Regulators to Sort out These 6 Areas of Crypto Next 365 days

November 24, 2021 / Unchained Day to day / Laura Shin

Day to day Bits ✍️✍️✍️

-

ConstitutionDAO announced its decision to disband following an unsuccessful strive at buying for a reproduction of the US Constitution.

-

India is expected, at some point soon of the iciness session of Parliament, to introduce a crypto invoice that can per chance well most seemingly ban most cryptocurrencies.

-

Wolf Sport, a brand new play-to-affect sport, is ranked first in volume on OpenSea over the previous seven days.

-

Fei Protocol and Rari Capital, two protocols that combine for roughly $2.4 billion in TVL, appreciate proposed a merge.

-

Bank of The United States released a file that views stablecoin legislation as a catalyst for major adoption of crypto expertise.

-

ORIGYN Foundation, an NFT authentication company, raised $20 million at a $300 million valuation.

-

ADA and TRX can be delisted from eToro due to regulatory concerns.

-

Martha Stewart is cooking up a batch of NFTs in a Thanksgiving-themed drop; Macy’s is leaping into NFTs with a series essentially based entirely on its Thanksgiving Day Parade.

-

Pantera Capital raised $600 million for a brand new crypto fund.

-

The company in the back of Pokemon GO is enabling Fold app customers to score Bitcoin rewards.

-

Rarible launched a messenger characteristic that allows customers to straight away talk about NFT purchases.

-

An OlympusDAO malicious program resulted in a user taking home $1.43 million in OHM after paying roughly $50,000.

-

Constancy, UBS, and Order Avenue Global Advisors confirmedthat they are taking a appreciate a examine potentially providing purchasers exposure to cryptocurrencies via crypto funds.

-

Per the IMF, “Bitcoin might well perhaps well unexcited no longer be passe as a appropriate form delicate” in El Salvador.

What Enact You Meme?

What’s Poppin’?

US Regulators Trace 2022 for Crypto Readability

In a joint assertion the day gone by, The Board of Governors of the Federal Reserve Diagram, Federal Deposit Insurance protection Company, and Location of job of the Comptroller of the Currency outlined plans to “present bigger clarity” on definite crypto-banking actions.

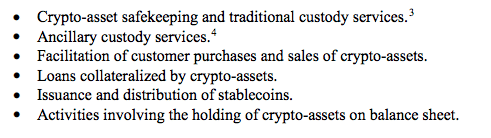

Per the assertion, the companies notion to post guidance on the legality of the following six diversified crypto-banking actions at some point soon of the following 365 days.

Supply: Joint Commentary on Crypto-Asset Coverage Speed Initiative and Next Steps

Every of these actions became once identified earlier this 365 days in “policy sprints” as areas “where further public clarity is warranted,” because the joint assertion describes them. For the time being, agency team developed customary frameworks for banks getting fascinated with handling crypto resources. Issues addressed by the sprints integrated rising a customary and constant vocabulary for crypto-banking actions, the analysis of probably dangers for banks handling crypto resources, and the acceptability of most modern rules being passe to sustain a watch on crypto resources.

The day gone by, moreover as to the joint assertion, the OCC also printed an interpretive letter confirming that national banks might well perhaps well most seemingly engage in “definite cryptocurrency, disbursed ledger, and stablecoin actions.” For banks to set so, the OCC says banks might well perhaps well unexcited notify “ample controls in keep.” Additionally, the OCC says banks might well perhaps well unexcited no longer engage in crypto actions except they’ve received a non-objection from its supervisory keep of job.

“This letter clarifies that the actions addressed in those interpretive letters are legally permissible for a bank to appreciate interaction in, provided the bank can notify, to the pride of its supervisory keep of job, that it has controls in keep to habits the instruct in an exact and sound manner,” said Tuesday’s letter.

The day gone by’s letter became once issued after a analysis of the interpretive letters by faded performing comptroller of the OCC, Brian Brooks (who, after a pit discontinuance as Binance US CEO, is now Bitfury CEO), who first and predominant made waves by allowing banks to fabricate crypto custody companies and products to prospects.

Advised Reads

- No longer Plain on composability:

- @fintechjunkie on getting crimson-pilled:

- @magdalenakala on web3 + the song industry:

On The Pod…

The Tokenomics Episode: Why ‘EIP 1559 Is Cherish Catnip for Investors’

Two tokenomics experts, Yan Liberman, co-founder of Delphi Digital, and Viktor Bunin, protocol specialist at Coinbase Cloud, talk about their experiences building tokens, their thoughts on the most modern ENS/PSP airdrops, and what “beautiful” token distribution looks enjoy. Exhibit highlights:

- the definition of tokenomics

- what factors (reminiscent of utility, equity, liquidity, safety, and a number of others.) token designers are incentivizing for

- what Yan learned from serving to get Astroport tokenomics

- what Vikor learned from serving to get Threshold, the token that became once constructed to facilitate the merge of NuCypher and Shield

- how the EIP 1559 burn has modified Ethereum’s tokenomics

- how EIP 1559 has improved investor outlook for Ethereum

- why Viktor is insecure about folk undoubtedly the utilization of Ethereum going ahead

- what Viktor and Yan assert how the ENS airdrop farming anguish became once handled

- what Viktor and Yan assert ParaSwap’s PSP airdrop and why Viktor thinks ParaSwap made a “mistake”

- how Viktor and Yan would dart about airdropping a token to excellent actors as an different of rotten actors

- how improvements in on-chain identification might well perhaps well most seemingly back future airdrops

- beautiful originate tokens versus VC-backed tokens

- what the definition of gorgeous is when it comes to tokenomics

- why Viktor thinks a token’s distribution is more crucial than a token’s originate

- what can be the optimal approach to distribute liquidity mining rewards

- how neighborhood impacts tokenomics

- straight forward pointers on how to incentivize NFT-essentially based entirely tokens, enjoy the approaching near near Bored Ape Yacht Club token, for the beautiful goals

Guide Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-notify now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-notify it as we order time!

You could aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com