This Metric on Ethereum Is Up 200x From a 300 and sixty five days Previously

Might per chance 18, 2021 / Unchained Day after day / Laura Shin

🎉Welcome to Unchained Day after day 🎉

ICYMI, the Unchained Newsletter is transferring from a weekly recap to a daily blog. Every morning you are going to receive just a few snappy bullet aspects summarizing the day prior to this’s details, a pair of memes, a immediate breakdown of a trending topic, and just a few suggested reads.

For these of you who were expansive followers of the weekly recap, don’t apprehension — the weekly recap will peaceable be on hand on the reduction half of of the Unconfirmed pod on Friday!

With out additional ado… right here is the 2d edition of the Unchained Day after day.

Day after day Bits ✍️✍️✍️

-

Bitcoin dropped to $42,000, a three-month low

-

Monetary institution of America joined the Paxos Settlement Service, which makes exercise of blockchain tech to variety identical-day settlement for shares

-

Coinbase equipped plans to present a $1.25 billion debt providing to licensed traders.

-

Digital asset firm Galaxy Digital had an outstanding Q1

-

The FDIC is asking banks about how they’re coping with digital resources

- US Congressman Tom Emmer sent a letter to the Monetary Accounting Standards Board (FASB) urging the institution of determined accounting standards for digital currencies

What Construct You Meme?

On Monday, Kyle Samani, CEO and co-founding father of Multicoin Capital, tweeted:

The postulate that memes transfer markets is now not original. In point of fact, on Unchained in February of last 300 and sixty five days, Linda Xie, co-founder at Scalar Capital, be taught an essay she wrote titled “How Memes Can Support Crypto Fling Mainstream.”

Alternatively, in the previous few months, this theoretical realizing of memes appearing as market movers has become a original fact. The crypto enterprise has seen Dogecoin skyrocket previous a 10,000% return YTD ensuing from a constant barrage of Elon Musk whine, whereas the same meme-money enjoy SHIB and AKITA have been pumped online — even though one non-pumper, Vitalik Buterin, additionally dumped them, pretty publicly.

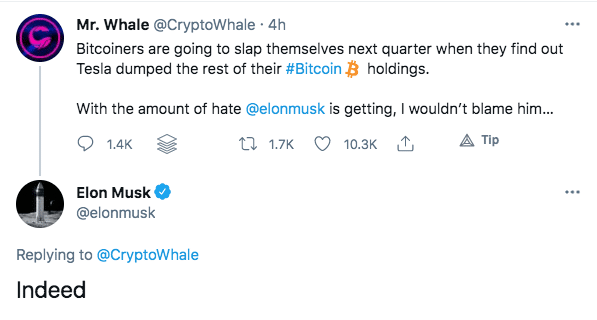

Even Bitcoin is interestingly being pushed up and down by memes, with a single Elon tweet clarifying that Tesla has now not sold its BTC location bumping the worth up by roughly $2k in beneath 30 minutes. For sure, Musk fully needed to challenge a clarification ensuing from the hypothesis growing from an earlier tweet:

I convey all this to put collectively you, variety reader, for the video below, which is self-described shitcoining and a truly most animated example of how memes and crypto are intersecting on the 2d.

What’s Poppin’?

Ethereum transaction charges are popping.

Decrypt reports that Ethereum transaction charges for Might per chance of 2021 are end to breaking the earlier monthly picture of $722 million — with two weeks left to head in the month — ensuing from the bullish combination of network exercise and ATH ETH costs.

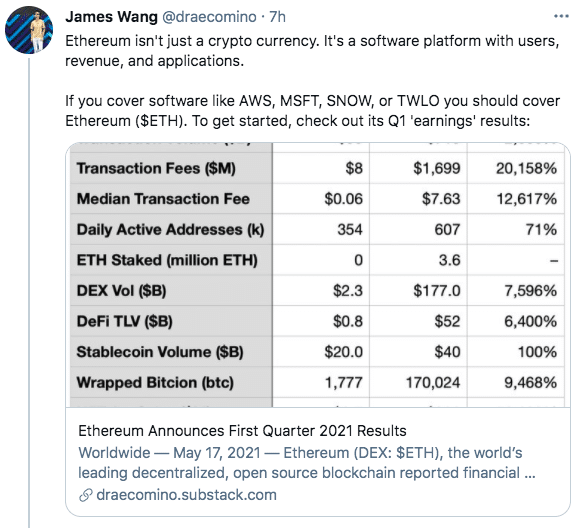

A original excessive in transaction charges (aka network earnings) on Ethereum is gorgeous one fragment of an outstanding “Q1” for the blockchain, as pointed out by James Wang, a aged ARK analyst, in an insightful article the day prior to this.

Listed right here are just a few highlights on the enlargement of Ethereum between Q1 2021 and Q1 2020 from the article:

- total transaction charges on Ethereum are up 200x, to $1.7 billion

- daily active users elevated 71%

- total fee locked in DeFi rose 64x to $52 billion — from $800 million

- NFT artwork sales rose from $700k to $396 million

Be taught the total picture right here:

Urged Reads

-

Stand aside Bitcoin, almost definitely Ethereum is the fastest horse beautiful now:

-

Jeff Dorman, CIO at Arca and present Unconfirmed guest, penned an essay on Elon, Bitcoin, and where to enhance details.

-

Questioning what your lawyer thinks of your latest NFT aquire? She/he potentially can’t await you to demand:

On The Pod…

Bitcoin vs. the Petrodollar: Which Is More Environmentally Friendly?

Closing week, Tesla equipped they’re going to no longer settle for Bitcoin as fee for autos. In a timely episode, Alex Gladstein, chief technique officer on the Human Rights Foundation, and James McGinniss, CEO and co-founding father of David Vitality, attain onto the snarl to chat about Bitcoin, the petrodollar, and how one can contextualize the energy usage of the first cryptocurrency (BTC) versus the leading fiat currency (USD). Repeat highlights:

-

their backgrounds and how they grew to become in the intersection of currency and energy usage

-

why Alex and James of direction direct Tesla stopped accepting BTC as fee

-

why James thinks Bitcoin’s energy depth is a “characteristic, now not a bug”

-

Alex on the history of the petrodollar and how the USD in present decades has been tied to fossil gasoline production

-

evaluating the carbon fee of a dollar to Bitcoin’s energy consumption

-

what both James and Alex recall to mind the Sq. and Ark Make investments be taught paper announcing renewable energy production also can presumably be tied with Bitcoin mining

-

why measuring Bitcoin’s energy usage is advanced

-

how Bitcoin mining in China is changing for the upper

-

how the Biden administration also can impact Bitcoin

-

where to secure more details on Bitcoin and energy consumption

E book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Sizable Cryptocurrency Craze, is now on hand for pre-explain now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-explain it this day!

You are going so as to aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com