MicroStrategy Buys 5,445 More Bitcoin for $147.3M

MicroStrategy (MSTR) got roughly 5,445 bitcoin (BTC) for roughly $147.3 million in money since August 1, a median label of $27,053 per bitcoin, per a novel filing with the U.S. Securities and Substitute Rate on Monday.

As of Sept. 24, MicroStrategy and its mates held a whole of 158,245 bitcoins, which were got at an aggregate bear label of round $4.68 billion and a median bear label of $29,582 per bitcoin. The amounts per bitcoin embody expenses and charges.

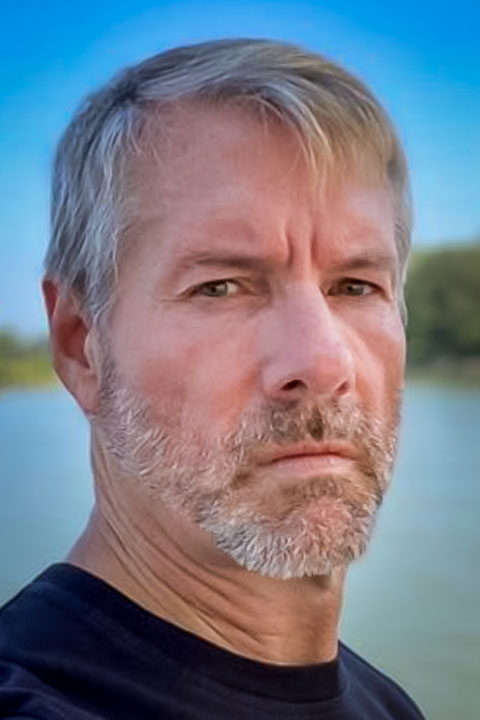

The company’s co-founder and Executive Chairman, Michael Saylor, has been a critical bitcoin advocate, turning the tool supplier into a BTC-looking out out out juggernaut. The company has been newly emboldened by bitcoin’s 60% label amplify this three hundred and sixty five days appropriate 13 months after Saylor resigned as CEO, with the largest cryptocurrency by market capitalization languishing smartly under $20,000.

Be taught more: A Country Now Owns $20M in Bitcoin

Bitcoin became as soon as currently trading at $26,350, down better than 1% and interior the vary it has occupied for weeks. When Saylor handed over the CEO job to the company’s then president, Phong Le, MicroStrategy held appropriate short of 130,000 bitcoin.

MicroStraetgy shares were fairly flat on Monday afternoon at $324.89.

In early September, MicroStrategy obtained an further boost when the Monetary Accounting Requirements Board (FASB), which items accounting standards for publicly traded companies within the U.S., voted to enable companies to make employ of pretty-price accounting to reward fast beneficial properties and losses on their earnings statements. Firms needed to beforehand reward will increase in cryptocurrencies when they sold the assets however could maybe well maybe reward losses at the very least as soon as a three hundred and sixty five days.

Be taught more: MicroStrategy Will increase Its Bitcoin Cache With 14,620 Unique Tokens

In a commentary on the social media platform formerly identified as X, Saylor applauded the commerce when it became as soon as launched, writing that it “eliminates a critical obstacle to corporate adoption of $BTC as a treasury asset.”

Separately, in August, MicroStrategy launched that it would mission and promote shares of its class A fashioned stock for an aggregate offering label of up to $750 million. As of Sept. 24, the company had issued and sold 403,362 shares, ensuing in rep proceeds of $147.3 million.

Founded in 1989, Virginia-essentially based mostly mostly MicroStrategy turned identified first as a supplier of data intelligence tool earlier than pivoting not easy into digital assets. MicroStrategy started looking out out out bitcoin in 2020 to scale reduction the company’s money assets under the possibility of inflation.

Source credit : unchainedcrypto.com