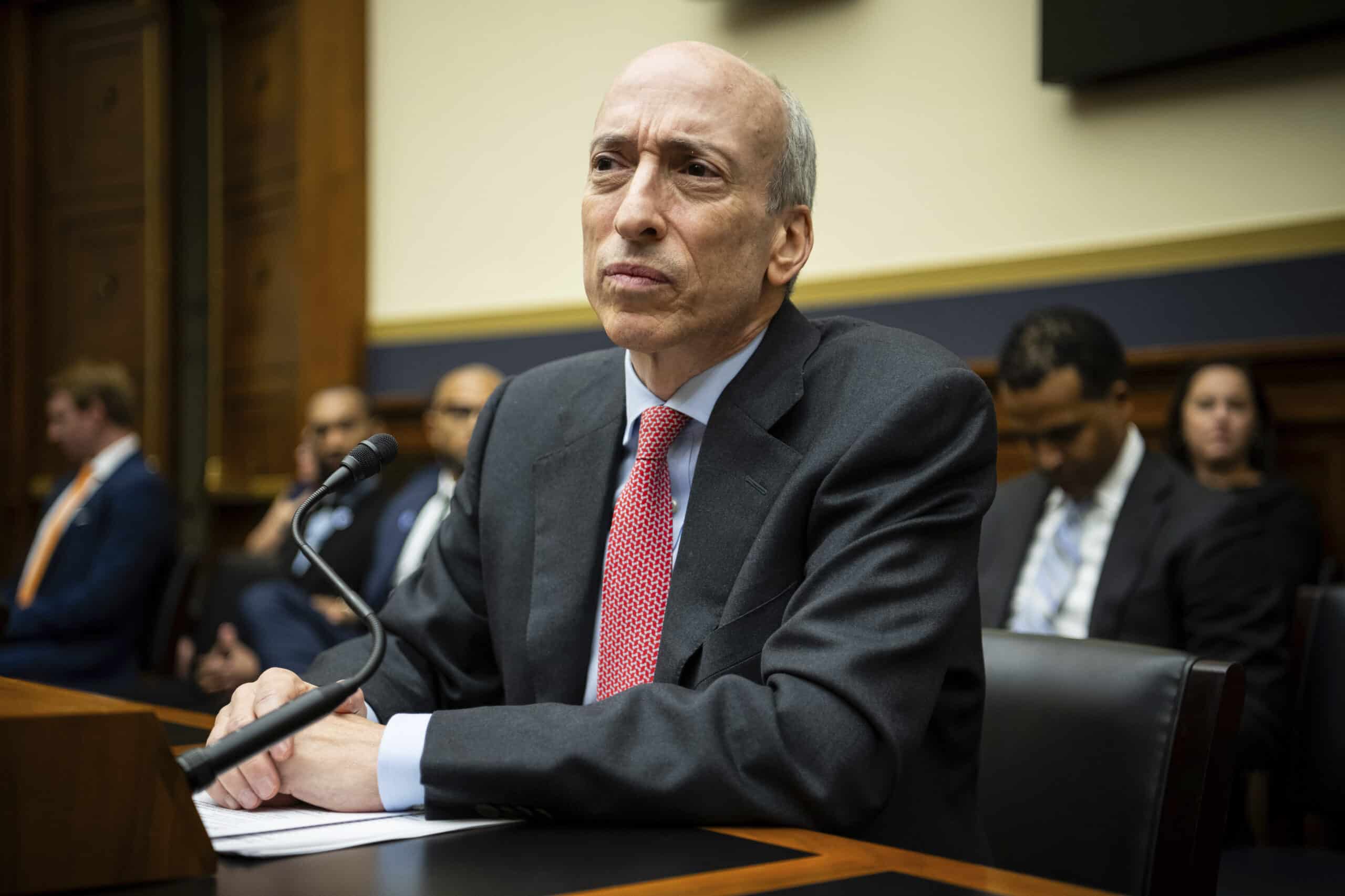

SEC Chair Gary Gensler to Resign on Inauguration Day; Trump All of the draw in which down to 4 Finalists

Gary Gensler will resign from his role as Chair of the Securities and Alternate Commission (SEC) on January twentieth, the day of president-elect Donald Trump’s inauguration. Trump has over and over promised to “fireplace” Gensler on his first day as an alternative of job, nonetheless it appears to be like Gensler plans to grasp away himself first.

In step with two americans mindful of the deliberations, the Trump administration plans to whine a nominee to replace Gensler as SEC Chair tomorrow or Monday.

Read More: The Trump-Linked Brad Bondi Is a Contemporary SEC Chair Contender and Pro-Crypto

A source shut to the contenders acknowledged Trump will likely pick Brad Bondi, world co-chair of investigations and white collar protection on the law firm Paul Hastings, or Brian Brooks, fashioned performing comptroller of the currency and fashioned CEO of Binance.US. They alongside with two further sources acknowledged that Theresa Goody Guillén, co-chief of the blockchain crew at law firm BakerHostetler, and Paul Atkins, a fashioned SEC Commissioner and a favourite in conservative lawful circles, are finalists.

Crypto executives shut to the administration as well to leaders interesting within the policy build aside hang been asked for their final input this week, ahead of the announcement. Brooks and Bondi hang change into industrial favorites, adopted by Guillén, attributable to their work within the crypto industrial.

Bondi, Brooks, Atkins and Guillen didn’t acknowledge to requests for comment.

Read More: Trump’s Plans for a ‘Crypto Czar’ and a Crypto Advisory Council: Right here’s What We Know

The industrial on the total calls the SEC’s ways under Gensler’s management “regulation by enforcement,” relating to how the agency has over and over sued crypto companies with out first elaborating on lawful interpretation or making rules which elaborate when cryptocurrencies are to be handled as securities under federal law. Though the SEC started its enforcement of the crypto industrial under the Trump administration, with its lawsuit against digital rate community Ripple, under Gensler’s management, it has attributable to this reality sued a unfold of entities from crypto exchanges to NFT creators normally for registration/disclosure kind infractions. Primary companies targeted by the SEC with Wells Notices or whine enforcement actions consist of Coinbase, Kraken, OpenSea, amongst others.

The animus Gensler has introduced about from the crypto industrial gave gasoline to Trump’s campaign after he promised to grasp away Gensler and prioritize the cryptocurrency industrial’s demands in expose to kind The US the “world capital for crypto and bitcoin.” Though Trump would hang likely not been ready to fireplace Gensler fully from the cost under federal law, he might possibly possibly well moreover hang demoted Gensler to a commissioner build aside.

Read More: What Gary Gensler May possibly presumably well also Aloof Fabricate In opposition to Crypto in His Final Days as SEC Chair

In response, several crypto entrepreneurs and companies donated to Trump’s campaign, including Coinbase, Ripple, and enterprise capital firm Andreessen Horowitz, which invests heavily in crypto. The campaign raised over $7.5 million in cryptocurrency donations within the invent of bitcoin, ether, XRP and USDC.

UPDATED: (Nov. 21 at 4:00 p.m. ET): This fable used to be as a lot as this level to level to that the four finalists for SEC Chair didn’t acknowledge to requests for comment.

Source credit : unchainedcrypto.com