How OpenSea’s Weekly NFT Volumes Plummeted From $1 Billion to $20 Million in Excellent 2 Years

OpenSea, long the dominant NFT marketplace, has struggled to reverse its fortunes since losing its trading volumes lead.

OpenSea’s dropoff comes as the aggressive landscape — and the enterprise solutions that rep profits — for non-fungible token marketplaces has shifted.

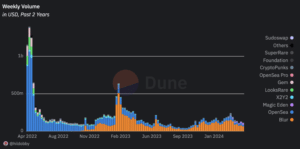

Almost two years ago, sooner than the open of competitors Blur and Magic Eden, OpenSea’s weekly trading quantity stood at over $1 billion, accounting for three-quarters of all NFT transactions finished on marketplaces.

OpenSea has since given up a grand deal of floor. Volumes on the alternate final week dropped under $20 million, accounting for roughly 16% of the total market, according to a Hildobby Dune dashboard. The real fact that stunning $20 million now accounts for roughly 16% of the total underscores how a long way market-vast passion and trading of NFTs has since fallen from their gradual April 2022 highs.

Be taught extra: NFT Market Cools as Traders Flock to Hovering Memecoins

Whereas the decline in OpenSea’s volumes stems from fresh entrants, total NFT trading has fallen significantly all over the final two years as passion in digital collectibles fell off a cliff. Roughly two years ago, entire weekly trading quantity stood at $1.4 billion. The figure has since dropped about 92% to $115 million.

Representatives for OpenSea, Magic Eden, and Blur did now not return Unchained’s requests for comment for this story.

In step with the Hildobby Dune dashboard, Magic Eden surpassed OpenSea in weekly trading quantity for the first time all over the week of April 15, bumping OpenSea to third establish. Blur, meanwhile, booked quantity of $64.4 million, declaring the tip device it’s held since Feb. 2023.

Expectations of OpenSea’s Decline

OpenSea losing its lead is “very anticipated… [OpenSea] retains losing key segments to opponents. [And] they lack determined target segments and functionality to get them,” wrote Eddie Wharton, a Web3 knowledge science handbook in a message to Unchained on X. Wharton is moreover an NFT supplier.

In step with Wharton, OpenSea’s “first vast loss” used to be to Blur. OpenSea’s rival launched with zero trading prices and airdropped its governance token for the first time in Oct. 2022. Paying out royalties to NFT creators has moreover proved contentious for OpenSea. The choice for the marketplace to create royalties optionally available soured creator relationships with OpenSea, “fully burning that bridge,” Wharton acknowledged.

Some disclose OpenSea’s lack of a aspects program has contributed to the corporate losing its edge. OpenSea falling on the relief of in quantity used to be “anticipated as they don’t like any incentives relish Blur/Magic Eden, [which] like aspects applications,” wrote Martin Lee, assert material lead at blockchain analytics company Nansen, to Unchained via Telegram.

Not like OpenSea, Magic Eden moreover helps NFT trading on numerous blockchains, such as Bitcoin and Solana — now not stunning Ethereum.

Even so, OpenSea “aloof having a decent amount of users shows the energy of their designate,” Lee added. Per the Dune dashboard, OpenSea has extra day-to-day and weekly merchants when put next with its two competitors, even though it trails Blur and Magic Eden in quantity.

OpenSea stays “the first NFT trading platform that practically all rookies dangle of,” Andrew Forte, head of strategy at web3 consulting company Unfungible, as of late wrote on X. “Seasoned NFT-ers prefer other platforms while rookies aloof scream OpenSea,” Forte added.

Source credit : unchainedcrypto.com