Lido’s Execution Client Diversity Improves as Geth Utilization Drops Below 50% for the First Time

Liquid staking chief Lido has substantially improved its execution shopper fluctuate.

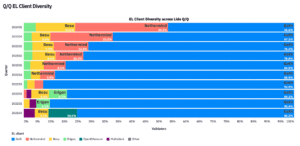

Lag Ethereum (Geth), doubtlessly the most common execution shopper, has viewed its utilization among validators flee by Lido node operators decrease to 46.6% on the give up of Q1 2024 from 67.1% in the previous quarter, fixed with a listing printed by Lido on Wednesday.

Lido’s utilization of Geth has decreased each and each quarter since Q3 of 2022 when nearly 93% of all validators flee by Lido node operators had been the consume of Geth, which posed dangers to the security of Ethereum itself, especially if a bug had been to be conceal in the supermajority shopper.

Ethereum purchasers are instrument programs that contributors can get to participate in running the Ethereum community. Each validator generally operates two purchasers concurrently to tackle plenty of aspects of Ethereum: one for the consensus aspect and one other for the execution layer.

Lido’s node operators had wished to give a take to their execution shopper fluctuate, which potential of having a “supermajority shopper” love Geth where the huge majority of validators are running the identical instrument shopper can result in detrimental outcomes for stakers, similar to loss of staked ETH, and even for Ethereum, similar to a chain split, which can possess brought lasting reputational wound to the 2nd-largest blockchain community.

In Jan. 2024, two minority Ethereum execution purchasers, Besu and Nethermind, suffered bugs. While each and each had been resolved and had minimal impact, the incidents had sparked concerns of the hypothetical possibility of a same bug impacting Geth, which can possess prompted an outage for Ethereum insofar as validators wouldn’t be in a location to form blocks for the reason that majority of them historical Geth.

Lido’s decreased utilization of Geth is “critical which potential of it presentations each and each that various purchasers possess in the kill matured ample where many participants in the community are jubilant running non-Geth purchasers at a in actuality excessive price,” wrote Kasper Rasmussen, Lido marketing lead, to Unchained in a Telegram message.

Alternative execution purchasers to Geth—Besu and Nethermind—possess each and each viewed their adoption grow since final quarter. Over a third of validators flee by Lido node operators consume Nethermind as their execution shopper, an amplify from 23.2% in Q4 2023, whereas Besu’s half has better than doubled from 6.9% final quarter to 14.6% in Q1 of 2024.

With the identical diagram of cutting again existential dangers to Ethereum, in Feb. 2024, Coinbase began imposing a idea to diversify its Ethereum staking architecture by rolling out give a take to for 2 execution purchasers, Nethermind and Erigon, as well to Geth.

Learn More: Most Ethereum Staking Pools Are The consume of Proper One Execution Client, Doubtlessly Growing Dangers to the Community

“It’s well-known not simplest for the resilience of the community that the ‘multi-shopper’ manner is having fun with out in practice however also emblematic of the efficacy of Ethereum’s soft-governance manner by consensus and transparency,” Rasmussen acknowledged. “From a Lido protocol standpoint, it’s well-known that the node operators of the largest staking protocol and the DAO are aligned in the values of decentralization and creating sturdy validator items.”

Lido, which pioneered liquid staking, is the largest decentralized finance protocol with a total locked price of nearly $34.89 billion on the time of writing, recordsdata from DeFiLlama presentations. Of the over 32.5 million ETH staked, Lido is accountable for close to 9.28 million or about 28.54% of total ETH staked, per a Dune dashboard created by Hildobby.

Source credit : unchainedcrypto.com