LFG Welcomes AVAX to Its UST Reserve

April 8, 2022 / Unchained On a typical basis / Laura Shin

On a typical basis Bits ✍️✍️✍️

-

Frax Finance is brooding about buying billions price of crypto resources to abet its algorithmic stablecoin FRAX.

-

The Tubby Penguins ground stamp has tripled after a substitute in ownership.

-

The total stamp locked in Ethereum layer 2s is over $7 billion.

-

BreederDAO launched a whitepaper.

- The Crypto Council for Innovation launched 5 novel hires.

In the present day in Crypto Adoption…

-

Treasury Secretary Janet Yellen made her first speech about digital resources and called crypto “transformative.”

-

A uncommon economic zone in Honduras identified crypto as correct gentle, and an self reliant space of Portugal published this could focal level on Bitcoin adoption.

-

Bitcoin 2022 skilled its first mountainous announcement when Robinhood Chief Product Officer Aparna Chennapragada urged the target audience that the trading platform had activated crypto wallet functionality for 2 million potentialities.

-

Crypto.com will probably be paying bonuses in BTC to UFC fighters.

-

CashApp now offers a come to receives a price without extend in BTC and could well merely supply Lightning capability shortly.

The $$$ Corner…

-

Blockchain security company CertiK launched an $88 million funding spherical that saw participation from damaged-down behemoths love Tiger Global, Goldman Sachs, and Sequoia Capital. CertiK is now valued at $2 billion.

-

Crypto funds company Wyre modified into once bought by Trail in a deal valued at roughly $1.5 billion, stories The Block.

-

eToro launched a $20 million creator fund for NFTs.

-

Community Gaming raised $16 million in a Sequence A.

- Fantastic, a British metaverse firm, raised $150 million.

What Discontinuance You Meme?

What’s Poppin’?

UST Adds AVAX to Its Reserves

Terra expanded its UST reserve plans to incorporate AVAX the day earlier than this present day.

Luna Foundation Guard launched an over-the-counter aquire of $100 million in AVAX, the native token of the layer-1 dapper contract platform Avalanche. AVAX is the predominant addition to UST’s international substitute reserve blueprint outdoors of BTC.

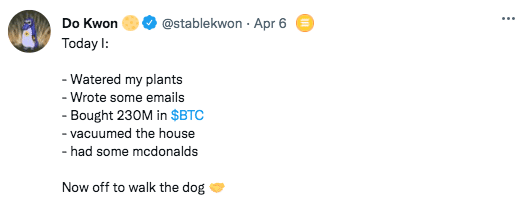

In a tweet thread, the crew described the switch because the “starting put of a varied and non-correlated asset pool supporting the $UST peg,” further hinting, as Discontinuance Kwon did on Unchained, that LFG will proceed including other resources besides BTC and AVAX to its international substitute reserves.

The Avalanche x Terra relationship is being further expanded in a separate $100 million token swap between Avalanche Foundation and Terraform Labs, which spearhead pattern on their respective chains. Terraform Labs now holds $100 million in AVAX while Avalanche Foundation holds $100 million in LUNA, and essentially essentially based on Terra’s Twitter story, $100 million in UST from the LFG aquire.

The news comes shortly after Terra’s biggest DeFi protocol, Anchor, modified into once applied on Avalanche. Terra published that “a few more” Terra protocols are brooding a few the same switch.

Per Emin Gun Sirer, the founder of Avalanche, the partnership is motivated by getting publicity to UST. “A tiny bit identified rule, after ‘Don’t roll your salvage crypto,’ is ‘Don’t strive and roll your salvage stablecoin, you’ll screw it up.’ Here’s why Ava Labs partnered with the professionals in this sport as an alternative of launching its salvage,” he wrote.

As of press time (5 pm ET), LUNA is down 7% on the day. AVAX is up 1.37%.

Advised Reads

-

Messari’s @dunleavy89 on sports NFTs:

-

Joel John on how web3 grants ought to gentle be utilized:

-

Grant Gulovsen on tips on how to promote your DeFi token with out working afoul of securities law:

On The Pod…

Here’s Why USDN De-Pegged From the Dollar – And Why UST Might possibly perchance possibly Too

Kevin Zhou, co-founder of Galois Capital, discusses a loopy week on the earth of algorithmic stablecoins that saw USDN de-peg from the dollar and Terra unveil plans to invent a novel liquidity pool on Curve to toughen UST. Uncover highlights:

-

how USDN and Waves works

-

what made USD de-peg

-

why Kevin thinks algorithmic stablecoins fail so most often

-

what Kevin thinks about backing UST with BTC

-

how 4pool works in the context of Curve Finance, 3pool, UST, Frax Finance, and Redacted Cartel

-

why Kevin believes Anchor is the motive UST could de-peg

-

what could occur to Terra and the crypto market writ gargantuan if UST were to de-peg

-

why lowering yields on Anchor could depress LUNA’s stamp by 8x

-

how UST and LUNA redemptions work

Ebook Replace

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Astronomical Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

That you might possibly aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com