Tron’s Justin Sun Has Change into Rather the Airdrop Farmer of Late

Justin Sun, the controversial founding father of the Tron blockchain network, has been very active as an airdrop farmer currently.

On Would possibly 11, four wallets (0x79a, 0xdc3, 0x176, and 0x7a9) in step with blockchain data and identified by onchain analytics firm Nansen as belonging to Sun had collectively claimed more than 3.6 million EIGEN tokens value about $28 million, one day after EigenLayer activated its airdrop claims.

Sun collecting EIGEN tokens in his addresses comes roughly two months after one among the wallets claimed about 25,000 ETHFI, the governance token for liquid restaking protocol Ether.Fi, value about $83,000.

In total, Sun’s pockets is eligible to shriek 3.Forty five million ETHFI tokens value roughly $11.43 million at contemporary market prices. However, Sun can’t claim the entirety of his ETHFI airdrop allocation on story of he must discover EtherFi’s vesting time desk, which ensures “fairness, prolonged time period growth, and steadiness,” in step with EtherFi’s claims page. Sun’s ETHFI airdrop allocation resulted from the Tron founder depositing 120,000 into the liquid restaking protocol on March 13.

The most current airdrop allocations to Sun’s wallets are a continuation of what he used to be doing closing 300 and sixty five days when but every other take care of of Sun’s had claimed 5,250 ARB in March 2023, value with regards to $7,000 on the time, data from DeFi portfolio firm DeBank reveals.

Read Extra: 8 Causes Why LayerZero’s Upcoming Airdrop Would possibly Be the Most Advanced Ever

Incomes Facets, Too

Sun’s focal point didn’t end at EigenLayer, EtherFi, and Arbitrum; his connected wallets were additionally contributing to diversified protocols that indulge in but to conduct their token genesis event. Let’s notify, Sun has deposited gigantic amounts of crypto resources into liquid restaking protocols Swell and Puffer Finance, both of which indulge in but to start out their tokens.

Essentially based on DefiLlama and Etherscan, Sun deposited about $345.5 million of his crypto resources into Swell’s straightforward staking dapper contract on Would possibly 5, which helped Swell’s total value locked amplify 29% from about 450,700 ETH value about $1.4 billion on Would possibly 4, to roughly 580,470 ETH value more than $1.8 billion the following day.

Swell protocol team members are currently the utilization of a functions program to present of us the different to assemble what they call “pearls,” that are redeemable for SWELL at its token genesis event. The Swell team additionally announced plans for the layer 2 network which has now no longer rolled out on mainnet. Nonetheless to attract liquidity, Swell lets crypto traders transfer resources into Swell’s L2. Those that deposit into Swell’s L2 are eligible for airdrops from both Swell and initiatives building on Swell’s rollup, in step with the protocol’s documentation.

Meanwhile, on Feb. 8, Sun locked 58,000 stETH, value roughly $167.4 million, into Puffer Finance, which has $1.3 billion in total value locked, in step with blockchain explorer Etherscan and DefiLlama. This system that Sun, from a single pockets take care of, is chargeable for roughly 12% of Puffer Finance’s TVL.

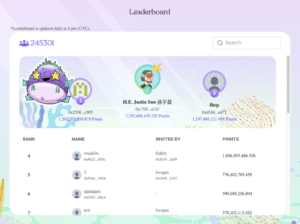

Puffer Finance, which is currently setting up its governance mechanism, has applied a functions program and as of presstime, Sun has the most functions of anybody.

Read Extra: Top 10 Crypto Initiatives With Facets Packages That Haven’t Held Airdrops Yet

Andrew Van Aken, an data scientist at blockchain analytics firm Artemis, had doubts about whether or now no longer Sun has been seriously farming airdrops, nonetheless. “Despite the truth that rewards were given on how ‘grand’ you stake, [it] would be very now no longer going for him to sell given liquidity,” Van Aken wrote to Unchained via Telegram. “I own [Sun is] procuring for further yield and is up up to now on crypto, so he finds these opportunities.”

In March 2023, the Securities and Replace Commission charged Sun and three of his companies for now no longer only offering and airdropping unregistered crypto asset securities Tronix (TRX) and BitTorrent (BTT) however additionally for “fraudulently manipulating the secondary marketplace for TRX via intensive wash procuring and selling.”

At the time of publication, Justin Sun’s onchain portfolio exceeded $1 billion, per Arkham Intelligence.

Source credit : unchainedcrypto.com