcoin futures, fairly than the underlying asset

-

properly calculate gold’s inventory-to-poke along with the circulation mannequin

-

why he believes the inventory-to-poke along with the circulation objects works — even when detractors relate it is miles unsuitable

-

how the pandemic has affected Bitcoin’s stamp

-

what PlanB thinks about China’s likelihood to effectively ban Bitcoin

-

the three charts PlanB uses to mannequin Bitcoin

-

what the associated rate floor for Bitcoin shall be in October, November, and December

-

whether or no longer PlanB thinks we’re in a supercycle

Book Update

My guide, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Expansive Cryptocurrency Craze, is now accessible for pre-repeat now.

The guide, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-repeat it nowadays!

That chances are high you’ll be in a region to aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com