Bitcoin Tackle Command Declines to April 2020 Levels

July 2, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

The series of BTC active addresses hit a low no longer considered since final April

-

Soros Fund Administration has cleared its traders to alternate in BTC

-

Animoca Brands, an organization that provides digital property rights through NFTs, announced a $139M elevate that values the company at $1B

-

Mintable, an NFT platform, raised a $13M Sequence A

-

The crypto-payment app Strike is now letting customers aquire and promote BTC for practically zero fees

-

SoftBank invested $200M in 2TM Neighborhood, the mummy or father company of 1 in all Brazil’s most practical exchanges, at a valuation of $2.1B

- FEWOCiOUS sold an NFT art work series for $2.1M at Christie’s

What Kind You Meme?

What’s Poppin’?

Robinhood Files for IPO

The old day, Robinhood, the usual — and considerably noxious — stock shopping and selling app, filed for an IPO with the SEC. The corporate goals to rob $100M and plans to alternate below the ticker image “HOOD” on the Nasdaq.

The S-1 filing shows big vow for the company, which has bigger than doubled the series of accounts on the platform and tripled its sources below custody in precisely one Twelve months.

In step with the filing, crypto shopping and selling made up 17% of Robinhood’s Q1 revenue, totaling $522M. Right here is up from 4% in Q4 of 2020. Particularly, a gigantic chunk of that vow came straight from Dogecoin, which accounted for 34% of the firm’s crypto transaction revenue — which plan Robinhood made roughly $30M for being a meme-middleman.

The corporate’s S-1 filing comes in the same week that FINRA hit the shopping and selling app with a $70M aesthetic for “systemic supervisory screw ups and necessary damage suffered by hundreds of hundreds of purchasers.”

Instructed Reads

- Dmitriy Berenzon on how DeFi is taking on financial products and companies:

- Ranking up to bustle on DAOs:

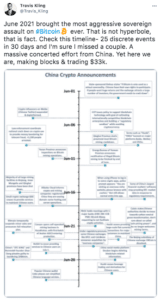

- Travis Kling timestamped 25 China-related occasions that took affirm in June:

On The Pod…

FTX’s Sam Bankman-Fried Provides the Tom Brady/Gisele Bundchen Backstory

-

why Sam is so mad to ship Tom Brady and Gisele Bündchen onto the FTX crew

-

how FTX decides on who to sponsor

-

why so numerous FTX’s sponsorship are focusing on US customers

-

what makes the sports alternate the kind of aesthetic affirm to advertise for FTX

-

how FTX’s tokenized shares work

-

what Sam learned from the GameStop/Robinhood verbalize

-

what makes FTX’s tokenized shares diversified from Binance’s offering

-

how FTX is facing regulatory barriers

-

what merchandise is on the quit of Sam’s regulatory wishlist

-

whether FTT is a security

E book Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Extensive Cryptocurrency Craze, is now on hand for pre-issue now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-issue it this day!

You’ll likely be ready to aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com