This Crypto Stock Jumped 240% in 1 Trading Day

October 26, 2021 / Unchained Every single day / Laura Shin

Every single day Bits ✍️✍️✍️

-

SEC Chair Gary Gensler talked about that DeFi will “discontinuance poorly” without protections.

-

Digital asset funding products saw $1.5 billion in inflows final week — an all-time excessive.

-

Sino Capital launched a $200 million fund with backing from FTX to speculate in crypto initiatives.

-

China is no longer soliciting public understanding regarding its bitcoin mining ban.

-

An investor in Europe is searching for $140 million in compensation from Binance by claiming his station became unjustly liquidated in leisurely 2020.

-

BlockFi is partnering with Neuberger Berman to intention a line of crypto products, fancy ETFs.

-

Solana (SOL) reached a brand novel all-time excessive at approximately $219 and is now the sixth-largest cryptocurrency by market capitalization.

-

Matt West, a Yearn developer, is working for Congress.

-

Over 3 million email addresses from CoinMarketCap had been leaked.

-

Korea Teacher’s Credit Union, which manages $47 billion, is investing in Bitcoin, stories Joseph Younger.

-

Senator Rand Paul is questioning whether cryptocurrency may perhaps change into the reserve currency of the arena.

-

NFT marketplace SuperRare had its simplest month ever according to shopping and selling quantity.

- Shut to Protocol is providing $800 million in grants funding for ecosystem growth.

- A novel picture from the US Treasury Department and various businesses will exhibit that the SEC may perhaps composed compile fundamental authority to govern stablecoins.

What Attain You Meme?

What’s Poppin’?

The day outdated to this, Bakkt (NYSE: BKKT) shares rose 234.43%, jumping from $13.87 to $30.60 at some level of shopping and selling hours because the crypto platform announced partnerships with Mastercard and Fiserv. In after-hours shopping and selling, shares ballooned even additional, reaching nearly about $47, as of 6:04 pm ET,

Bakkt is unlocking crypto price rails for Mastercard patrons, in response to a Monday morning press initiating. Quickly, Mastercard prospects may perhaps maybe be ready to aquire, sell, and compile digital sources through Bakkt custodial wallets. Moreover, Mastercard says the partnership will streamline the issuance of branded crypto credit score and debit playing cards.

“Mastercard is committed to providing a wide fluctuate of price solutions that raise extra want, price and affect on on each day foundation foundation,” talked about Sherri Haymond, executive vp of digital partnerships at Mastercard, in an announcement. “Alongside with Bakkt and grounded by our principled manner to innovation, we’ll no longer most interesting empower our companions to produce a dynamic combination of digital sources alternatives, however also raise differentiated and connected person experiences.”

Fiserv announced a identical deal with Bakkt on Monday afternoon. By Bakkt’s digital asset platform, Fiserv plans to “enable good makes exhaust of of crypto and emerging asset classes” for his or her prospects. The payments company particularly envisions Bakkt helping facilitate crypto-asset price mechanisms for B2B and B2C payouts, loyalty functions, and transactions.

It has been a busy week for Bakkt. As well to the novel gives with Mastercard and Fiserve, the crypto platform went public final Monday (October 15th) through a SPAC deal that valuedthe company at $2.1 billion.

Steered Reads

- @Punk6529 on NFTs:

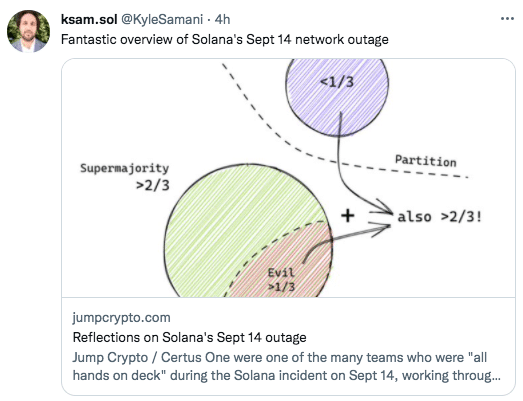

- Soar Crypto on Solana’s community outage in September:

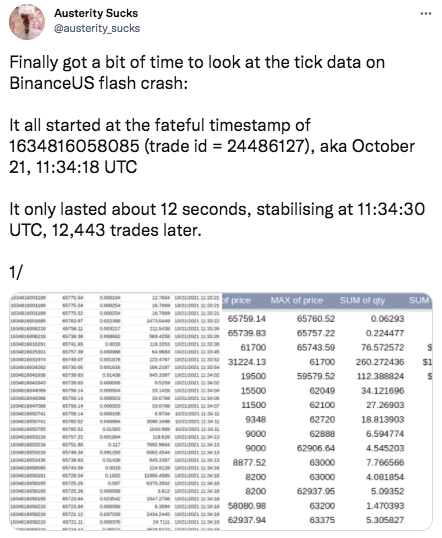

- @austerity_sucks on Bitcoin crashing to roughly $8K on BinanceUS:

On The Pod…

Now now not Reporting Recordsdata on Some Transaction Companions May maybe perhaps maybe Quickly Be a Criminal

Keep in mind the $1 trillion infrastructure invoice, which prompted the truth is wide backlash from the crypto neighborhood consequently of the language regarding “brokers?” Abe Sutherland, an adjunct professor at College of Virginia College of Law, believes one other provision tucked inside the invoice may perhaps discontinuance up being a much extra major problem for anybody transacting in digital sources. Demonstrate highlights:

-

how Abe fell down the crypto rabbit gap

-

what provision 6050I is and the procedure in which it will perhaps maybe want an price on anybody transacting with digital sources

-

how 6050I works and when it would practice

-

why violating 6050I may perhaps perhaps be a prison

-

how 6050I discourages digital asset transactions

-

how 6050I would practice to various transaction sorts, fancy admire-to-admire trades, NFT gross sales, and trim contract escrow accounts

-

what recordsdata recipients of digital sources must take a look at from the sender

-

how the chief got right here up with the $10,000 reporting threshold and why Abe believes this amount is out of date

-

why Abe thinks proposing 6050I inside the infrastructure invoice is harmful

-

what causes the chief has to must place such stringent reporting requirements on digital asset transactions

-

how 6050I matches beneath the financial authorized pointers of the Bank Secrecy Act

-

why Abe believes the modification desires to be struck from the infrastructure invoice

-

what Abe thinks of the constitutionality of 6050I

-

how Abe views 6050I as less about producing tax earnings and extra about monitoring folks’s digital asset transactions

-

what action steps he says the crypto neighborhood can take hang of to repair the invoice

E-book Exchange

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Massive Cryptocurrency Craze, is now readily available for pre-present now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-present it on the original time!

You may perhaps perhaps perhaps aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com