IMF to Central Banks: ‘Get Fervent’ in Digital Forex

Is this how adoption begins?

The realm bustle to launch a dominant stablecoin is heating up in a indispensable intention, with the IMF prompting central banks to initiate, the Libra Association formally signing its structure, China racing to launch its cryptocurrency, inclined CFTC Chair Christopher Giancarlo advocating for a digital dollar, a Fed official acknowledging the Fed is actively debating this now, the G-8 issuing guidelines for regulating digital forex and far extra. Plus the IRS is making obvious it gets a allotment of the motion.

But no longer all forces are pushing forward. Two senators despatched letters to rate companies that had initially keep signed on to be members of the Libra Association threatening to present them increased scrutiny over their existing companies in the event that they stayed in the Libra Association, and the SEC filed a restraining portray against messaging app Telegram for its yet-to-be-launched cryptocurrency.

Meanwhile, on the podcasts, I had a charming dialog about DAOs with Mariano Conti and Peter Pan on Unchained, the keep we received into why Mariano voted against Peter’s application to hitch MolochDAO, Mariano’s are trying at on-chain corruption known as SelloutDAO, LAOs, and why these DAOs in truth require loads of off-chain social coordination. Plus, Jonathan Levin talked about how Chainalysis helped regulations enforcement shut down the largest child porn feature, leading to 337 arrests in 38 countries. Bravo to Chainalysis.

This Week’s Crypto Recordsdata…

World Stable Coin War Heats Up

It wasn’t that intention succor that the change used to be simply hoping that regulations wouldn’t waste innovation off. This week, there used to be a ton of activity in the bustle to impress a world stable coin from each and each central banks and tech companies.

- As a Bloomberg article build it, “When finance ministers and central bankers attain to Washington this week, the International Monetary Fund has a message for them: Digital currencies are on the doorstep. Change into involved.”

- The FT has a legend on how various initial members dropped out of Libra, with some inclined members announcing they felt Facebook underestimated the amount of regulatory scrutiny Libra would receive, and moreover that they plot it used to be a mistake for the mission to be so closely tied to the tech big.

- But none of this has stopped Facebook. Libra formally signed the Libra Association Constitution this week, making the 21 existing signers the initial members of the Libra Council.

- Meanwhile, China is racing forward on its digital forex. RBC analysts Mark Mahaney and Zachary Schwartzman said in a be taught expose Tuesday. “If U.S. regulators in a roundabout intention brush off Libra and establish no longer to draft regulations to succor Crypto innovation in the U.S., China’s [Central Bank Digital Currency] would possibly presumably even be strategically positioned to turn out to be the de facto world digital forex in emerging economies, largely thru Alipay, WeChat, UnionPay and totally different messaging & rate apps.”

- But it doesn’t plot take care of the US is entirely asleep at the wheel. A Fed official did disclose the central bank is actively debating a digital dollar.

- And inclined CFTC chair Christopher Giancarlo wrote an op-ed in the WSJ advocating that the US impact a blockchain-essentially essentially based entirely digital dollar.

- Plus, the IRS is making obvious it doesn’t miss out.

Senators Create Thinly Veiled Threat Over Libra

Senators Sherrod Brown and Brian Schatz despatched letters to rate companies that had initially keep signed on to be members of the Libra Association threatening to present them increased scrutiny over their existing companies in the event that they stayed in the Libra Association.

SEC Recordsdata Restraining Expose In opposition to Messaging App Telegram

What used to be to be Telegram’s almost straight away-to-be-launched cryptocurrency is now delayed, after the SEC filed a short restraining portray to pause Telegram from distributing any Grams.

Avichal Garg of Electric Capital printed a sizable tl;dr on the SEC’s filing against Telegram. As he locations it, “The SEC went to town on the assertion that Telegram in truth raised money to be taught Telegram Messenger, Telegram controls the TON Foundation, and the one folk constructing TON are Telegram workers. Thus, it’s miles a identical outdated enterprise and profits are driven by efforts of others.” He goes on to claim, “Some complications the SEC highlights that totally different initiatives will are trying to retain away from in due course: A/ Don’t possess the company and basis managed by the identical folk; B/ Don’t spend funds to finance an existing company; C/ Don’t possess only company workers committing code.”

Binance Crosses $1 Billion in Earnings

Basically the most smartly-most popular crypto change has its 2d-easiest quarterly profit ever. Larry Cermak of the Block notes that right here’s no matter trading volume being down, which implies that Binance is successfully diversifying its income.

Why Multi-Collateral Dai Is About More Than Correct New Forms of Collateral

For those of you shopping for extra diminutive print on the upcoming launch of multi-collateral Dai, Cyrus Younessi of MakerDAO notes that governance and security will be gigantic focal level areas.

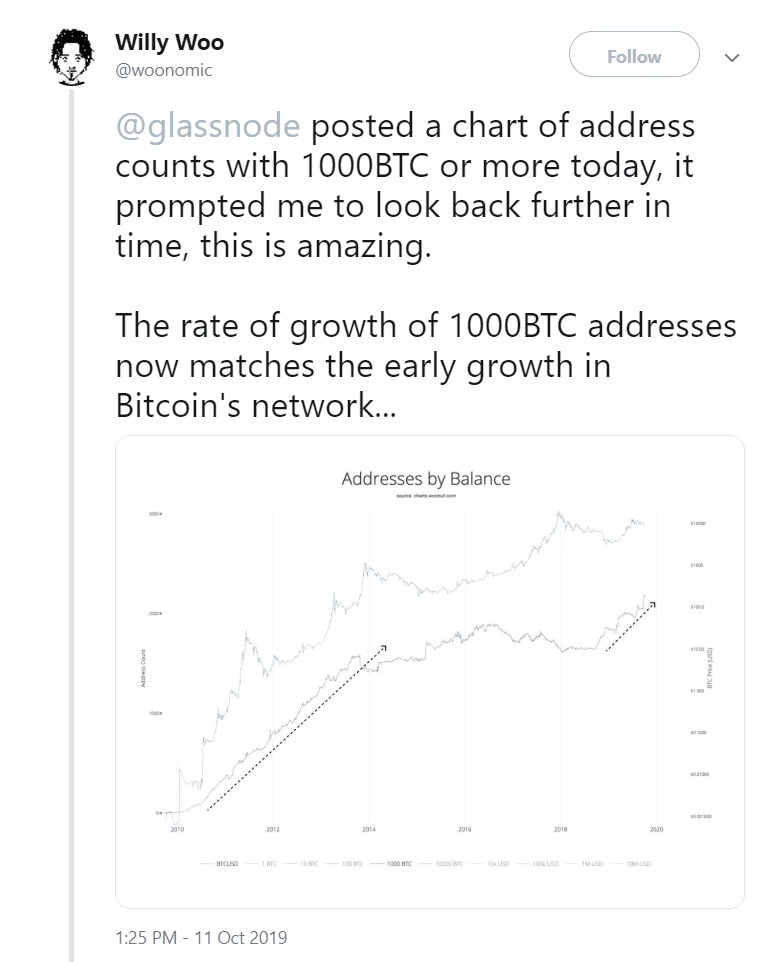

Crypto Milestones: 1,000-BTC Addresses Rising at a Fee Not Considered Since the Early Years of Bitcoin

Willy Woo posted a charming chart displaying that the growth in the resolution of Bitcoin addresses with at the least 1,000 now matches what it used to be in the early years of the network. As he says, “In the early years, gaining 1000BTC used to be a matter of being an uber geek, colorful concepts to mine it, and a few investment in hardware and electrical energy. … In 2019, 1000BTC intention an investment of ~$10m … IMO we’re most likely in a brand unusual renaissance of Bitcoin, this one is powered by capital influx of high rep worth merchants, while the early one used to be from the tech savvy who were bootstrapping the network. Comely Bullish.”

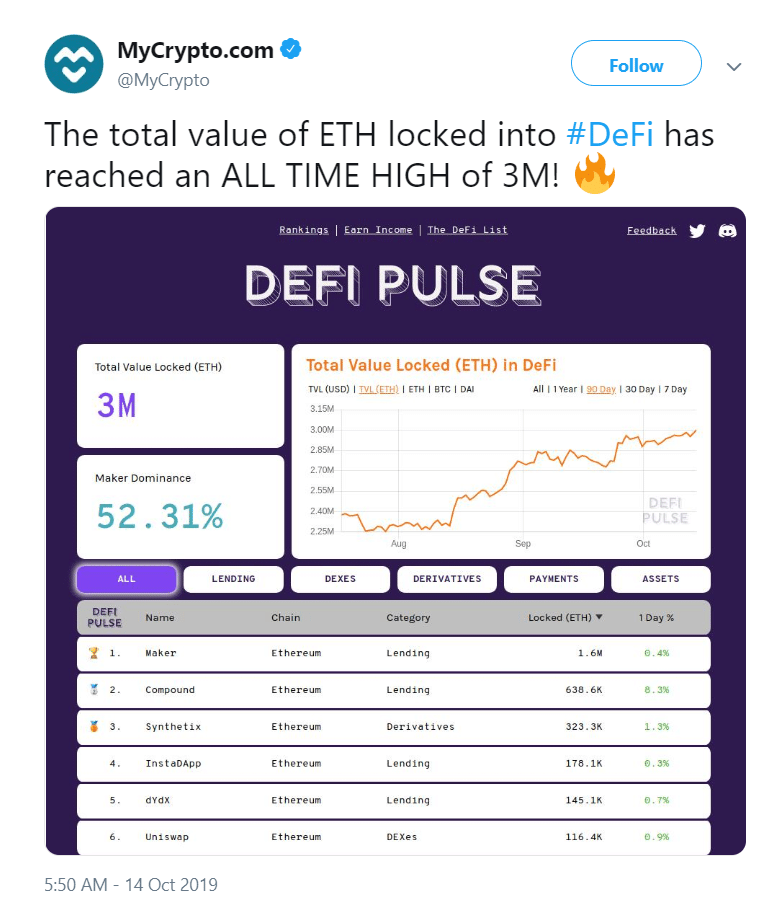

Equally, MyCrypto eminent that the amount of ETH locked into DeFi has hit 3 million ETH.

12 Crypto Questions

Ali Yahya of a16z wrote up 12 questions that remain to be answered in crypto. It’s a gigantic distillation of the uncertainties, such as when are the keep decentralization matters most, what number of networks will dominate, the keep cost will be captured, and heaps others.

Huge Storm Hits DevCon 5 as God Makes an strive to Rid the World of Ethereum Neighborhood

Coin Jazeera killed it this week with its rep recap of DevCon 5. My authorized section used to be positively the reference to how the dinosaurs died: “The single exclaim battling God from going Biblical on Japan and sending a meteor to scorch the earth used to be Coindesk reporter Leigh Cuen’s controversial article calling Ethereum a rip-off, pissing off each and each bagholder at DevCon. This amused God enough to no longer send us the total intention of the Dinosaurs.”

Source credit : unchainedcrypto.com