Why Ethereum Gas Costs Possess Fallen to Their Lowest Level Since 2020

The reasonable payment of a transaction on Ethereum is at its lowest stage since Jan. 2020 (one gwei represents one-billionth of 1 ether and is the unit of ETH used to measure gas costs). The decline reflects the motion of activity from Ethereum’s defective layer to its elephantine array of Layer 2 solutions.

Moreover, the begin of the Dencun toughen, which vastly diminished expenses for those layer 2 networks, has handiest intensified this trend of decrease transaction charges. Gas costs on Ethereum contain diminished about 92% from about 63 gwei on March 12, the day before the toughen, to around 5 gwei at presstime, files from blockchain explorer Etherscan and analytics investment platform Ycharts reveals.

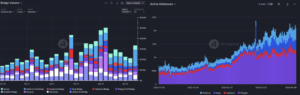

Basically based completely on layer 2 watchdog platform L2Beat, the likelihood of fascinating and upcoming L2 initiatives collectively stands at 95. Over the last several months, customers contain vastly increased the amount of crypto sources they’ve bridged over to a lot of layer 2 scaling rollups. And of the L2s, the tip ones by total price locked—namely, Arbitrum, Optimism, and Frightful – contain viewed a spike in fascinating day to day addresses, indicators of accelerating user activity.

Read More: Vitalik’s Contemporary EIP-7702 Draws Early Enhance; Could well most definitely Be Incorporated in Ethereum’s Next Laborious Fork Toughen

“We are in a position to no doubt see a trend upwards on EVM like minded chains of day to day fascinating addresses, that system customers are going to cheaper alternate alternatives. Wanting at bridge files additionally confirms this, as bridge activity all the blueprint in which via Layer 2s has increased from ~$170mn per week to ~$300mn per week,” Andrew Van Aken, a files scientist at blockchain analytics firm Artemis, stated in a Telegram message to Unchained.

Moreover, Ethereum has viewed over $3 billion in obtain outflows of ETH over the last three months, per Artemis, with the bulk of the flows going to L2s corresponding to Arbitrum, zkSync, Frightful, Starknet, and Optimism.

The decrease in Ethereum’s transaction charges is “a reflection of the constant evolution of blockchain. Originally Ethereum served because the universal layer for all apps, from decentralized exchanges, to video games, to trading memecoins, wrote Justin, CEO of decentralized perpetual futures platform Vest Change, in a Telegram message to Unchained. “Alternatively, with the arrival of Layer 2 solutions and app chains, builders and customers (and MEV bots) are realizing that there are tailored ecosystems for explicit spend cases. In return, we additionally see Ethereum to be transitioning moreso as a foundational safety layer and for supporting extra ‘passive’ protocols corresponding to lending and LSTs.”

Ethereum Put up-Dencun Toughen

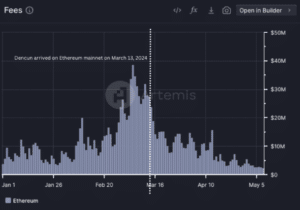

Dencun, basically the most most up-to-date Ethereum no longer easy fork that introduced several codebase adjustments, went reside on mainnet on March 13.

Whereas the likelihood of transactions has remained stable at upright over a million per day, the amount of expenses paid by dwell customers of Ethereum has plummeted since Dencun, per Artemis.

With much less overall transaction expenses, the amount of ETH burned has gone down as smartly. Basically based completely on Ethereum analytics platform Extremely Sound Cash, the amount of ETH issued in the previous thirty days is higher than the amount of ETH burned, one consequence of the Dencun toughen.

“The fresh offer of ETH is now rising at the fastest day to day rate for the reason that Merge as expenses burned plummeted as a result of the Dencun toughen,” analysts at blockchain analytics firm CryptoQuant wrote in a listing published on Wednesday.

The rate of ETH reached a multi-365 days excessive of $4,000 on the day of Dencun, but has since dropped roughly 25% to around $3,015 at the time of publication, files from CoinGecko reveals.

Source credit : unchainedcrypto.com