A Bitcoin Commonplace?

PLUS: JPMorgan to provide bitcoin exposure to clients

This week used to be gorgeous busy on the earth of Bitcoin. JPMorgan will provide clients exposure to bitcoin by way of an actively managed fund as soon as this summer. The publicly traded firm Nexon bought $100 million of BTC for its balance sheet. The SEC decided to additional procrastinate on its bitcoin ETF determination by delaying its ruling on the VanEck utility one other Forty five days. Tesla provided 10% of its bitcoin situation and Matt Levine gave the skinny on what used to be in truth occurring. Pete Rizzo and Alex Gladstein wrote fully killer pieces on Satoshi and switching to the Bitcoin Commonplace, respectively.

In varied files, ether hit an all-time high because the investment arm of the EU raised $121 million from bonds utilizing Ethereum. ETH 2.0 hit a bump within the avenue when a pc virus stopped validators from incomes block rewards. Binance announced it will originate an NFT marketplace on the Binance Natty Chain. Visa, Mastercard, PayPal, and Paxos every produced crypto-particular headlines. (Btw, if you’re , I’m moderating a dialogue between Charles Cascarilla, CEO of Paxos, and Vlad Tenev, CEO of Robinhood, subsequent Tuesday, Would possibly possibly possibly also 4. Register right here.) The NYT experiences that ragged art work collectors are wary of the NFT style. The alleged administrator of Bitcoin Fog, one amongst the long-established coin mixers, used to be caught by authorities. In fun files, a bitcoin ETF is, it looks, a ugly concept, and it’s likely you’ll well now vacation utilizing only BTC.

On Unchained, Devin Finzer, co-founder and CEO of OpenSea, talks about all issues non-fungible. Click on the link below to hear him atomize down NFTs and how he thinks the exchange might possibly well seemingly evolve whereas also giving the inside of scoop on OpenSea. On Unconfirmed, Dan Finlay of MetaMask describes how its monthly active customers quintupled within the final half one year.

Hear to the Most standard Episode of Unchained

How NFT Platform OpenSea Plans to Sustain Its Competitive Again

Devin Finzer, co-founder and CEO of NFT marketplace OpenSea, talks all issues non-fungible.

Hear to the Most standard Episode of Unconfirmed

Dan Finlay, co-founder of MetaMask, talks concerning the meteoric development of monthly active customers of the crypto wallet, which has quintupled within the previous six months.

Thank you to our sponsors!

Crypto.com

InterPop

NEAR

This Week’s Crypto News…

BTC Institutional Adoption Strengthens as Bitcoin ETF Delayed

Sources insist CoinDesk that JPMorgan Scurry will provide an actively managed bitcoin fund to obvious clients as soon as this summer, marking an about-face for the firm led by CEO Jamie Dimon, who infamously called Bitcoin a “fraud” in 2017. NYDIG, a bitcoin-centric investment company, will serve because the fund’s custody provider.

Asian online sport writer Nexon, a publicly-traded firm, announced the acquisition of roughly $100 million price of Bitcoin. The allocation represents about 2% of its whole money and money equivalents as of December 2020.

The U.S. Securities and Commerce Charge delayed its ruling on VanEck’s bitcoin ETF utility, extending the long-established Forty five-day determination window to 90 days. The unique time restrict is decided for June 17, though it could well well be additional delayed to embody 240 days. The extension ought to no longer approach as a shock: the securities regulator has delayed varied bitcoin ETF proposals, every ending in rejection.

Tesla Sold 10% of Its Bitcoin Space

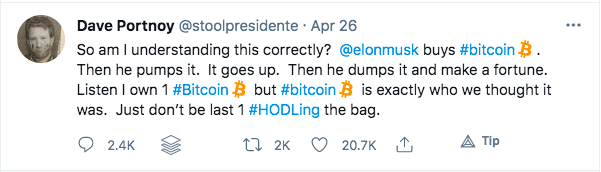

A Q1 earnings file confirmed that Tesla generated $100 million+ in profits from the sale of bitcoin, helping enhance profits to a quarterly file high to delivery out 2021. The electrical vehicle firm’s long-established have of $1.5 billion in BTC is currently valued at $2.48 billion — even with the sale. Barstool CEO Dave Portnoy, acting as a stand-in for crypto day merchants and other folks that don’t know what it device to HODL, tweeted at Musk:

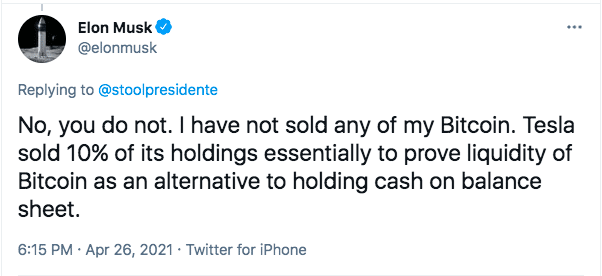

Musk responded:

Bloomberg columnist Matt Levine renowned that Tesla’s chief financial officer Zachary Kirkhorn mentioned bitcoin liquidity so a lot on the determination. As Levine places it, “Tesla decided to place a chunk of its corporate money into Bitcoin and I notify critical to procure obvious that its money wasn’t trapped. A cheap field!” He then brought up the accounting principles that might possibly well well be a unfavorable for firms holding Bitcoin on their balance sheets.

He says, “When your Bitcoins saunter up, you don’t guide a impress, but after they saunter down you carry out guide a loss. The single device to guide a impress on Bitcoins is to promote them.” The upshot, he says, is that “if it’s likely you’ll well well also be Elon Musk and it’s likely you’ll well procure Bitcoin saunter up by tweeting about it — you nearly have an duty to carry out it? Most likely a fiduciary duty to your shareholders, but at the least a form of trendy duty to comedy. If Bitcoin desires Musk to protect an eye fixed on it, Musk in truth ought to protect an eye fixed on it.”

Speaking of Bitcoin, I suggest two long reads this week:

- April 26th used to be the tenth anniversary of Satoshi’s final-known verbal exchange with the Bitcoin neighborhood. In Bitcoin Magazine, Kraken editor-at-nice Pete Rizzo analyzes the final days of Satoshi, when there used to be, Rizzo writes, “a rising belief – stronger maybe than any self belief in Satoshi himself – that no Bitcoin particular person shall be elevated or lower than any varied, that they have been all nodes on the community, authors of code, people to blame for the utility’s success.”

- Alex Gladstein, chief technique officer at the Human Rights Foundation, wrote concerning the hidden mark of the waning petrodollar — a U.S. buck paid to a petroleum exporter in exchange for oil — on U.S. fiscal policy and political energy. He believes a transition to a Bitcoin accepted from the petrodollar “plays to the strengths of delivery societies, doesn’t depend upon dictators or fossil fuels, and is within the destroy flee by electorate, no longer the entrenched elite.”

Ether Reaches a Modern All-Time High

After hitting $2,600 for the well-known time final week, ether soared to a unique all-time high over $2,700 on Wednesday afternoon.

Coinciding with the all-time high, the European Funding Financial institution, the EU’s lending arm, announced it dilapidated Ethereum to enlighten $121 million in digital notes. Here’s how it works:

- The EIB points a series of bond tokens on Ethereum

- Investors have + pay for the bond tokens in fiat

- The money dilapidated to aquire the bonds is minted as a CBDC on Ethereum

- The vital is paid in fiat at maturity to CBDC holders

Ethereum 2.0 Updates:

- Final Friday, Ethereum creator Vitalik Buterin outlined the enchancment roadmap for ETH 2.0. His understanding would look Ethereum evolve into a proof-of-stake blockchain, put in power sharding ideas to reinforce throughput, and tweak security features for the better.

- On Saturday, Ethereum 2.0 had its first vital incident when a pc virus used to be chanced on that averted a nice discipline of validators from producing blocks. Validators are customers staking 32 ETH+ on Ethereum 2.0 to energy the proof-of-stake blockchain. The malicious program used to be patched after 403 blocks and prompted shrimp disruption exterior of obvious validators dropping out on block rewards.

Binance Natty Chain NFT Announcement Marred By $50 Million Hack and Doubtless Violation

Cryptocurrency exchange Binance plans to originate an NFT marketplace that will flee on its Ethereum competitor, the Binance Natty Chain.

That announcement used to be overshadowed by a Binance Natty Chain dapp, Uranium Finance, dropping $50 million in a likely rug pull. Quite so a lot of tokens, including bitcoin and ether, have been drained from the protocol early Wednesday as a consequence of a pc virus that allowed the exploiter to make employ of a swap feature to protect shut the funds.

Furthermore, Binance’s most modern liberate of stock tokens that tune Tesla, Coinbase, and MicroStrategy stock caught the ire of Germany’s Financial Supervisory Authority BaFin as being “suspicious.” The exchange might possibly well seemingly incur as a lot as $6 million in fines — 3% of Binance’s annual earnings. Regulators within the U.Okay. and regulations firms in Hong Kong have already wondered the legitimacy of the stock tokens.

In connected files, Brian Brooks, the soon-to-be CEO at Binance.US, has gigantic plans to make the exchange as a Coinbase competitor and out of the shadow of its guardian firm, Binance. He is decided to amplify the exchange’s reach within the route of the U.S. Brooks suggested The Block that his “precedence is doing what is fundamental to procure what desires to be accomplished on licenses” for states the place Binance.US is currently unavailable, respect Texas and Modern York, amongst others. He acknowledged he believes that if the company “factual added these states and nothing else, the exchange would seemingly double.”

Charge Platforms Continue to Include Crypto

- In an earnings name earlier this week, Visa CEO Alfred Kelly described the company as “extraordinarily successfully-positioned” to discontinuance its crypto targets connected to a multi-pronged technique including bitcoin services, stablecoins, and CBDCs.

- Mastercard used to be published because the partner for Gemini’s upcoming credit rating card, which is ready to provide rewards in crypto for cardholders. Gemini is the crypto exchange founded by the Winklevoss twins.

- In a most modern profile by Time Magazine, PayPal CEO Dan Schulman acknowledged that “Inquire of of on the crypto aspect has been a pair of-fold to what we before all the pieces expected. There’s so a lot of excitement.”

- Paxos, the blockchain infrastructure firm powering PayPal’s and Venmo’s crypto choices, raised $300 million. CEO Charles Cascarilla is optimistic about Paxos’ development, telling The Block, “We understanding we might possibly well seemingly add one buyer the scale of PayPal this one year. I notify we can add three to five.”

NFTs Discipline Criticism From Art Collectors

The Modern York Instances experiences extinct school art work collectors are reluctant to enroll within the blockchain art work craze over concerns concerning the usual, ownership, and authenticity of NFTs. Critics of NFTs shock concerning the exclusivity of an NFT, which anyone can look online, along with, as one place it, the “nice unsolved copyright points.”

Then again, the NYT cites artists angry to abolish digital say on the blockchain and art work galleries including NFTs to displays. Positives apart, Tina Rivers Ryan of the Albright Knox Art Gallery acknowledged it finest: “the $69 million request is whether or no longer this goes to change into one other hype cycle respect digital fact used to be in 2016 or respect Catch art work used to be earlier than the dot-com bubble burst in 2001.”

The Alleged Administrator of Bitcoin Fog Caught

Bitcoin Fog used to be one amongst the well-known Bitcoin washing machines — a carrier designed to support anonymize cryptocurrency transactions by mixing particular person’s funds.

On Tuesday, U.S. officials arrested Roman Sterlingov, the alleged administrator of Bitcoin Fog, on money laundering connected prices. The IRS dilapidated an “prognosis of bitcoin transactions” along with varied investigative knowledge to name Sterlingov.

More than 1.2 million BTC used to be despatched by way of Bitcoin Fog, price $336 million at the time. Per Wired, at the least $78 million passed by way of the mixer to illegal marketplaces, a lot like Silk Avenue.

This Article Changed into as soon as a Bad Thought

The Financial Instances published a bit of writing titled “A bitcoin ETF is a ugly concept,” asserting that for ETFs, “the property ought to be liquid too. That might possibly well well be a topic with bitcoin, the provision of which is capped at 21m coins. In a market drop, merchants might possibly well seemingly procure themselves locked into the shares.” All I in truth must notify to that is that maybe earlier than publishing one thing in an world newspaper, it’s a reliable recommendation to carry out a shrimp evaluation on it.

Vacationing The usage of Bitcoin?

Paradise is on its way: The One Bequia style, the place 39 luxury villas are discipline to be inbuilt the Caribbean, intends to change into the realm’s first fully Bitcoin-enabled neighborhood. Folks shall be ready to pay for property in Bitcoin whereas also utilizing BTC for daily essentials respect groceries, eating locations, and movie theaters.

The property owner, Storm Gonsalves, says the adoption of BTC is more necessity than gimmick, citing banking challenges coming up from limited island nations sending and receiving money internationally as a struggle as a consequence of derisking by nice world banks.

Source credit : unchainedcrypto.com