The 15-Yr-Used With a Non-public Jet Story

His nickname? ‘Miniature one Al Capone’

This was a exciting week in crypto, where a call of gargantuan companies had news, nonetheless some of the most accurate motion was taking speak in some of the most smaller corners of the scrape. Read on to fetch the thin on the Steem wars and the Aragon/Autark dispute.

Meanwhile, on the pods, hear to my panel from the Tantalizing Layer One convention, in which we got into a debate on whether or not Bitcoin or Ethereum are insist opponents. Plus on Unconfirmed, we discover in regards to the Patoshi pattern, which was learned in 2013, and why it grew to turn out to be relevant again in most modern weeks.

This Week’s Crypto News…

When It Involves Bitcoin, Goldman Sachs Is Unimpressed

A Goldman Sachs analysts call on COVID-19 and Bitcoin got everyone infected — unless the accurate call took place, and it was certain that Goldman thinks puny of the first cryptocurrency. The slides from the call sum up the firm’s viewpoint slightly noteworthy. One subheadline says, “Cryptocurrencies Including Bitcoin Are Now not an Asset Class.” The bullet functions were:

- Invent Now not Generate Money Fade Like Bonds

- Invent Now not Generate any Earnings By Exposure to World Financial Progress

- Invent Now not Provide Constant Diversification Advantages Given Their Unstable Correlations

- Invent Now not Dampen Volatility Given Historic Volatility of 76%

- On March 12, 2020, the cost of Bitcoin fell 37% in in some unspecified time in the future

- Invent Now not Indicate Proof of Hedging Inflation

It persevered, “We ponder that a security whose appreciation is primarily dependent on whether someone else is willing to pay a better tag for it’s miles not a like minded funding for our clients.

We moreover ponder that whereas hedge funds would possibly presumably well fetch shopping and selling cryptocurrencies engaging due to of their excessive volatility, that entice does not portray a viable funding rationale.”

The next slides would possibly presumably well moreover be summarized in three phrases: “criminal money,” “hacks” and “tulips.”

Fortune had a fun recap of the Crypto Twitter reaction, including this gem from Neeraj Agrawal of Coin Center.

Though Goldman didn’t overview Bitcoin on its accurate aspects, the indisputable truth that the analysts felt the maintain to quilt it in any appreciate suggests there’s hobby from clients.

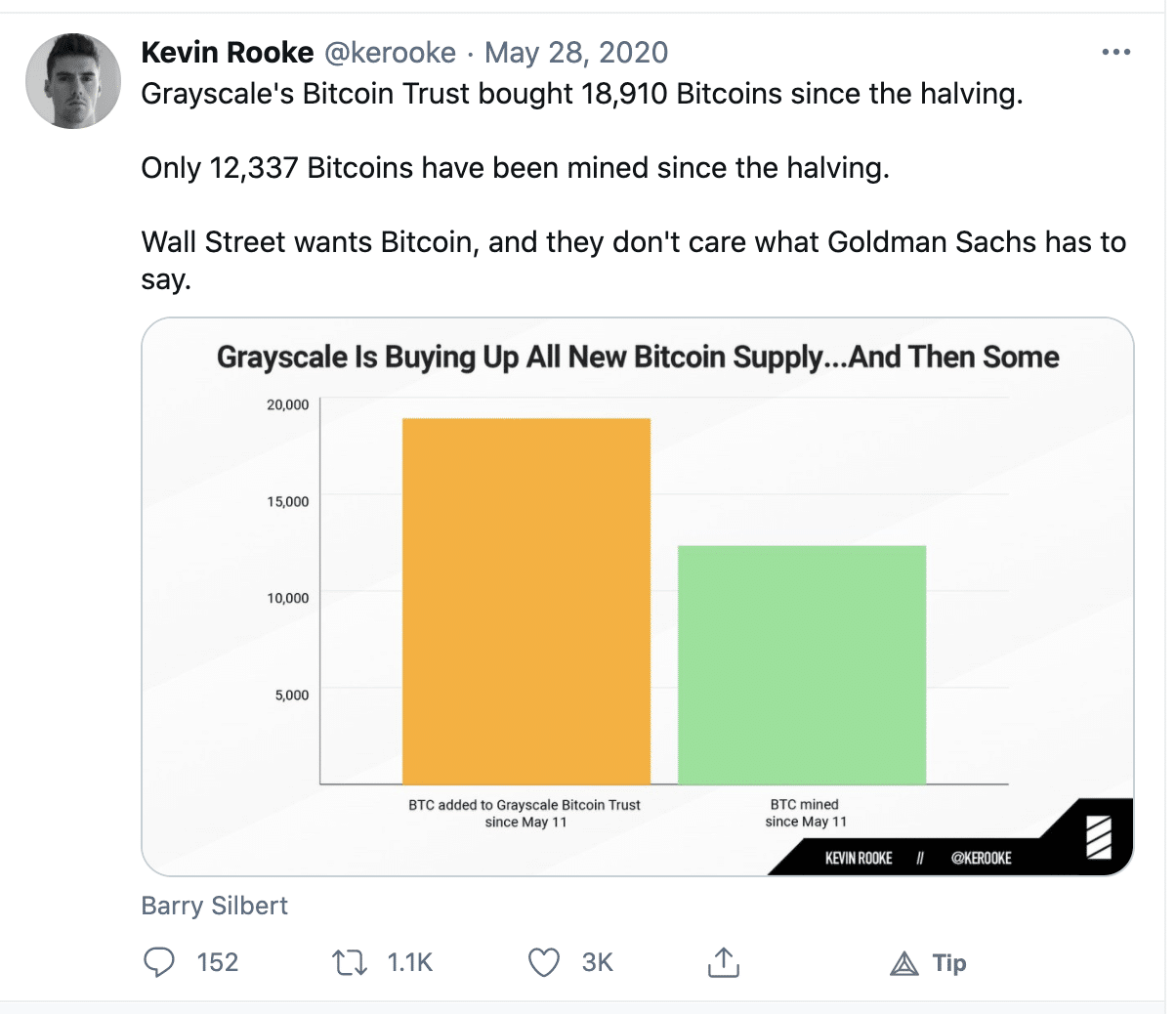

As Kevin Rooke tweeted:

Coinbase Buying Top Broker Tagomi in a $70+ Million Deal

First reported by The Block perfect tumble, crypto unicorn Coinbase is shopping top dealer Tagomi, which helps clients build gargantuan trades at the correct conceivable tag. The deal is pending regulatory approval. The Block moreover studies that Tagomi was moreover in talks with Binance and that two sources point out the cost label was someplace between $70 million and $100 million. In an interview with CoinDesk, COO Marc Bhargava mentioned that the acquisition wouldn’t pose a conflict of hobby. He mentioned, “We ponder we are in a position to tranquil be in a website to raise surely gargantuan pricing to our clients. Obviously, we are in a position to tranquil maintain market maker relationships. Over time, we’ll repeat which exchanges we continue to work with.” ICYMI, make tear that Hear to the Unchained interview with Tagomi.

Calibra Renames to Novi

Facebook’s Calibra has a new name, Novi. Head of Novi David Marcus tweeted, “Novi comes from the mix of two Latin phrases, novus = new, and thru = capability.” Novi will moreover be interoperable with Whatsapp and Facebook Messenger.

Polkadot Launches Its First Chain Candidate

Polkadot launches what is its first candidate for the Polkadot main fetch. As founder Gavin Wood wrote in a weblog post, Polkadot hopes that it’s lastly selected because the final Polkadot chain. He moreover defined that Polkadot had not essentially launched and its token isn’t very but transferable. That would happen ideal in direction of the end of the start route of and below a governance motion. He moreover mentioned the final stage is to bring in parachains, “once the a form of safety common sense is in speak and has been audited, and is tranquil some weeks away.”

Steem Forks and Wars Save Binance, Other Exchanges in a Bind

Steem underwent a fork that made the asset balances of obvious users rush to zero. The addresses focused were owned by 64 other folks that did not enhance the acquisition of Steemit by Tron and Justin Solar. In an knowledgeable declare, Binance cofounder and CEO Changpeng Zhao mentioned, “We’re very noteworthy against zeroing folks’s sources on the blockchain. This goes against the very ethos of blockchain and decentralization. The indisputable truth that this is in a position to presumably well happen on a blockchain capability it’s overly centralized. We don’t maintain to enhance this upgrade. But there could be a flip facet. If we don’t enhance it (technically), no users can withdraw any STEEM money. The wallet stopped syncing at a obvious height, and there are no other forks. We waited to gape what other exchanges would fetch. And quickly sufficient, other exchanges did the upgrade and enabled withdrawals. A entire bunch our users ask it as successfully.” This was his reason within the motivate of why Binance supported the fork. He went on to practically imply that the focused users originate a new fork and mentioned that Binance would likely enhance “another sensible neighborhood forks.”

Andreas Antonopoulos tweeted that he expected that the onerous fork would end result in a class-motion lawsuit and that any exchanges that participated is probably going named defendants. CZ mentioned he was stunned to gape Andreas bringing up lawsuits on disorders around onerous forks, consensus and decentralization.

Blocktower Capital’s Ari Paul known as the drama with Steem “doubtlessly the finest thing taking place in crypto now. It’s an improbable experiment in crypto M&A, adversarial plot and the real/social repercussions of ‘stealing’ thru onerous fork, forcing refined discussions across many gargantuan exchanges. … What this drama surely reveals is that the arbiters of actuality in an even sense have a tendency to remain ‘economically necessary nodes’ (I.e. largely centralized exchanges) for the foreseeable future.”

Aragon Affiliation Sues Grantee Autark

On Could per chance 22, every Autark and the Aragon Affiliation published competing weblog posts that be taught be pleased a “he mentioned, she mentioned: DAO version.” Autark got two grants voted on by Aragon Network Token holders, and the Aragon Affiliation paid for the total first grant after which for some of the most 2nd grant. In January, the Aragon Affiliation stopped funds, which Autark says was, “for no reason.” Autark moreover claims that even supposing the neighborhood celebrated the grant, Aragon cofounders Luis Cuende and Jorge Izquierdo, stopped the funds themselves. In distinction, Aragon says that it did not continue funding Autark “due to the breach of the grant agreement.”

Aragon moreover says that it grew to turn out to take into accout that Autark was working on other initiatives “utilizing the Affiliation’s funding that were not in profit to the Aragon neighborhood in any appreciate,” and that Autark moreover threatened Aragon, underperformed, lacked quality in its code and breached confidentiality.

The Aragon Affiliation is now suing Autark in Swiss court docket, which is ironic due to Aragon’s main focal point is governance and it has a court docket for resolving disputes. Obviously prominent Ethereum avid gamers be pleased Eva Beylin requested why Aragon wasn’t utilizing its be pleased court docket. She tweeted, “whereas you happen to can’t utilize your be pleased dispute decision platform for neighborhood challenges forward of searching out for real motion, then you’re veritably a fraud.” Luis’s protection was, “Aragon Court handles on-chain situations for DAOs. Correct agreements made by attorneys in accordance to Swiss law desires to be disputed in Swiss courts, the same capability that an Aragon Agreement desires to be disputed in Aragon Court.”

Maria Paul summed it up this suggests, “With out reference to who’s real on the Aragon/Autark dispute, right here is a extraordinarily engaging case and reveals the obstacles of DAOs. It reveals we’re not ready to noxious every little thing on-chain and I’m hoping more other folks realize the want for hybrid alternatives (DAOs+ accurate existence real entities).”

At the same time as you overlooked it, right here is the Unchained interview with Luis Cuende of Aragon.

Dangers for Bitcoin in Custodial Banking

Self reliant crypto researcher Hasu wrote a exciting essay on the Deribit weblog this week. The elemental premise is that since the Bitcoin block dimension is limited, the inducement is for users to utilize custodial banks, due to “they provide decrease transaction tag over a bunch of dimensions. These can consist of stronger community build, quicker payment clearing, real recourse, decrease transaction charges, or access to financial companies and products be pleased change or money markets.” He advocates for issues be pleased “pioneer[ing] ways for more than one users to share a single UTXO, so they are able to moreover bundle their hobby and live to screech the tale within the on-chain marketplace for blockspace with custodial banks.”

DevCon VI to Be Held in Bogota — in 2021

The Ethereum Basis announced that it can presumably well decentralize a chain of neighborhood, regional or virtual events for 2020, nonetheless preserve concerned with turning in a DevCon VI in Bogota, Colombia in 2021.

Most realistic possible of the Yr at Coin Metrics

The shining team at Coin Metrics is celebrating its first one year and created a one year-in-evaluate of highlights. Since I do know many of you are nerds who abilities factual analyses of info, I figured I’d can enable you to achieve about it whereas you happen to want to behold some of the most posts for your be pleased, apart from the ones that maintain been featured right here on Unchained and Unconfirmed!

How This 15-Yr-Used Stole $23.8 Million in Cryptocurrency

In January 2018, at the height of the crypto bubble, crypto OG Michael Terpin of BitAngels had his cryptocurrency tale hacked, and $24 million was whisked away. In a most modern lawsuit, Terpin alleges that Ellis Pinsky was the thief; he was 15 at the time of the theft. The Novel York Submit describes Pinsky as a tenth-grader who ran song, played soccer and got factual grades. It moreover says his mother is a doctor at NYU Langone. Alternatively, he did for the time being, write to an acquaintance, “I’d aquire you and your entire family. I surely maintain 100 million dollars,” and the complaint alleges that an accomplice seen, in December 2017, “data indicating that Ellis had $70 million.” At the same time as you were questioning what diagram Pinsky allegedly frail to raise off his heists? A SIM swap. Read the beefy Submit article for shrimp print on how he and his alleged collaborators utilized these thefts, and for shrimp print on how he lived the excessive existence by doing issues be pleased retaining an tale at the non-public jet firm JetSmarter. The kicker? After Terpin’s lawyer contacted Pinsky’s mother at her speak of job, Pinsky despatched cryptocurrency, money and a Patek Philippe Nautilus peek, price over $100,000, to Terpin with out any prerequisites. Restful, Terpin is suing the puny one who he’s nicknamed ‘Miniature one Al Capone’ for $71.4 million.

Source credit : unchainedcrypto.com