DWF Labs to Make investments in Memecoins, Onchain Data Finds LADYS Transactions

DWF Labs is arresting to deploy capital into memecoins, a that that that it’s good to seemingly also mediate of signal of the contagious fever the memecoin craze has dropped at retail merchants and institutional corporations.

On Tuesday, the managing companion for funding firm and market maker DWF Labs, Andrei Grachev, wrote on X, “We’re in talks with a couple of memecoins and arresting to deploy a wide quantity of funds in uncover to let them grow sooner and atmosphere pleasant.”

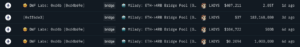

As of presstime, DWF Labs already has onchain activity connecting it to LADYS, the memecoin of the Milady NFT ecosystem. One command wallet contend with belonging to DWF Labs, 0xd4b, has purchased six-resolve-dollar sums of the Milady memecoin (LADYS) and bridged all of its purchased LADYS tokens price over $500,000 to the more fee effective layer 2 blockchain network Arbitrum over the final six days.

Analytics firm Lookonchain furthermore spotted earlier in the afternoon that a separate DWF wallet contend with (0x53c) had transferred $5 million USDT to a Milady multisig signer.

Whereas the total crypto market has gotten smaller 2% in the past 24 hours, LADYS has elevated 22.7% in the same duration and 90.7% in the past seven days to a market cap of $242.5 million, per CoinGecko.

Liquid Markets, DWF’s platform for over-the-counter shopping and selling, listed LADYS alongside rival memecoin FLOKI in March 2024.

Grachev’s assertion on the social media platform and DWF’s onchain activity comes as memecoin ecosystems on deal of blockchain networks are thriving. Some Ethereum-essentially based memecoins, equivalent to frog-inspired PEPE, non-public posted all-time highs in the past week, whereas Solana protocols catered to memecoin enthusiasts are attracting celebrities equivalent to hip hop artist Rich the Microscopic one and Olympic gold medalist Caitlyn Jenner utilizing Pump.Fun.

The willingness of DWF Labs, broadly diagnosed for its market making services and products, to deploy funds in direction of memecoins so that you just can nurture development is now no longer the principle time a monetary institution has dipped its toes into the memecoin arena. As an instance, a non-earnings for the Avalanche blockchain – Avalanche Basis – gained publicity in March to 5 rather a couple of memecoins native to Avalanche.

Learn Extra: Avalanche Basis Finds Its 5 Initial Memecoin Holdings

DWF, which has an onchain portfolio of over $47.7 billion, per Arkham Intelligence, is really apt one of many greatest accounts on centralized exchanges. For the reason that initiating of 2024, DWF Labs has deposited $147.24 million into exchanges and withdrawn $211 million from them, records from blockchain analytics firm Arkham Intelligence reveals.

Binance is the live alternate for deposits, accounting for $81.90 million or 56% of entire DWF Labs deposits into exchanges and is the 2nd most-vulnerable alternate for withdrawals. DWF Labs has withdrawn $90.63 million from Bitfinex and $74.67 from Binance since Dec. 31,

The Wall Avenue Journal reported earlier this month that a ragged group of workers member of Binance’s market-surveillance team used to be fired after ending an inside of investigation that chanced on proof of DWF manipulating markets on the alternate.

DWF did now no longer reply to Unchained’s multiple requests for roar.

Source credit : unchainedcrypto.com