Ethereum L2 Networks Reach Yarn High of seven Million Certain Addresses

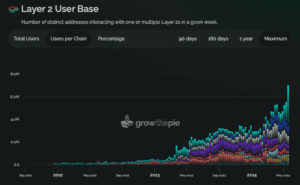

The series of clear addresses for Ethereum layer 2 blockchain networks has climbed to an all-time excessive final week, a signal that the rollup-centric roadmap is coming to fruition.

In step with L2 analytics platform GrowThePie, the series of clear addresses interacting with as a minimal one layer 2 blockchain network between Might well well well 13 and Might well well well 19 stood at over seven million, greater than double the quantity for the reason that final week of 2023.

The tip layer 2 blockchain network by clear wallets final week develop into as soon as Arbitrum with 3.7 million, making it liable for 52% of the total addresses that interacted with one or a pair of L2s. Disagreeable, the L2 that develop into as soon as incubated by dominant U.S.-basically based fully change Coinbase, took 2d put with nearly 815,000 addresses.

The injurious layer of Ethereum, in distinction, had 2.1 million exciting addresses.

The rollup-centric roadmap entails a shift of process from Ethereum’s injurious layer to its layer 2 networks. “For the time being, users comprise accounts on L1, ENS names on L1, capabilities live fully on L1, etc. All of right here’s going to comprise to interchange,” wrote Ethereum co-founder Vitalik Buterin in Oct. 2020. “We would must adapt to an world where users comprise their foremost accounts, balances, resources, etc fully internal an L2.”

The sustained progress of addresses interacting with layer 2 networks highlight the continued improvements within the Ethereum ecosystem’s scalability, or skill to deal with more transactions.

Be taught More: Why ETH Isn’t Transferring Higher After SEC Approves Key Filings for Region ETFs

The series of clear addresses on Ethereum L2s hit the novel account excessive earlier than the U.S. Securities and Substitute Fee current the 19b-4s filings of a variety of put ether change-traded funds the day gone by. Whereas the transfer is a step closer to the rollout of ETFs straight investing in ETH, the native gasoline token for the Ethereum blockchain, shopping and selling of put ETH ETFs calm awaits an additional SEC approval.

The SEC has to approve S-1 forms, registration paperwork wished for a firm to provide shares of an ETF to the general public.

The price of ETH has rallied about 20% within the past seven days however has reduced 2.5% within the past 24 hours to interchange at $3,720 on the time of writing, info from CoinGecko reveals.

Source credit : unchainedcrypto.com