What Coinbase Must Fabricate Regarding the SEC

September 9, 2021 / Unchained On a regular basis / Laura Shin

On a regular basis Bits ✍️✍️✍️

-

Robinhood launched a brand original program that enables possibilities to dwelling habitual crypto purchases without costs.

-

Internal most equity agency 10T Holdings raised approximately $750M across two funds to put money into digital asset corporations.

-

An OpenSea computer virus destroyed $100K fee of Ethereum-essentially essentially based NFTs.

-

Eden Community, an Ethereum protocol, raised $17.4M to fight miner extractable fee.

-

A lawmaker in Panama launched a bill to administer crypto sources to the country’s Nationwide Assembly.

-

Reports from Twitter ticket that some users got over $50,000 in airdropped DYDX tokens; US traders were now not eligible for the airdrop ensuing from concerns over securities laws.

-

Flexa, a crypto payments agency, is working with merchants in El Salvador to compose out Lightning Community fee programs.

- Ukraine’s parliament passed a laws legalizing and regulating virtual sources all around the country.

What Fabricate You Meme?

What’s Poppin’?

The US Securities Exchange and Exchange Price (SEC) issued a Wells stare to Coinbase final Wednesday, signaling the regulator’s intent to sue the cryptocurrency exchange when/if Coinbase launches its Lend program.

Great esteem a form of crypto corporations, reminiscent of BlockFi, Coinbase now not too long ago launched a brand original program, dubbed Lend, to allow possibilities to attach ardour on particular sources — starting with 4% on USDC.

According to Coinbase’s Chief Sincere Officer, Paul Grewal, the exchange had been in contact with the SEC for over six months referring to Lend. “Coinbase believes within the fee of birth and substantive dialogue with our regulators,” Grewal wrote. So, in preference to launching after which asking forgiveness, Coinbase took Lend without extend to the SEC outdated to going reside with the product.

The SEC, however, allegedly deemed Lend a security, citing the precedent of two Supreme Lawsuits, Howey and Reves. Which skill, the SEC unfolded a formal investigation into Coinbase and has asked for the title and assemble in contact with data for every customer on the Lend waitlist, to which Coinbase has now not equipped.

Tuesday night, Coinbase CEO Brian Armstrong took to Twitter to profess his displeasure with what he described because the SEC’s lack of conversation and guidance. “They refuse to repeat us why they mediate it’s a security, and as a change subpoena a bunch of data from us (we comply), quiz of testimony from our employees (we comply), after which repeat us they are going to be suing us if we proceed to launch, with zero explanation as to why,” Armstrong wrote.

He went on, noting that Coinbase intends to be a laws-abiding corporation, even when Armstrong finds the most modern narrate of regulation worrying. “Search data from….we’re dedicated to following the laws. Continuously the laws is unclear. So if the SEC wants to submit guidance, we’re additionally gratified to study that (it’s nice when you no doubt put into effect it evenly across the commerce equally btw),” he added. “They are refusing to present any understanding in writing to the commerce on what wants to be allowed and why, and as a change are participating in intimidation suggestions within the encourage of closed doorways. Whatever their theory is right here, it feels esteem a reach/land clutch vs a form of regulators.”

Rapid reactions:

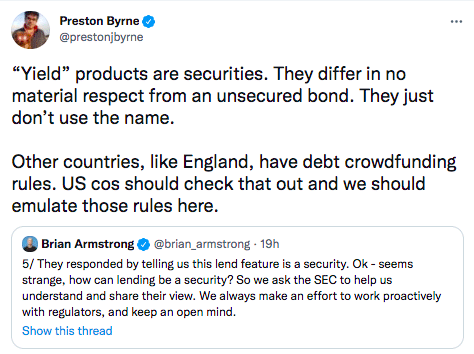

- Preston Byrne, associate at Anderson Extinguish, acknowledged that Coinbase’s Lend product is probably a security. He recommends that Coinbase, and US corporations in total, assemble in contact with English counsel to resolve out gain out how to place into effect UK debt crowdfunding principles.

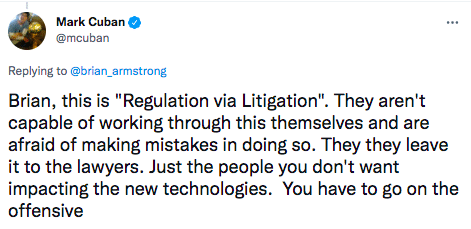

- Heed Cuban, Dallas Mavericks Owner, believes that Coinbase ought to head on the offensive towards the SEC and power the regulator to gain the impact of original tech.

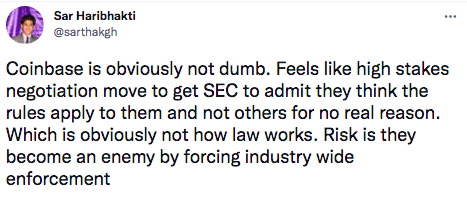

- Sar Haribhakti, program director of fintech at On Deck, thinks Coinbase’s transfer to without extend engage the SEC could perchance well possibly successfully be awful, as an SEC decision on Coinbase could perchance well possibly also lead to commerce-wide enforcement.

Advised Reads

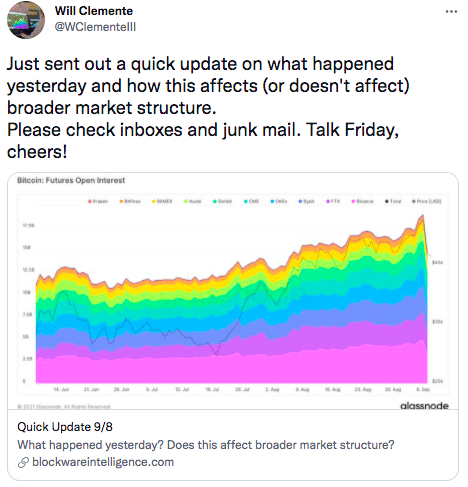

- Blockware’s Will Clemente on how Tuesday’s dip affects the crypto market:

- LexDAO on NFTs and valid property:

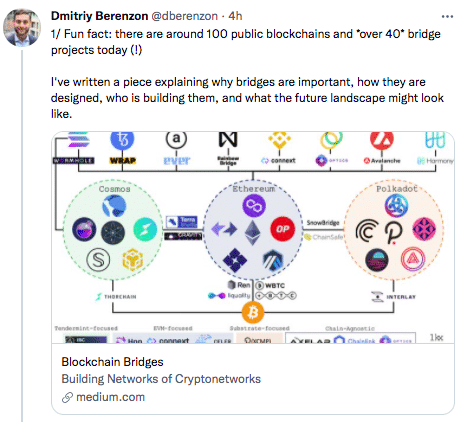

- Dmitriy Berenzon, research associate at 1kx, on blockchain bridges:

On The Pod…

How Crypto Streaming Provider Audius Hit Six Million Monthly Active Customers

Audius, a blockchain native song streaming platform, hit six million month-to-month active users in August and launched a partnership with TikTok. Roneil Rumburg, co-founder and CEO of Audius, talks about how Audius works, AUDIO tokenomics, the give and take of decentralization, and more. Relate highlights:

- what complications Audius is solving for creators

- how artists are utilizing crypto to join with fans

- how the crypto parts of Audius fit together

- what three utilities AUDIO, the native token of Audius, gives holders

- why Audius requires over $500K in AUDIO tokens to flee a node

- why AUDIO’s inflation fee is higher than a form of popular tokens esteem Ethereum or Bitcoin

- which parts of Audius are centralized versus decentralized

- the place the bulk of Audius’s listens come from (value: it’s now not the app)

- how Audius has created a “password” machine to draw blockchain know-how more uncomplicated to make utilize of for non-crypto natives

- why Audius uses both Solana and Ethereum

- how sizable-title artists esteem Diplo stumbled on their device onto Audius

- how Audius makes it more uncomplicated to add song to TikTok

- what’s next for Audius

Guide Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Substantial Cryptocurrency Craze, is now on hand for pre-sing now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-sing it on the fresh time!

You ought to obtain it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com