Half of Blur’s Quantity Comes From 500 Wallets

On-chain recordsdata means that NFT marketplaces like Blur are compromising on prolonged-term profitability to compete for a dinky pool of traders.

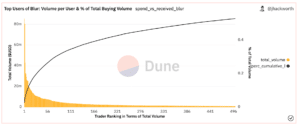

Analysts compiling contemporary recordsdata from the NFT issue score attain up with some relating to outcomes over the last week, particularly with appreciate to the favorite new marketplace Blur. A Dune analytics dashboard created by J. Hackworth figured out that factual 500 traders made up 50% of its purchasing and selling quantity.

Even extra concerningly, his diagnosis shows that fifty traders made up 25% of Blur’s total quantity. To position this into point of view, the head wallet purchasing and selling on Blur contributed to $75 million price of quantity.

Comparatively, rival NFT marketplace OpenSea’s high 250 traders ultimate made up 11% of its total quantity.

The reward for high traders from the Blur airdrop became particularly profitable, compared to platforms like OpenSea. J. Hackworth’s recordsdata shows that the head 500 traders noticed a median 2200% magnify of their revenue and loss circulate from the airdrop. Alternatively, it became the heavy purchasing and selling insist, in preference to the authenticity of trades, that ended in these huge airdrop rewards.

Blur ultimate appears to be like to be continuing this incentivization strategy, announcing on Tuesday a 300 million BLUR token distribution to its neighborhood in “Season 2.” The platform said that users with 100% loyalty stand the final note likelihood to plan Legendary Care Functions, price 100 times extra than the Strange Care Functions.

Some users score taken dispute with this model, which they assume will hurt creator relationships and profits in the prolonged creep.

Inferior selections:

Killing profits – 0 costs

Killing creator relationships – Slicing royalties

Compromising prolonged term development – royalties mark prop is required for attracting new creators and their followers to the NFT issue so we are in a position to hit mass adoption

Sounds rapid sighted to me 🤷♂️

— Kofi (@0xKofi) February 21, 2023

https://twitter.com/jumpmanft/position/1627510231961051136

Earlier this week, OpenSea shifted to a nil-payment marketplace model and made creator royalties 0.5% for all collections with out on-chain enforcement.

“if this turns into the brand new fact it would perchance well presumably power OS [OpenSea] to teach in a different way about strategy, particularly whether it makes sense to continue combating over the pro traders or as an alternative collect a dual-marketplace world and shift energy toward a scrumptious UX/UI for the prolonged-tail,” said NFT analyst “jumpman” on Twitter.

Tune in to this week’s version of The Lowering Block where Pacman, founder of Blur, talks relating to the company’s origins, competitors with OpenSea, the ‘demise’ of royalties, and extra.

Source credit : unchainedcrypto.com