Bitcoin Mining Earnings Descend as ‘Hashprice’ Hits All-Time Low

Not lengthy after bitcoin miner revenues surged thanks to transaction costs from the Runes fungible token’s launch on the halving, the profitability phases of miners has fallen to an all-time low.

A minimal of as defined by “hashprice,” which measures projected mining earnings from a defined quantity of hashrate, or computational energy dispensed to mine bitcoin.

On April 20, one day after the halving, hashprice reached 0.0028 BTC or $182, a two-year high, sooner than falling shut to 72% in BTC terms to 0.000785 BTC per day as of e-newsletter. This means miners can build a query to 1 PH/s of hashing energy to yield about 0.000785 BTC, or $47 per day, an all-time low, in step with details from Hashrate Index.

Subscale Miners Suffer, Whereas Scaled Miners Are Neatly-Positioned

The affect on profitability from mining is no longer evenly dispensed, as subscale miners, which own much less handy resource-intensive mining operations that are no longer efficient at scale, are in more sturdy waters.

“Subscale miners are no longer mining profitably, so we build a query to to discover them creep offline and network issue to regulate accordingly, wrote Asher Genoot, CEO of Bitcoin mining firm Hut 8, in an electronic mail to Unchained. “These post-halving prerequisites highlight the importance of securing low-tag vitality while managing an efficient snappy.”

Learn More: Bitcoin Miners Diversify Their Earnings Streams as Halving Nears

Genoot acknowledged scaled mining operators anticipated hashprice to diminish following the halving — and own been preparing for months. Which capability, “[they] are properly-positioned to no longer handiest weather this volatility however also act on alternatives for suppose as distressed resources near up within the marketplace at discounted valuations,” in step with Genoot.

The Presence of Runes

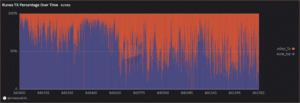

The decrease in hashprice comes as hobby in Runes has fallen, gleaned by a decrease in Runes transactions, per a Dune dashboard by Matt Kimmell, a CoinShares analyst.

“Runes, BTC DeFi, Ordinals, etc are all welcome enhancements lengthy-term. Who knows which of them will own staying energy however for miners to succeed they need more suppose and rate generation onchain,” wrote Quinn Thompson, chief funding officer at crypto hedge fund Lekker Capital, in a non-public message to Unchained.

At block high number 840,003 — three blocks after the Bitcoin halving — Runes accounted for 97.3% of all transactions, dominating Bitcoin and rising miner income within the scheme.

Whereas the share of Runes transactions on Bitcoin has fluctuated, the onchain suppose of Runes has reduced within the most most in vogue blocks.

“The difficulty is the spikes in suppose in most cases signal native peaks because it’s for height speculative actions, no longer basic staunch employ cases,” Thompson acknowledged. “Here’s a controversy and why I ask how legit this stuff are.”

Restful, Runes, occasionally, makes up the bulk of transactions in a single block. As an instance, at block 841,547, Runes used to be liable for 87.4% of all suppose.

“Time will account for however it’s unclear there’s sufficient staying energy in BTC suppose for the time being to enhance the valuable revenues for miners,” Thompson acknowledged.

Source credit : unchainedcrypto.com