🗞 Caroline Confesses All the pieces 😳

November 15, 2022 / Unchained Each day / Laura Shin

What’s Poppin’?

Caroline Ellison Says Alameda Feeble FTX Customer Funds to Repay Loans: NYT

by Samyuktha Sriram

Alameda’s Caroline Ellison told the Original York Conditions that the trading company passe FTX possibilities’ funds to make mortgage funds after the crypto demolish earlier this yr.

BlockFi Denies Rumors That Majority of Sources Custodied on FTX

by Samyuktha Sriram

BlockFi, the crypto lender that halted withdrawals final week, denied claims that it held the majority of its property on bankrupt crypto alternate FTX.

Crypto.com Users Chronicle Delays in Withdrawals

by Samyuktha Sriram

Some Crypto.com customers had been ready on withdrawals for better than 12 hours as high community web bellow online web bellow online visitors resulted in vital delays.

Paxos Freezes $19M From Four FTX-Linked Ethereum Addresses

by Samyuktha Sriram

Paxos has frozen funds linked to FTX on the seek files from of U.S. Federal Law enforcement.

In A ramification of Records… ✍️✍️✍️

- Changpeng Zhao mentioned Binance plans to enforce a brand new Proof-of-Reserves protocol developed by Vitalik Buterin. 9 other exchanges announced identical plans after the Binance CEO’s announcement.

- The CEO of Crypto.com (disclosure: sponsor of Unchained) disregarded insolvency rumors, nevertheless its token designate is falling sharply.

- Travis Kling, Chief Investment Officer at Ikigai, mentioned the fund held the majority of its property on bankrupt crypto alternate FTX.

- Yuga Labs, the creator of the Bored Ape Yacht Club (BAYC) NFT series, received Beeple’s NFT platform, Wenew, and its NFT series, 10KTF.

- FTX pulled the rush on its utility with the CFTC to supply automated margin trading.

- Visa shut down its debit card partnership program with FTX.

- Prosecutors from the Division of Justice’s Southern District of Original York launched a probe into the collapse of crypto alternate FTX.

- Hbit, a crypto platform based entirely mostly in Hong Kong, disclosed it has $18.1 million worth of cryptocurrencies deposited in FTX.

- A pockets that would very effectively be owned by Ethereum inventor Vitalik Buterin sold 3,000 ETH at a designate of $1,254, worth $3.8 million.

- Crypto endeavor capital company Multicoin Capital has a $25 million stake in FTX through its $430 million endeavor fund, in step with The Block.

Right this moment in Crypto Adoption…

- Derivatives crypto alternate PowerTrade partnered with London-based entirely mostly company Copper to supply custodial and settlement companies for its institutional purchasers.

- Caribbean country Saint Kitts and Nevis could well undertake Bitcoin Money (BCH) as apt gentle by March next yr.

- Sports giant Nike will delivery its catch platform for Web3 wearables.

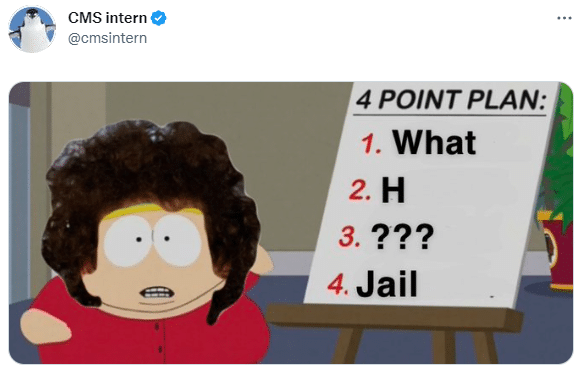

What Attain You Meme?

Suggested Reads

- Fortune’s Leo Schwartz on proof of reserves

- CoinDesk’s Nik De on the regulatory impacts of FTX’s failure

- Bloomberg’s Matt Levine on the steadiness sheet of FTX

On The Pod…

Will FTX Customers Ever Gain better Their Sources? Two Insolvency Consultants Weigh In

Wassielawyer, a lawyer that specialise in restructuring and insolvency, and Thomas Braziel, founder and CEO of 507 Capital, discuss the industrial fracture of FTX. Expose highlights:

- what the industrial fracture direction of of FTX is expected to appear love

- why FTX received to the the level of filing for financial fracture security

- why Wassie thinks Alameda is lifeless

- why FTX filed for financial fracture in the US supplied that it’s a Bahamian company

- how FTX’s steadiness sheet consists and whether or no longer it entails Alameda

- whether or no longer Justin Solar would perhaps be dragged into the industrial fracture

- how FTX’s phrases of carrier differ from Celsius’s and Voyager’s

- how the $600 million hack affects the industrial fracture persevering with

- whether or no longer it’s worth it to employ millions of bucks in law corporations to trip after the hacked money

- what’s the impact of the 192 million FTT tokens that had been printed Saturday evening

- what’s going to happen with the fork of Serum and the forked tokens

- the penalties on your entire tasks that FTX invested in

- why Wassie thinks that tokenizing the liabilities could well very effectively be a correct skill acknowledge

- how the FTX’s financial fracture affects Voyager’s court cases and possibilities

- whether or no longer FTX’s financial fracture has do BlockFi in misfortune

Ebook Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Immense Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now accessible!

That that you just can well presumably enjoy it here: https://amzn.to/3CvfrbE

Source credit : unchainedcrypto.com