Goldman Sachs Taking Perfect thing about Celsius Location?

June 27, 2022 / Unchained Day to day / Laura Shin

Day to day Bits✍️✍️✍️

- Harmony, a layer 1 blockchain, suffered a $100 million exploit and is now offering a $1 million bounty.

- Yuga Labs, the entity in the wait on of BAYC NFT series, filed a lawsuit in opposition to Ryder Ripps for scamming customers.

- Bitpanda, a European crypto commerce, announced layoffs.

- The Ronin bridge, which connects the Ronin sidechain with Ethereum, will reopen after the $552 million exploit.

- Coinbase will launch Bitcoin futures by skill of Coinbase Derivatives Alternate.

- Ripple will open an plight of job in Toronto, Canada, and can dangle to rent 50 engineers.

Presently time in Crypto Adoption…

- Salvatore Ferragamo, an Italian luxury trend impress, is launching an NFT series.

The $$$ Corner…

- Flowdesk, a French crypto firm, raised $30 million in a Sequence A funding round.

- Cryptoys, an NFT gaming platform, purchased $23 million in funding led by a16z.

What Enact You Meme?

What’s Poppin’?

Goldman Sachs to Aquire Celsius?

By Juan Aranovich

Goldman Sachs, one of the main financial institutions on this planet, is elevating $2 billion to aquire distressed resources from Celsius, per CoinDesk. Celsius, one of the absolute most life like crypto lenders in the US, has currently been facing liquidity issues, or even even insolvency.

Two weeks previously, and at some stage in the crypto market plummeting, Celsius halted withdrawals from its platform due to the what it known as “indecent market stipulations” and caused notable fear among its customers.

Goldman Sachs appears to be like to be having a ogle to elevate money from investors with the diagram of making an strive for Celsius resources at a bargain. Simply a pair of weeks previously, Goldman Sachs released a document which concluded that cryptocurrencies “weren’t a viable funding.”

Arthur Hayes, feeble CEO and cofounder of BitMex, changed into once a small bit skeptical in regards to the news. “Please don’t factor in Goldman Sachs is striking their dangle money at distress unless they explicitly inform so (…) Any and all “bailouts” needs to be considered PR stunts, till valid money is deployed, and valid depositors can withdraw some or all of their funds from bancrupt CENTRALISED crypto lenders,” he said on Twitter.

Celsius has already started preparing for economic damage, even supposing they haven’t confirmed it officially. On Friday, the Wall Toll road Journal reported that Celsius had employed restructuring advisers from the firm Alvarez & Marsal, in negate to aid them put together the seemingly economic damage filing. This switch comes days after Celius engaged attorneys from Akin Gump Strauss Hauer & Feld LLP with the same diagram.

Alex Mashinsky, founder and CEO of Celsius, has said small since this distress started as antagonistic to that “the crew is working non-stay”.

In linked news, Morgan Creek Digital, a crypto funding firm, is having a ogle to elevate $250 million to aquire a stake in BlockFi, yet any other crypto lender that has been going via an identical distress to Celsius. It appears to be like Morgan Creek’s changed into once compelled to bear this switch on memoir of of the credit line that BlockFi secured with FTX. Consistent with the terms of that deal, FTX may perhaps aquire BlockFi for terribly small money, which would in flip wipe out BlockFi’s equity shareholders.

Advised Reads

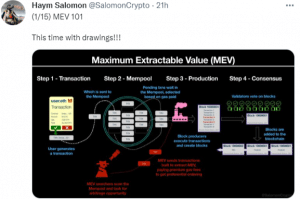

1) Haym Salomon on Maximum Extractable Price:

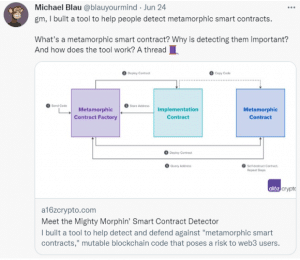

2) Michael Blau on detecting metamorphic good contracts:

3) Mind Frye on Yuga Labs vs. Ryder Ripps:

On The Pod…

Solend and Bancor Drama: Did These DAOs Violate the Ethos of Crypto?

Derek Hsue, cofounder at Reverie, discusses the most up-to-the-minute controversial choices by Solend DAO and Bancor, the importance of organising processes for sunless swan events, and whether decentralized governance the truth is exists. Show highlights:

- what distress precipitated Solend to the truth is feel it changed into once in jeopardy

- what Solend DAO’s response changed into once to that distress

- why Derek views it as “the nuclear chance”

- why the proposal sparked an outcry from the crypto group

- whether this yelp can were prevented or managed differently if the protocol changed into once constructed on a blockchain different than Solana

- why, a day later, the DAO reversed its first determination to diagram cease over the whale’s memoir

- whether Derek thinks the DAO made the true determination to now not diagram cease over the whale’s memoir

- what is Impermanent Loss Protection, a feature equipped by Bancor

- why Bancor made up our minds to cease Impermanent Loss Protection

- whether Celsius and 3AC had anything else to invent with Bancor’s distress

- how Bancor’s determination changed into once made unilaterally

- how DAOs can dangle to manage with sunless swan events

E book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Large Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You would also aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com