The World’s First Massive-Scale Crypto Bank Run

June 18, 2021 / Unchained Day-to-day / Laura Shin

Day-to-day Bits ✍️✍️✍️

- Wedbush Securities joined the Paxos Settlement Service, which settles US securities the utilization of blockchain tech

- NFT valid property sold for $913K in Decentraland

- The Bitcoin Mining Council hosted its first assembly the day outdated to this

- The National Republican Congressional Committee is partnering with BitPay to objective fetch donations in cryptocurrency (Axios)

- World Bank denied El Salvador’s search records from for assistance in making Bitcoin valid gentle

- Circle is partnering with Maps.me to fabricate customers stablecoin skill

- TRM Labs, a blockchain analytics company, raised a $14M Collection A

What Manufacture You Meme?

What’s Poppin’?

In response to records from Coin Gecko, IRON Titanium Token (TITAN) crashed from $60 to staunch a sliver above $0 in less than 24 hours on Wednesday.

TITAN is linked to the IRON Finance project, which mints so-called stablecoins by locking in a mixture of 25% TITAN and 75% USDC. CoinDesk reported that QUOTE “when new IRON stablecoins are minted, the search records from for TITAN will enhance, utilizing up its price. Conversely, when the price of TITAN falls dramatically, as became once the case on Wednesday evening, the peg becomes unstable.”

In a submit-mortem weblog submit, Iron Finance described the event as “the world’s first orderly-scale crypto bank slouch.”

As TITAN began freefalling from $60, so did the pegged price of IRON, falling to below 70 cents as a bank slouch became once initiated on TITAN, setting up, as Fred Schebesta, founding father of Finder.com.au and an Iron Finance investor, informed CoinDesk, “a crypto vortex of money.” Iron Finance explained this vortex as a “negative strategies loop” and “the worst thing that would possibly perchance happen to the protocol,” the keep scare promoting led to extra TITAN introduction which drove TITAN prices down, which precipitated extra scare…

For context, at one point, Iron Finance had $2+ billion in price locked into the network. That number has dropped to $238 million as of press time.

TITAN and IRON Finance had been on hand on Polygon and Binance Dapper Chain. Place Cuban, billionaire investor and avid DeFi particular person, recently admitted to being a liquidity supplier on Quickswap, an computerized market maker native to Polygon, for the DAI/TITAN trading pair (in a weblog submit on DeFi that I imply in my day-to-day e-newsletter earlier this week).

In response to a tweet referencing the TITAN shatter as a rug pull, Cuban replied that he “got hit love everyone else.”

Later, in an email to Bloomberg, he called for regulation in the alternate “to present an explanation for what a stable coin is, and what collateralization is acceptable.”

Preston Byrne, companion at Anderson Kill, tweeted abet at him:

Advisable Reads

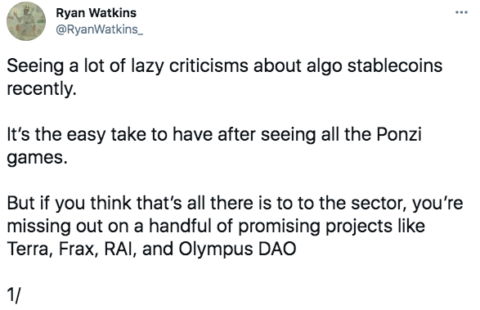

- While TITAN and IRON unequivocally failed as a stablecoin, Messari’s Ryan Watkin’s believes that every algo stablecoins are now not minted equally:

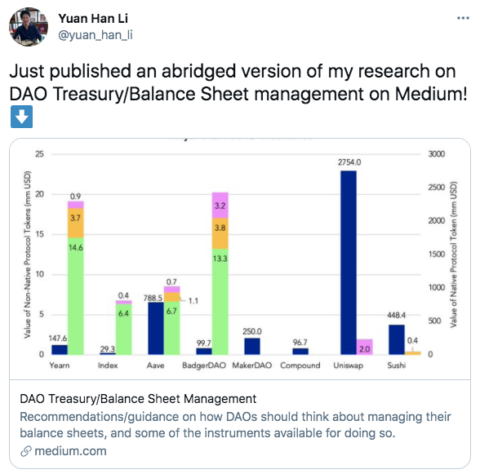

- Yuan Han Li, a researcher at Blockchain Captial, on his solutions and steerage for DAOs with regards to treasuries and stability sheets:

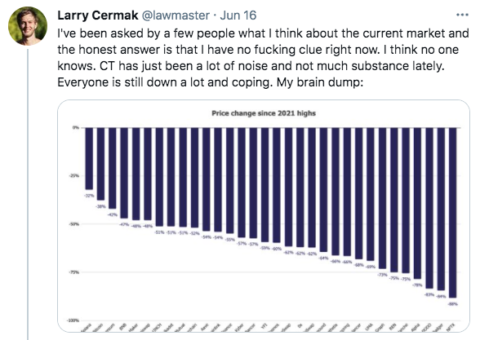

- Larry Cermak, director of learn at The Block, tweeted a high quality brain dump on the sigh of crypto:

On The Pod…

Polygon: The Layer 2 Resolution Doing 8 Times as Many Transactions a Day as Ethereum

Jaynti Kanani, cofounder and CEO of Polygon, discusses why the layer 2 resolution has seen plenty success at some stage in a down crypto market. Conceal highlights:

-

what elements comprise led to Polygon’s and MATIC’s impressive performance YTD

-

how Polygon is scaling Ethereum

-

what forms of initiatives are taking off on Polygon

-

how Polygon is attempting to contend with the whine of layer 2 composability

-

how Polygon plans to exhaust its most widespread funding

-

why Jaynti is confident Polygon will peaceable be major after ETH 2.0 launches

Guide Replace

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Gargantuan Cryptocurrency Craze, is now on hand for pre-expose now.

The e book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-expose it this present day!

You ought to buy it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com