How GameStop Is Like Crypto

+ Michael Saylor on Unchained

Excluding for the news that Coinbase will dash public via a suppose itemizing, it used to be a considerably mute news week in crypto. On the opposite hand, Crypto Twitter used to be following every twist and flip of the GameStop sage. On Unconfirmed, Sam Bankman-Fried of FTX and I focus on about the GameStop saga — the most life like seemingly method it used to be same to the vogue crypto markets characteristic, whether blockchain know-how may per chance per chance prevent quite loads of those instances within the prolonged saunter, and the most life like seemingly method FTX used to be ready to make tokenized model of Wall Aspect road Bets shares.

On Unchained, Michael Saylor talks about his upcoming Bitcoin for Companies occasions, what number of queries he’s been receiving from firms attracted to adding bitcoin to their stability sheets, as well to whether or no longer Microstrategy would ever “rob some off the table” if Bitcoin were to enter a bubble.

Impress definite to learn to the high for essentially the most efficient of Crypto Twitter on the GameStop/hedge fund/Robinhood spectacle.

This Week’s Crypto Data…

Coinbase Pronounces Plans to Wander Public via a Order Record

As published in mid-December, Coinbase will dash public later this 365 days. On Thursday, the crypto exchange said it meant to compose so via a suppose itemizing, rather than an IPO. In a suppose itemizing, in have to recent shares being created and sold to the public, most efficient present, excellent shares will be sold. That is no longer most efficient a more cost effective process but also permits Coinbase to preserve away from definite restrictions that wants to be followed with an IPO, reminiscent of lockup intervals that support insiders from selling their shares for defined intervals.

More Institutional Patrons Pile Into Bitcoin

Invoice Miller of Miller Worth Partners, and the passe chairman of Legg Mason, wrote, for its Q4 letter, that it had purchased shares of Microstrategy’s 0.75% convertible bond. After an intensive analysis of why it believes in Bitcoin’s promise, as well to a rebuttal of frequent criticisms of the cryptocurrency, he writes that the Microstrategy bond provided “cramped or no downside and a nearly-free call possibility on Bitcoin.”

Meanwhile, CoinDesk reported that the Harvard, Yale, Brown and University of Michigan endowments were procuring bitcoin straight away on Coinbase and varied exchanges, a truth alluded to in Coinbase Institutional’s 2020 Year in Overview.

Attributable to the institutional take a look at for bitcoin exposure, Pantera Capital, if truth be told one of the critical oldest funds within the placement, is launching a peculiar fund within the following few months for institutional bitcoin traders, the Block reports.

Ethereum 2020 Year in Overview: Transferring More Worth Than Bitcoin

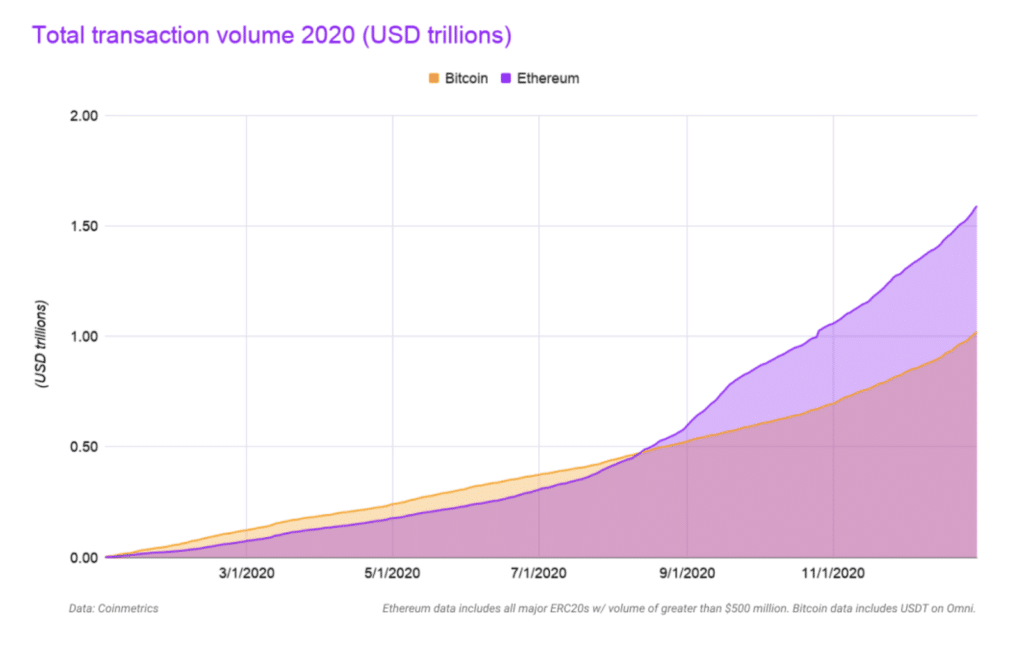

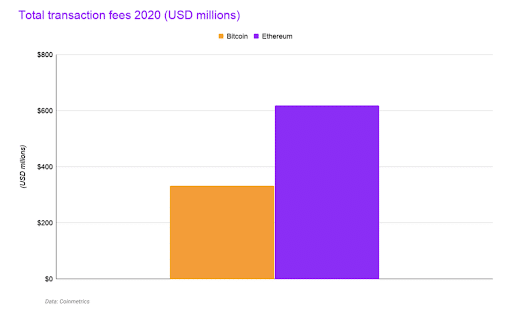

Josh Stark of the Ethereum Foundation and Evan Van Ness of the Week in Ethereum e-newsletter, printed a 2020 365 days in overview for the 2nd-supreme blockchain by market cap. The first takeaway used to be that 2020 used to be the principle 365 days whereby Ethereum transferred essentially the most label — $1.6 trillion charge of sources, 60% more than Bitcoin’s $1 trillion.

Transaction charges on Ethereum, at more than $600 million, were also almost double that of Bitcoin’s.

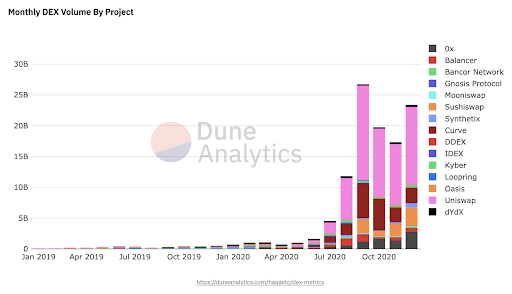

Yet every other pattern cited used to be the rising creator economic system on Ethereum, with crypto art quantity totalling $23 million, which sounds cramped, but makes it about 5% of the $500 million paid out by Patreon to its creators in 2019. The narrative also successfully-known the upward push in decentralized exchanges, with volumes averaging between $17 billion and $26 billion within the autumn.

Meanwhile the Ethereum Foundation and Reddit provided a partnership to “motivate tempo up the development being made on scaling and make the know-how desired to originate gargantuan-scale applications take care of Community Functions on Ethereum.”

Grayscale Recordsdata for A couple of Unique Trusts, Collectively with Some in DeFi

On Wednesday, Grayscale Investments, the supreme digital asset manager, filed for five unusual trusts for crypto sources: Aave, Cosmos, Polkadot, Monero and Cardano. Over the weekend, CoinDesk reported that Grayscale had also registered trusts for Chainlink, Decentraland, Livepeer, Tezos and Filecoin.

It’s per chance no longer stunning a pair of of those are DeFi-connected. The Block reports that OTC desks are seeing an uptick in hobby in DeFi. Genesis is seeing trades in DeFi money reminiscent of UNI, CRV and SUSHI. Richard Rosenblum, founder of GSR Trading, said, “now that BTC has had time to make a selection down, folks are procuring for the next thing to make investments in.” Equally, volumes on dexes hit $forty five billion in January, more than double in contrast to December.

Paradigm’s Data to Optimistic Rollups

Paradigm printed an in-depth explainer on how Optimistic Rollups work. It starts with the undertaking of the plot seeking to scale without losing its properties of low-label and low-belief, every of which motivate support the plot decentralized. It explains that the route Optimistic Rollups rob in scaling is to limit on-chain transactions and to recount fraud proofs to execute invalid “convey transitions.” Since fraud proofs are on-chain, it also has a come to disincentivize fraud, called a constancy bond, required from so-called sequencers, who retailer and do those off-chain transactions and put up a minimal amount of files about them called merkle roots to the Ethereum blockchain. If a sequencer’s files is proven to relate fraud, then that bond may per chance per chance be slashed and dispensed to the so-called verifiers, whose characteristic is to gain out about for fraud. It’s a posh plot, but Paradigm does a gargantuan job of explaining the most life like seemingly method it works, for those inclined to learn more about what is at possibility of be the short- to medium-time interval scaling resolution for Ethereum.

For the Math-Minded, Vitalik’s Introduction to zk-SNARKs

Yet every other doable scaling resolution for blockchains is zk-SNARKs, which Vitalik Buterin, the creator of Ethereum, no longer too prolonged ago cited as essentially the most promising prolonged-time interval resolution, as the know-how improves. This week, in a peculiar weblog post dedicated specifically to zk-SNARKs, he explains how they make doable choices to two complications that blockchains face: scalability and privacy. As he describes it, “A zk-SNARK permits you to generate a proof that some computation has some particular output, in this kind of method that the proof will even be verified extremely like a flash although the underlying computation takes a without a doubt prolonged time to saunter.” Additionally, he adds — and that is the piece that makes it a doable privacy resolution, “The “ZK” (“zero files”) piece adds an further feature: the proof can support a pair of of the inputs to the computation hidden.” He says that this would make it doable to relate that you simply are going to absorb got the real to transfer some asset without revealing which asset you bought. He says, “This ensures security without unduly leaking files about who is transacting with whom to the public.” These are the fundamental takeaways, but for those attracted to the cramped print about how this works, he goes into detail on it — fair a warning that it requires a supreme bit of math.

Crypto Twitter Can’t Conclude With GameStop

If, take care of me, that you simply may per chance maybe’t bag sufficient of this sport of chicken between Redditors and the 0.1%, here’s a roundup of different tweets from Crypto Twitter.

Author and speaker Andreas Antonopoulos tweeted, “Time to administer ‘outsider procuring and selling’

LOL”

Time to administer “outsider procuring and selling”

LOL

— Andreas (@aantonop) January 28, 2021

Elizabeth Stark, CEO of Lightning Labs, tweeted, “2008: Too gargantuan to fail

2021: Too cramped to earn”

2008: Too gargantuan to fail

2021: Too cramped to earn

— elizabeth stark ???? (@starkness) January 28, 2021

Jake Chervinsky, frequent counsel at Compound Labs, tweeted, “Take into consideration the SEC denying a bitcoin ETF proposal due to market manipulation concerns in spite of everything this.”

Take into consideration the SEC denying a bitcoin ETF proposal due to market manipulation concerns in spite of everything this.

— Jake Chervinsky (@jchervinsky) January 27, 2021

Tyler Winklevoss, CEO of Gemini, tweeted, “If I used to be the CEO of GameStop $GME, the next transfer may per chance per chance be to amass #Bitcoinand save it on the stability sheet.”

If I used to be the CEO of GameStop $GME, the next transfer may per chance per chance be to amass #Bitcoin and save it on the stability sheet.

— Tyler Winklevoss (@tyler) January 26, 2021

Many took the different to promote DeFi, with Ryan Adams tweeting:

Robinhood fair banned Gamestop and AMC!

The pass folks are winning so they delisted the sources.

Right here’s what they don’t know…

They simply recruited one other 1m folks into DeFi.

UNISWAP NOT ROBINHOOD

PROTOCOLS NOT BANKS

For that reason we dash bankless.

Robinhood fair banned Gamestop and AMC!

The pass folks are winning so they delisted the sources.

Right here's what they don't know…

They simply recruited one other 1m folks into DeFi.

UNISWAP NOT ROBINHOOD

PROTOCOLS NOT BANKS

For that reason we dash bankless.

— RYAN SΞAN ADAMS – rsa.eth ???????????? (@RyanSAdams) January 28, 2021

Soona Amhaz of Volt Capital tweeted, “Robinhood isn’t fit to be called that anymore.”

https://twitter.com/soonaorlater/field/1354789344704397312

Source credit : unchainedcrypto.com