THIS Is Pushing Up the Tag of Bitcoin

Plus, how great that you would possibly per chance produce staking ETH2

This week, on Monday, Bitcoin reached a brand original all-time high, and on Tuesday, Ethereum 2.0 went are living with the beacon chain. Many signs original institutional investment being the driver unhurried the recent bull poke, since public hobby has but to realize the heights of the 2017 frenzy. Congress is pushing a bill that would require all stablecoin issuers to affect bank charters, nonetheless the crypto neighborhood says this sort of law would be nothing nonetheless a step backward. Visa has announced that they’ve begun integrating USDC into their platforms. And the Forbes’ annual Below 30 list has a stable presence of crypto entrepreneurs.

This Week’s Crypto Files…

Ethereum 2.0’s Beacon Chain Is Dwell

On Tuesday at noon UTC, the Ethereum 2.0 beacon chain launched after years of anticipation, ushering in the blockchain’s next generation. The beacon chain originate is “half 0” of Ethereum’s multi-step upgrade to a more scalable blockchain. There are composed many technical hurdles to surpass, including sharding and rollup adoption, sooner than the chain will seemingly be fully operational. Alternatively, as of press time, there are nearly 1 million ETH staked, nearly double the number that used to be required for the originate.

Within the event you’re wondering about staking’s risks and rewards, for staking 1 ETH, validators are for the time being earning round 0.014 ETH/month, or $8.50, with the quantity anticipated to decrease as the number of contributors will enhance. Alternatively, any ether staked on the chain will seemingly be locked up for months and seemingly even years. Staking additionally entails utility risks as well to the risk that it is possible you’ll presumably per chance lose your preliminary deposit for these that fail to retain with the network.

Despite some ideas that recent DeFi rewards will seemingly be a bigger wager, exchanges are already desiring to enhance Ethereum 2.0 staking. Coinbase has announced this can enhance ETH2 staking and trading to eligible jurisdictions initiating early next yr whereas additionally allowing possibilities to convert ETH to ETH2 and produce staking rewards. Binance likewise announced an ETH2 staking service would be are living on December 2, with day-to-day rewards disbursed in the form of BETH tokens.

Bitcoin Hits Unique All-Time High

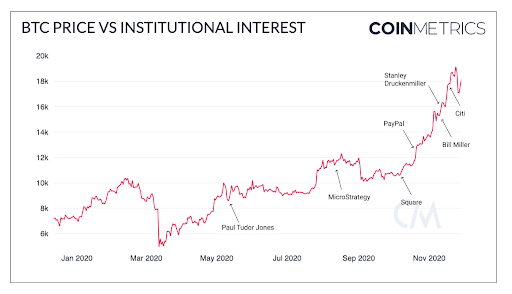

Bitcoin reached $19,850 on Monday morning, inching past the earlier file location in December 2017. Chainalysis attributed the rise to institutional traders procuring frequently over time, after which taking the money off exchanges to carry. An diagnosis by Coin Metrics initiating attach in November illustrated that the recent upwards designate movements were occurring largely at some stage in U.S. market hours, further supporting the thesis that institutional traders are pushing the designate up. When tracking the Bitcoin designate against considerable occasions of institutional hobby, akin to Microstrategy and Sq.’s purchases of Bitcoin, PayPal’s integration of Bitcoin and well-identified broken-down traders Bill Miller and Stan Druckenmiller expressing self assurance in Bitcoin, a clear trendline emerges.

One more records level supporting the theorem that institutional investor hobby is riding the designate up is that there is a lack of public hobby in Bitcoin when in contrast to leisurely 2017. The quantity of Bitcoin-linked tweets is much below phases at that point and has been fairly flat for the closing two years. Media mentions and searches are additionally at lower phases than at some stage in the earlier bull poke.

Niall Ferguson, writing in Bloomberg, cited the pandemic as a catalyst for increased adoption in Bitcoin this yr. He current that the explosion of stimulus dollars underscored Bitcoin’s value on account of its scarcity, and this used to be going down already amidst a shift toward digital payments. He went on to claim that the incoming Biden administration would possibly presumably per chance fair composed no longer glimpse to create a “Chinese-vogue digital greenback” and as an replacement “would possibly presumably per chance fair composed acknowledge some great benefits of integrating Bitcoin into the U.S. monetary gadget — which, despite everything, used to be in the initiating designed to be less centralized and more respectful of particular individual privacy than the systems of less-free societies.”

Metrics Veil Bitcoin and Ethereum Project is Heating Up

Online metrics are displaying an expand in activity on the Bitcoin and Ethereum networks. The Block’s Director of Learn, Larry Cermak, posted a entire records summary to Twitter, displaying “nearly everything we note is reaching all-time highs.” Total on-chain quantity increased to 51.5% to a brand original yearly high of $204 billion in November, with miner income rising forty eight% over the earlier month for Bitcoin and 22% for Ethereum. Stablecoins, namely, have bigger than tripled in 2020, with Cermak citing DeFi and Tether-collateralized derivatives as major factors. A watch by Blockchain Capital additionally reveals rising awareness and adoption among most other folks. Bigger than one in three American citizens interviewed acknowledged they’re seemingly to amass Bitcoin in the next 5 years, and 41% of American citizens chanced on it seemingly that most other folks will seemingly be the exercise of Bitcoin in the next ten years.

Dwelling Bill Would Require Bank Charters for Stablecoin Issuers

Within the U.S., Congress has presented a bill that would require stablecoin issuers to honest bank charters and regulatory approval sooner than issuing any stablecoin. The bill is designed to present protection to folk, in accordance with Advisor Rashida Tlaib, who acknowledged, “Preventing cryptocurrency services from repeating the crimes against low- and practical-profits residents of colour broken-down huge banks have is critically necessary.”

Circle Co-founder and CEO Jeremy Allaire spoke back to the news on Twitter, announcing, “Forcing crypto, fintech and blockchain firms into the extensive regulatory burdens of Federal Reserve and FDIC legislation and supervision is inconsistent with the targets of supporting innovation in the vivid and inclusive shipping of payments that comes from stablecoins.”

Visa to Hook up with USDC

Subsequent yr, Visa’s card network of 60 million merchants will seemingly be linked to stablecoin USDC. Visa will seemingly be the principle company card to enable firms to utilize a stability of USDC. Visa does no longer belief to custody USDC today, regardless that, effective instantly, Circle will commence working with Visa to integrate USDC utility with its platforms. In step with Visa head of crypto Cuy Sheffield, “We continue to imagine Visa as a network of networks. Blockchain networks and stablecoins, love USDC, are appropriate further networks. So we assume that there’s a first-rate value that Visa can provide to our purchasers, enabling them to earn entry to them and enabling them to utilize at our merchants.”

Crypto Files Roundup

- Bigger than $4 billion value of cryptocurrency (including $3.8 billion BTC) used to be seized by Chinese police at some stage in a crackdown on the PlusToken Ponzi plot, with a Chinese court docket announcing the seized crypto “will seemingly be processed pursuant to regulations” and “forfeited to the national treasury.”

- In collaboration with crypto startup Lukka, the S&P Dow Jones Indices plans to originate two index merchandise, which will enable asset management firms to affect their delight in crypto-primarily based investment merchandise.

- The Libra Affiliation announced the adoption of a brand original name, Diem, as well to a entire lot of govt appointments sooner than its eventual originate.

- After its chief executives were charged with violations of the Bank Secrecy Act by the Division of Justice, 100x Community, which runs BitMEX, appointed Alexander Höptner as its chief govt officer; Höptner used to be previously CEO of Börse Stuttgart and Euwax.

A Solid Crypto Displaying in Forbes’ 30 Below 30 2021 List

Forbes published its annual 30 below 30 list celebrating young entrepreneurs. Several blockchain and crypto entrepreneurs made the slit in the finance and enterprise capital classes. Amongst the crypto heavyweights on this yr’s list were Volt Capital’s Soona Amhaz, FTX Founder Sam Bankman-Fried, Augur co-founder Joey Krug, Coinlist co-founder Brian Tubergen, and Bitcoin Core developer Amiti Uttarwar, among others. You would possibly presumably per chance per chance additionally read an in-depth writeup on the crypto-centric names on the list at Decrypt.

Source credit : unchainedcrypto.com