Crypto Down Forty eight% Since Also can ATH

June 23, 2021 / Unchained Every single day / Laura Shin

Every single day Bits ✍️✍️✍️

-

Stronghold Digital Mining, which turns extinguish coal into electrical energy for BTC mining, announced a $105M funding spherical.

-

Sotheby’s will accept bitcoin or ether in an upcoming auction estimated to attain $10M.

-

CipherTrace, a blockchain forensics firm (and disclosure, a broken-down sponsor of my reveals), raised a $27.1M Series B.

-

Canada’s Ontario Securities Charge has charged Bybit with “working an unregistered crypto asset trading platform.”

-

Blockchain Capital closed a new fund with $300M in backing, at the side of PayPal and Visa as backers.

-

Iran has seized 7,000 mining computer systems since its mining ban in slack Also can.

-

On Friday, FATF plans to finalize its guidance on crypto legislation.

-

Polkadot’s DOT token rose by 70% in good four hours on Coinbase.

-

MicroStrategy’s most latest bonds are trading below face value; The Block reviews that mountainous, publicly traded companies are no longer following MicroStrategy’s lead into Bitcoin

What Cease You Meme?

What’s Poppin’?

The day gone by seen Bitcoin fall below $30K for basically the most important time since January, while ether settled under $2K for wonderful the second time in three months.

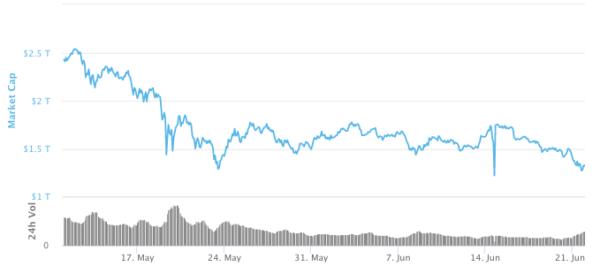

Since Also can 12th’s peak of $2.53T, the total cryptocurrency market capitalization has sunk advantage to roughly $1.3T, marking a Forty eight% decrease (at publishing time).

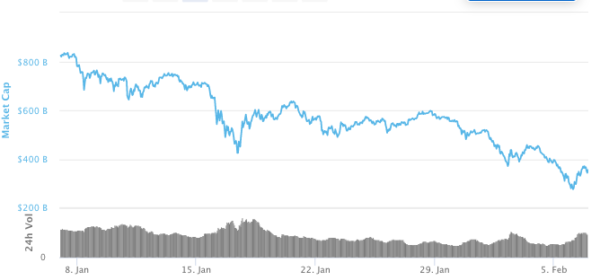

This sort of main correction isn’t very any longer unprecedented on the smash of a bull market. In 2018, the total cryptocurrency market cap raced to a high of $834B on January 7th sooner than falling to roughly $280M by February sixth — almost a 66% decrease in only a month.

Nonetheless, no longer all americans having a search on the charts sees a endure market.

Mati Greenspan, the founder of Quantum Economics, a crypto and financial diagnosis firm, educated CNBC that “we also can merely by no plan seek for one other crypto frosty weather again.” He argues, “there’s quite a bit more utility, adoption, and diversification in the commercial than we had in 2014 or 2018.”

Willy Woo, an on-chain analyst, educated CNBC that “We are some distance from a endure market, wonderful merchants are freaking out over technicals considered on exchanges admire volumes and value actions.” On Twitter, Woo posted a chart showing a bullish indicator in response to the ratio of coins held by powerful fingers versus speculative fingers. The chart reveals the be conscious of BTC dipping while powerful fingers rating.

Stephen Kelso, head of markets at IT Capital, educated CoinDesk that he sees a “looking to fetch opportunity for investors,” noting that “Bitcoin is presently trading approximately one-third below its long-term exponential pattern line,” which has wonderful took place for 20% of BTC’s historical past in response to Kelso.

Speedy Reads

- Why DeFi desires to take care of its miner-extractable-value articulate:

- Ivan Martin on Malta… sneak look: “Some €60 billion in cryptocurrency and various digital resources moved thru Malta after it first announced itself because the ‘blockchain island’…”

- Nic Carter on Bitcoin hashrate migrating out of China:

On The Pod…

Is Quadriga’s Gerald Cotten Aloof Alive? The ‘Exit Rip-off’ Podcast Aims to Resolution

Aaron Lammer, creator and host of the Exit Rip-off podcast, recounts the mysterious and controversial demise of QuadrigaCX’s founder Gerald Cotton. Display highlights:

- A like a flash recap of QuadrigaCX

- why Aaron felt compelled to fabricate a assortment on QuadrigaCX

- how Gerald Cotton, a lifelong Ponzi-addict, got here to be the CEO of Canada’s largest crypto alternate

- what Ponzi-schemes Gerald ran sooner than starting Quadriga CX

- why customers depended on QuadrigaCX and what crimson flags had been readily apparent having a search advantage

- the sketchy tactic Gerald at threat of single-handedly boosted QuadrigaCX’s trading volume by 30%

- a new important other, empty wallets, a without warning written will, and the conditions surrounding Gerald’s beautiful demise

- how Gerald’s darkish net background may possibly well need appealing him to spurious his hold demise

- what the percentages are high that Canadian authorities exhume Gerald’s body

- why Aaron is skeptical Gerald’s important other modified into once “in” on the QuadrigaCX fiasco

E book Replace

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Huge Cryptocurrency Craze, is now readily accessible for pre-characterize now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-characterize it this day!

It’s good to aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com