Why Every Crypto Company Is Writing to the SEC

April 20, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

LUNA is surging, with UST beming the third-largest stablecoin and Terra procuring an even portion of Convex (CVX) tokens.

-

DeFi OG Andre Cronje is aid – and he’s working on building out “regulated crypto” applications.

-

Compound might maybe also very neatly be ditching its reward mechanism for yield farmers.

-

Decentralized staking provider Lido (which is roofed in-depth in the suggested reads half) voted to allocate $6 million in LDO tokens to beef up Ethereum pattern.

-

Crypto funding funds saw their 2d week of outflowslast week.

-

Blockchain.com is planning on going public in 2022.

-

Bitfinex temporarily shut down trading on Tuesday.

- Okcoin introduced an NFT marketplace that can offer zero charges for Ethereum, Polygon, and other blockchains.

At the modern time in Crypto Adoption…

-

Australia’s first bitcoin ETF is space to be listed subsequent week.

-

The IMF issued a warning that Russia might maybe inform crypto mining to evade sanctions.

- Block CEO Jack Dorsey is bored to loss of life in building merchandise on Ethereum attributable to the community having, in his phrases, “many single aspects of failure.”

The $$$ Corner…

-

The Sandbox is reportedly raising a $400 million funding spherical at a valuation of $4 billion.

-

Framework Ventures unveiled a $400 million fund to invest in blockchain gaming.

-

CoinDCX, an Indian crypto exchange, raised $135 million at a valuation of $2 billion.

- BlockApps, an project blockchain agency, raised $41 million.

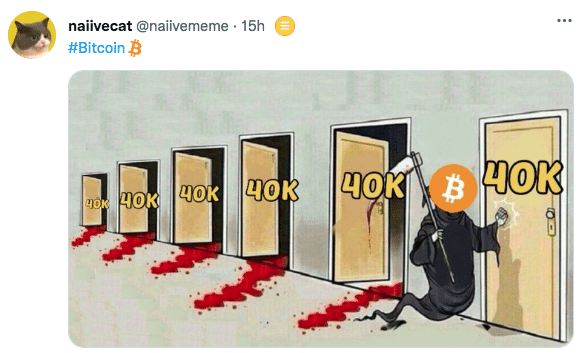

What Make You Meme?

What’s Poppin’?

Crypto Feedback

On January Twenty sixth, the SEC proposed a rule that can enlarge the definition of “exchange” and “Different Procuring and selling Programs” in a technique that might maybe have an effect on the crypto exchange – regardless of now not declaring crypto or DeFi once in its 200 pages. On March 18th, the proposal modified into printed in the Federal Register, opening up the proposal to 30 days for public comment – which ended yesterday.

Total, the SEC got 163 letters from former and crypto entities. Assorted crypto-heavy hitters admire Coin Center, Blockchain Association, a16z, DeFi Training Fund, Paul Grewal (the executive correct officer of Coinbase), Delphi Digital, and ConsenSys every expressed discontent with the proposal this week, lowering it somewhat conclude to the 30-day deadline.

Coin Center’s Peter Van Valkenburgh wrote one of the major extra poignant letters of comment. “The Commission’s proposed redefinition of “exchange” violates the First Amendment by requiring a license to relate–even of originate supply developers,” Van Valkenburgh explained. “The develop of the definition on originate supply software developers is however determined: someone writing or distributing DEX software would be violating the law in the occasion that they don’t register.”

Delphi Digital’s Gabriel Shapiro furthermore had fascinating phrases for the SEC. “The proposal will give upward push to an anti-competitive regulatory moat…If imposed on AMMs, this securities exchange regime would catch very unlikely regulatory burdens (such as FINRA registration) on originate-supply software devs, while sarcastically entirely failing to contend with AMMs’ real risks.”

Shapiro went on to indicate that crypto abilities, such as AMMs already addresses points such as “comely catch entry to, public pricing, [and] auditability” attributable to the inherent, public nature of blockchains.

As for what will even be done to rectify the anxiousness, many entities, admire ConsenSys, are calling on the SEC to slim the definition of a “securities exchange” to exempt crypto protocols:

“Furthermore, the proposal would now not point out cryptocurrency, blockchain, or decentralized finance, now not to mention indicate how the rigorous requirements of the ’34 Act might maybe sensibly be applied in the blockchain context. We completely would by no procedure inquire of or be inclined to hold the Commission would rob the out of the ordinary step of overlaying blockchain-essentially based fully programs without essential look or consultation. Nonetheless, for the sake of providing regulatory clarity for the burgeoning blockchain sector, we bustle the Commission to say expressly that blockchain-essentially based fully networks develop now not fall within the scope of the amendments at anxiousness right here.”

Urged Reads

-

CoinDesk’s David Z. Morris on The Cryptopians:

-

Certain Sats on why Ethereum’s largest staking provider might maybe pose a menace to the community’s decentralization:

-

Tascha Che on what L1s want to study from nation-states:

On The Pod…

Why Crypto Twitter’s Disrespect In direction of Regulators Is a ‘In actuality Execrable Commerce Resolution’

Two protection experts, Chris Lehane, chief technique officer at Haun Ventures, and Niki Christoff, the founder of Christoff and Co., focus on how the crypto exchange has done in Washington and the procedure in which it’ll better educate extra regulators and politicians about the abilities. Point to highlights:

-

Niki and Chris’s background

-

how Niki and Chris would grade the performance of crypto companies in Washington

-

what parallels Chris can scheme between crypto in the 2020s and FAANG in the mid-90s

-

whether or now not having a plethora of crypto protection teams helps or hurts crypto in Washington

-

whether or now not calling politicians and regulators names and making memes of them helps or hurts the crypto exchange

-

an efficient procedure crypto companies can advised lawmakers and regulators to prioritize crypto protection

-

why it goes to even be strategically smarter to are trying to persuade incumbents to undertake knowledgeable-crypto protection over supporting challengers

-

why Chris thinks crypto will doubtless be a bipartisan topic

-

what Chris and Niki deem the truth that Democratic candidates got extra donations from other folks working in the crypto exchange than Republicans did

-

the three forms of crypto customers which can be precious to political candidates

-

what Niki and Chris would allege Senator Elizabeth Warren about crypto in the occasion that they were to meet along with her this present day

-

what develop crypto might maybe want on midterms

-

why the terminology native to crypto might maybe also simply want to alternate

E book Substitute

My guide, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mammoth Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You ought to aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com