This Kind of Token Has Increased 30-Fold YTD

June 11, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

-

Ledger raised a $380M Collection C at a $1.5B valuation.

-

Meat dealer JBS paid $11M in BTC to come by to the underside of a ransomware attack.

-

ForUsAll, a 401(k) provider, is partnering with Coinbase to enable administrators to make investments up to 5% of their 401(k) contributions in crypto (ForUsAll’s CEO Jeff Schulte is that this week’s visitor on Unconfirmed).

-

The SEC despatched out a 2d display camouflage to customers, warning against Bitcoin futures.

-

Karura, a DeFi community for Kusama and Polkadot, raised $100M by technique of a crowd mortgage.

-

CryptoPunk 7523 sold for $11.7M.

-

Arrington Capital Management is launching a $100M fund to make investments in the Algorand ecosystem.

-

The Texas Department of Banking gave crypto custody a greenlight for enlighten-chartered banks.

-

0x and Polygon are spending $10.5M to woo developers to place on Polygon.

-

Referencing El Salvador, an IMF spokesperson acknowledged that “adoption of bitcoin as prison gentle raises a assortment of macroeconomic, monetary and prison components.”

- A global requirements physique for bank law recommends strict capital requirements for banks with crypto publicity in its latest consultation.

What Attain You Meme?

What’s Poppin’?

Inflation is poppin’.

The US Bureau of Labor Statistics reported a 5% upward push in the person imprint index over the previous twelve months — the greatest yearly broaden since a 5.4% upward push in August of 2008.

In a same vein, weekly knowledge presentations that the Federal Reserve’s steadiness sheet has topped $8 trillion for the fundamental time, up almost $1 trillion from June 2020 — the tough equal of a 15% broaden.

A Crypto Inflation Hedge Has Increased 30-Fold YTD

Fixed with analyze compiled by Arcane Study and summarized by CoinDesk, one crypto-asset class has been very a success all over Would possibly moreover and June’s bearish market high-tail, perhaps suggesting that crypto customers are taking a look for an inflation hedge and proven store of worth all over turbulent events.

Indeed, the market capitalization of gold-backed tokens has grown 30-fold for the explanation that launch of 2020. Carl Vogel, a senior product manager at Paxos, the creator of the greatest gold-backed token (PAXG), told CoinDesk that “gold tends to be, in very unstable events, a extraordinarily natural and gigantic asset class to head forward and diversify into.”

Bitcoin’s market cap, typically touted as a hedge against inflation, is handiest up about 25% YTD, coming nowhere end to the 30-fold assortment of gold-backed tokens, indicating that Bitcoin’s “digital gold” story can also just fill died down a exiguous bit.

Instant Reads

- The World Economic Dialogue board on DeFi:

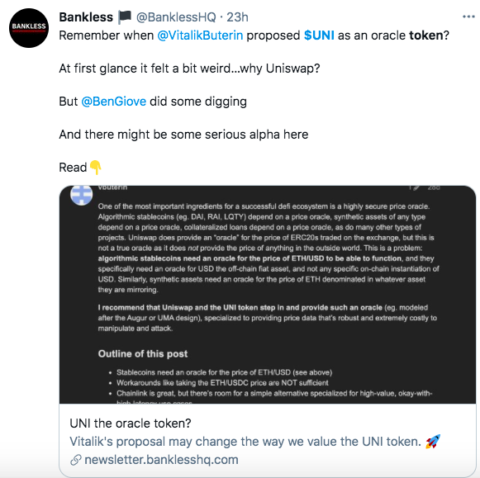

- Here’s an very good searching breakdown of Vitalik Buterin’s UNI as an oracle proposal:

- Glassnode on Bitcoin’s on-chain market cycles (an oldie but a goodie):

On The Pod…

Favor Crypto in Your 401(k)? It’s Within the raze Conceivable — With This Provider

ForUsAll currently announced a new product that will enable cryptocurrency investments to be made internal 401(k) retirement accounts. Jeff Schulte, CEO of ForUsAll, discusses why putting crypto in a 401(k) is this kind of game changer, how this differs from Bitcoin IRAs, and extra! Converse highlights:

-

how bringing crypto accurate into a 401(k) with ForUsAll will work

-

what “guardrails” ForUsAll is inserting on customers who desire to make investments in crypto

-

the tax advantages of shopping crypto internal a 401(k)

-

whether or not ForUsAll is providing a Roth IRA

-

why no person has supplied crypto internal a 401(k) sooner than now

-

what differentiates a crypto 401(k) from a self-directed IRA

-

what are the costs for the 401(k), who it’d be on hand to, and when it would possibly perhaps perhaps launch

-

how security and keys are being handled

-

why ForUsAll isn’t providing every token on hand on Coinbase

-

how ForUsAll is determining which cryptos may be on hand to swap

-

why providing crypto ETFs thru a 401(k) can also just place off problems regarding the fiduciary disaster of employers

-

what new crypto aspects ForUsAll is jubilant to roll out

E book Replace

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Great Cryptocurrency Craze, is now on hand for pre-enlighten now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-enlighten it on the present time!

That it’s possible you’ll also fill it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com