On-Chain Data Exhibits No Proof of Merchants Fleeing Binance: Glassnode

No topic being slapped with a lawsuit from the U.S. Commodities and Futures Buying and selling Rate (CFTC), Binance has firmly held its house because the arena’s preferrred centralized crypto alternate.

In an April 4 publication, Glassnode examined how crypto market participants responded to the CFTC’s lawsuit towards Binance.

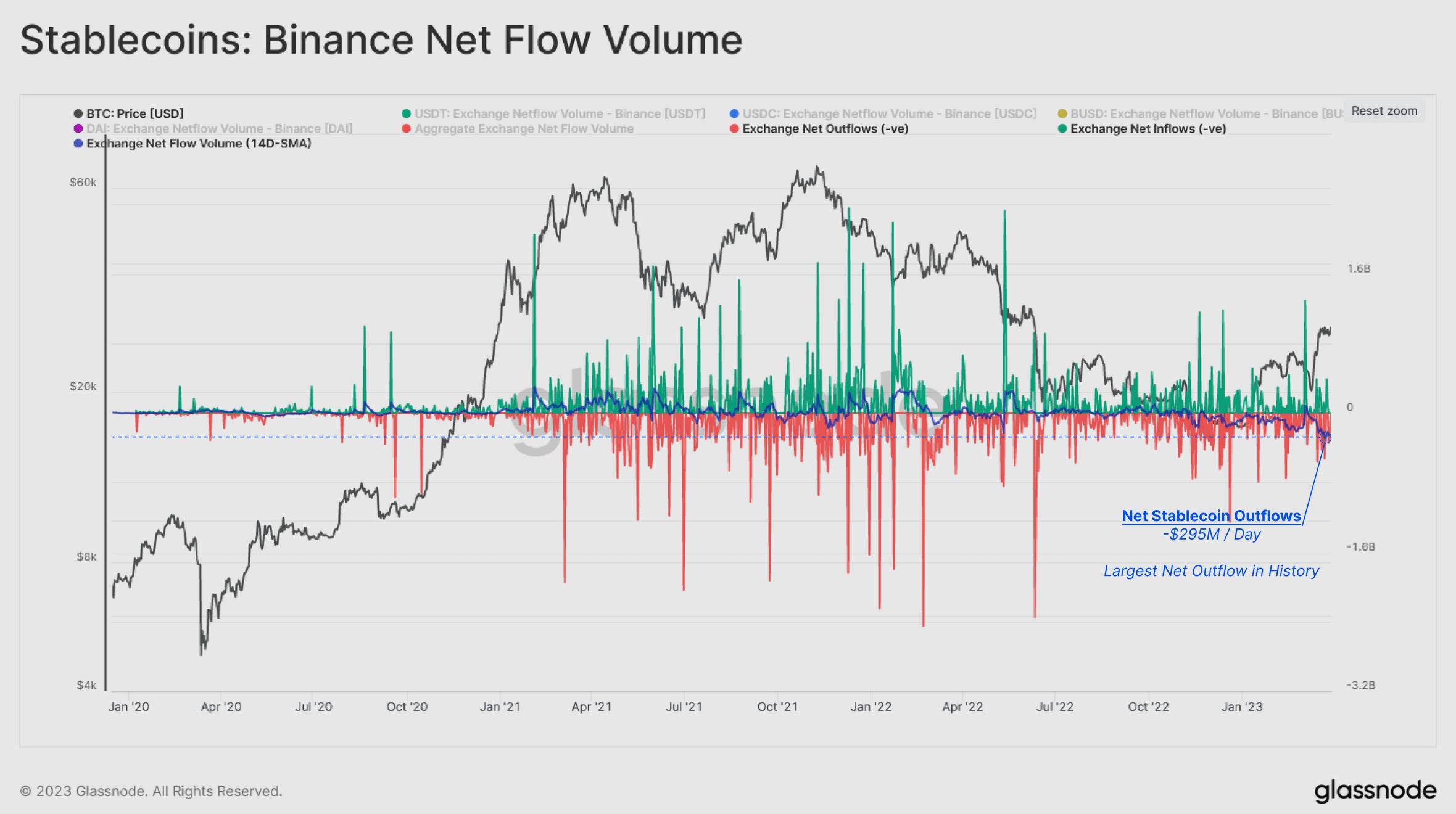

As became broadly reported final week, Binance recorded a significant quantity in outflows, particularly in stablecoins, when recordsdata of the lawsuit spread.

After keeping aside the gain day-to-day outflow the use of a 14-day Exponential Shifting Moderate (EMA), Glassnode chanced on that Binance recorded negative $295 million in stablecoin outflows per day – the preferrred gain outflow in historic previous.

Sizeable redemptions of BUSD come by also contributed to Binance’s declining stablecoin reserves.

“Of narrate is the historically low balances of USDC ($1.16B) and USDT ($2.17B), in fragment a aim of Binance’s are trying and shift trade quantity to BUSD pairs in contemporary months,” worthy Glassnode.

Then again, the coin-denominated steadiness of Bitcoin and Ethereum held on Binance has remained intact. The alternate’s Bitcoin reserves elevated by virtually 68,000 BTC, whereas ETH reserves remained flat year-to-date.

“No topic gain outflows of stablecoins, the market would not but seem like expressing frequent enlighten about Binance’s standing,” said the Glassnode analysts.

The yarn concluded that there became minute evidence that merchants were fleeing the alternate no topic Binance now being in the CFTC’s crosshairs.

“The predominant statement is a structural shift in stablecoins hosted on Binance as BUSD enters redeem-handiest mode and USDC sees international dominance declining,” they added.

Source credit : unchainedcrypto.com