DeFi Positioned to Pressure Crypto’s Next Bull Speed: Flipside Crypto

DeFi is poised to be the vital catalyst of the next bull bustle, outpacing non-fungible tokens (NFTs), which soared in 2021, in step with a teach published on Thursday by on-chain intelligence firm Flipside Crypto.

Decentralized finance (DeFi) is a determined sub-sector within the crypto ecosystem designed to enable users to habits financial transactions equivalent to lending, borrowing and shopping and selling without the need for intermediaries.

Flipside’s optimism for the ability of DeFi changed into once in step with an prognosis of its reputation closing 365 days. DeFi changed into once the principle power slack the development of the crypto home in 2023 because the majority of received users and plentiful users had been choosing DeFi-linked actions over shopping and selling non-fungible tokens (NFTs).

In its Onchain Crypto User Portray, Flipside Crypto outlined an “received client” as an contend with that has conducted no longer lower than two transactions, with the 2nd transaction occurring in 2023, and a “plentiful client” as a 2023 received client who has accomplished over 100 whole on-chain transactions over their lifetime.

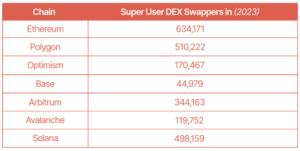

Across all noticed chains — Ethereum, Polygon, Optimism, Heart-broken, Arbitrum, Avalanche, and Solana — swapping on decentralized exchanges changed into once doubtlessly the most frequent notify amongst plentiful users in 2023, the teach said. Flipside furthermore important that “DeFi drives doubtlessly the most unpleasant-chain notify amongst EVM users… Interacting with DeFi protocols across more than one chains brings with it the choice of extra incentives.”

“Because the next bull bustle approaches, DeFi-linked actions equivalent to DEX shopping and selling and yield farming will continue to dominate total on-chain notify,” Flipside projects.

“My interpretation of the teach total is DeFi leads and NFTs apply,” Carlos Mercado, an information scientist at Flipside Crypto, said to Unchained in an interview. Memecoins, NFTs, decentralized self ample organizations (DAOs), governance, and “all that tradition stuff is candy getting more constructed-in in DeFi.”

“You don’t own an NFT anymore, try as a method to stake that NFT. It’s no longer good a governance token anymore, you’ve gotten to stake that governance token. And it’s no longer good a memecoin, try as a method to borrow and lend in opposition to the memecoin, you gotta ranking it a perpetual. Every little thing that’s tradition, DeFi is arresting,” Mercado added.

Decentralized alternate Uniswap and lending protocol Aave — two titans in the DeFi home — generated an life like of about $1.9 billion and $1.1 billion in costs for the seven days from Jan. 17 to 24, respectively, in step with cryptofees.information.

Whereas lower than Ethereum’s seven-day life like of $7.1 million and Bitcoin’s $3.6 million, the 2 DeFi giants own every generated more in costs on a seven-day life like than different blockchains equivalent to BNB Chain, Arbitrum, Optimism and Polygon, recordsdata from cryptofees.information displays. The blended worth of these four chains’ seven-day life like price is lower than $1 billion.

Flipside is no longer the handiest crypto watcher bullish on DeFi. “At closing blue-chip DeFi will flip L1s in costs,” wrote Aave founder Stani Kulechov on Jan. 18 in X.

Source credit : unchainedcrypto.com