1st Paxos Interview Since PayPal News

And Binance begins to block US possibilities

This week, the Ethereum neighborhood became rattled by a shock chain-split that some called an unannounced onerous fork, resulting in calls for for increased transparency from Ethereum devs.

The opposite mountainous news this week: Bitcoin surpassed $16k for the first time in three years. Meanwhile, mountainous-name investors are sending dueling indicators about it, with billionaire Stanley Druckenmiller revealing that he owns Bitcoin and Ray Dalio of Bridgewater Associates saying he believes governments will ban the digital currency if it continues to develop.

We’ve furthermore got news on Biden’s first bulletins of who will likely be steerage his monetary protection, a pointed critique from Congress addressed to the OCC’s Brian Brooks, a roundup of reports surrounding exchanges in Asia, and extra.

On the podcasts, Dan Tapiero and Cathie Wooden focus on Bitcoin below a Biden administration on Unchained. And on Unconfirmed, Chad Cascarilla of Paxos, talks about how Paxos helps PayPal enable crypto purchases for all its US possibilities.

This Week’s Crypto News…

Ethereum Chain By likelihood Splits in 2

On Wednesday, what gave the impact to be a primary exertion with Ethereum infrastructure provider Infura turned out to be the pause results of a worm within the Ethereum code that split the network’s transaction history in two. The turmoil began when a primary service outage struck Infura around 8:00 coordinated universal time, prompting some exchanges, alongside with Binance, to conclude ETH and ERC-20 token withdrawals temporarily.

It appears, the worm became in actual fact deliberately precipitated. Optimism cofounder and CEO Jinglan Wang tweeted an apology Wednesday evening, explaining that the Optimism body of workers had noticed the worm but, after seeing that practically all nodes had upgraded to the repair, they “made up our minds to envision the worm and confirm what would happen. This became boneheaded in hindsight,” she wrote.

The outage’s staunch deliver off became a worm within the Walk Ethereum consumer, which is ragged by 80% of Ethereum good points. A series split appears to had been precipitated by the consensus worm Ethereum developers had quietly patched a 365 days within the past within the Geth v1.9.7 free up. Geth body of workers lead Peter Szilagyi posted in a blog that the body of workers didn’t warn those that this mounted a consensus worm because, “In the case of Ethereum, it takes so a lot of time (weeks, months) to discover node operators to update even to a scheduled onerous fork. Highlighting that a free up contains foremost consensus or DoS fixes steadily runs the chance of any individual attempting to beat updaters to the punch line and taking the network down.” Others called for increased transparency from Ethereum devs. Nikita Zhavoronkov, lead developer at Blockchair, argued that the event constituted a consensus failure that can furthermore very properly be “primarily the most serious exertion Ethereum has faced because the DAO debacle 4 years within the past.”

Infura and other service suppliers littered with the chain split salvage since mounted the exertion by updating their nodes, with Infura posting a post-mortem on its blog. The fee of ETH itself became now no longer affected the least bit by the snafu.

Bitcoin Designate Roundup

- For the first time in three years, Bitcoin surpassed $16,000 after per week of consolidating between $14k-$16k. Bitcoin is now up 123% this 365 days.

- Billionaire hedge fund investor Stanley Druckenmiller printed that Bitcoin is a allotment of his portfolio. Making an are trying ahead to a three- to four-365 days decline within the greenback, Druckenmiller stated, “Frankly, if the gold wager works, the bitcoin wager will presumably work greater since it’s thinner, extra illiquid and has so a lot extra beta to it.”

- Bridgewater Associates founder and co-chairman Ray Dalio stated this week that ought to Bitcoin turn into “field cloth,” he may per chance presumably furthermore foresee a time when governments would switch to outlaw it. I in actual fact salvage a sense that if that had been to happen, PayPal, Fidelity, Sq. and other mountainous companies would presumably salvage something to teach about that.

- Bloomberg’s senior commodity strategist Mike McGlone says Bitcoin may per chance presumably furthermore ruin $20,000 in 2021, alongside with to his old projection that Bitcoin may per chance presumably furthermore then abilities a parabolic 365 days. Whenever you happen to didn’t salvage my interview with Mike McGlone on Unconfirmed in Also can, test it out here.

Crypto Neighborhood Optimistic About Gary Gensler Leading Biden’s Monetary Policy Transition Crew

President-elect Joe Biden has tapped inclined Commodity Futures Shopping and selling Rate chairman Gary Gensler to lead his monetary protection transition body of workers and command on Wall Boulevard oversight for the length of his administration. Gensler is properly-versed in cryptocurrency and has testified sooner than Congress on extra than one instances referring to cryptocurrency and blockchain technology. He staunchly adversarial the view that cryptocurrencies had been nothing extra than Ponzi schemes and has referred to blockchain technology as a “change catalyst.” Putting Gensler in this blueprint means that Biden’s gain will likely be “a appropriate ingredient” for cryptocurrency, as Kristin Smith of the Blockchain Association urged Fortune.

U.S. Lawmakers Criticize the OCC’s Give consideration to Cryptocurrencies

In what appears to be the first nice Congressional critique of a monetary regulator who favors cryptocurrency, six Congress contributors issued a letter Tuesday faulting acting OCC chief Brian Brooks for prioritizing crypto for the length of the continuing properly being and financial crises caused by COVID-19. The letter acknowledged that Brooks may per chance presumably furthermore unruffled have not any change bolstering crypto banking when hundreds of thousands of Americans need financial relief and stated such actions may per chance presumably furthermore assign “your total hierarchy” of greenback-denominated monetary sources at chance.

In a blog post, Union Sq. Ventures’ Fred Wilson, wrote, “If the US became rising (as is China), a digital currency stablecoin (a digital greenback), then those hundreds of thousands of at-chance folk would had been ready to receive their financial stimulus funds by any one of the smartly-liked cell apps that enhance or will rapidly enhance digital sources, devour Coinbase, Sq., PayPal, Robinhood, and so a lot of extra.

“It would had been much less expensive (by an command of magnitude or extra) and masses extra clever to discover funds to those at-chance folk with blockchain based completely sources vs out of date applied sciences devour paper assessments.”

Asian Exchange Roundup

- On the heels of two correct circumstances launched by the U.S. government in opposition to crypto derivatives change BitMEX, Binance has begun blocking off U.S. users from its platform, directing them to withdraw funds inner 90 days if based completely within the U.S.

- In a tweet Wednesday, KuCoin co-founder Johnny Lyu stated that the change had recovered 84% of affected sources from the $280 million hack in September, alongside with that further restoration foremost parts can’t be printed until the case is closed by rules enforcement companies.

- A month after OKEx suspended on-chain crypto withdrawals, users salvage devised diversified ways to eradicate their crypto sources, steadily at a lower sign of no lower than 20%, the utilize of OKEx’s over-the-counter platform, internal transfers, and other, riskier systems. Throughout that very same time, OKEx’s Bitcoin mining pool has lost in the case of all of its hash rate vitality, with recordsdata showing the pool has fallen from producing end to 9,000 petahashes per 2d to finest 20 PH/s now.

Bitcoin More Equitably Disbursed Than Diversified Cryptos

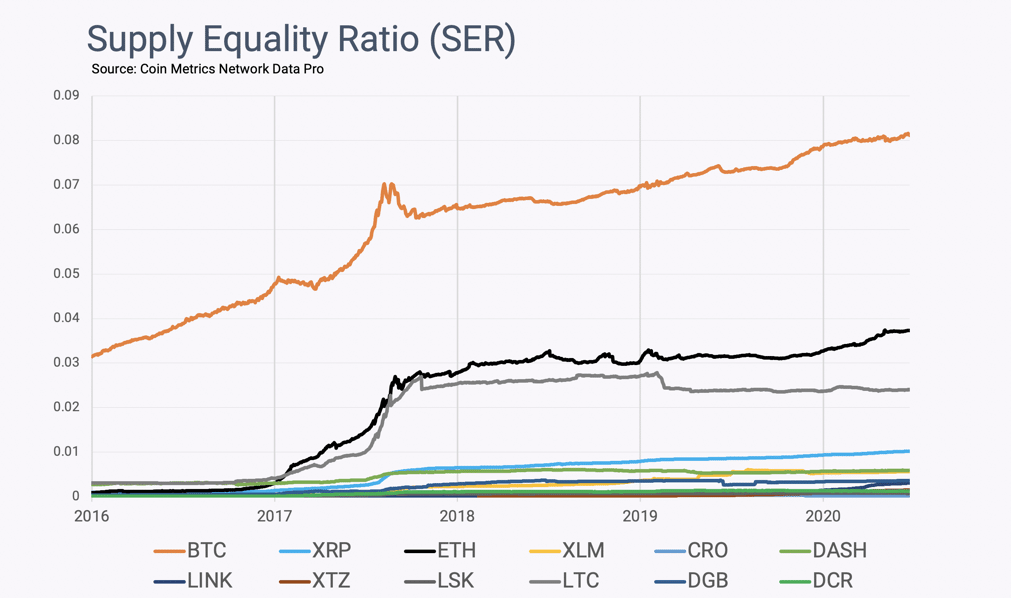

Based completely on Coin Metrics, even as Bitcoin remains to be the major crypto asset custodied by mammoth monetary establishments, Bitcoin appears to be like extra devour a grassroots circulate in phrases of wealth inequality. The major inequality metric, Provide Equality Ratio, is the ratio of the poorest accounts, the sum held by all accounts with a steadiness lower than 0.00001% of the availability, in opposition to the richest accounts, which is the final held by your total high 1% of addresses. When put next with other crypto sources, Bitcoin’s Provide Equality Ratio is a lot bigger, at 0.08, compared to below 0.04 for Ethereum.

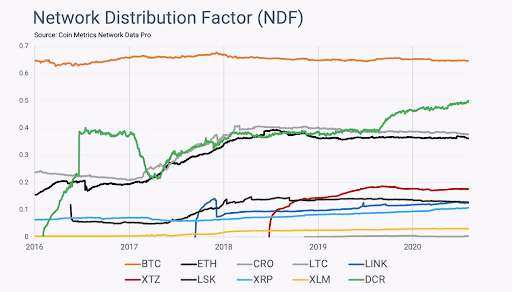

Coin Metrics furthermore checked out the availability dispersion thru a metric called the Community Distribution Side, a ratio encompassing a broader financial community extra equivalent to heart and lower classes, which is calculated by taking the combination offer in addresses keeping extra than 0.01% of a cryptoasset’s offer and dividing that by the final offer. Bitcoin continues to salvage the most reasonable distribution ingredient — bigger than 0.6, compared to 0.5 for Decred.

Every thing You Desired to Know About Oracles

It’s steadily known within the crypto neighborhood that oracles are a tricky ingredient to utilize and put into effect properly. Nonetheless this post by Sam Czsun, a security researcher now at Paradigm, goes into your total ways sign oracles may per chance presumably furthermore furthermore be manipulated. He begins with an actual-lifestyles instance of any individual who wished to head backstage at a concert to meet the band and so up up to now its Wikipedia page to teach he became a family member appropriate sooner than he approached the protection guards. Then Sam walks thru quite so a lot of examples of how sign oracles salvage malfunctioned or been manipulated, starting with the time a broken Korean Won sign oracle on Synthetix enabled a shopping and selling bot to manufacture off with $1 billion — which I’ve talked about with Kain Warwick of Synthetix. Diversified examples he offers are folk manipulating costs on Uniswap, the place costs are persistently fluctuating. He says, “attempting to read that sign accurately is devour reading the weight on a scale sooner than it’s completed settling.” There are a total bunch examples here, so whereas you ought to salvage a bigger knowing of how your DeFi trades may per chance presumably furthermore tear scandalous, this would perchance be a extensive post to investigate cross-test.

Ethereum 2.0 Neighborhood Staking Grants

Are you attracted to constructing up the Eth2 staking and validator neighborhood? If that is the case, The Ethereum Foundation is sponsoring a wave of Eth2 staking neighborhood grants, “funding the creation of instruments, documentation, and resources to manufacture for a savory staking and validator abilities.” Anybody is free to participate, and proposals are due by December 22, 2020.

Source credit : unchainedcrypto.com