The One 👀 Determine in the Coinbase S-1

MicroStrategy and Square stack more sats

One more week, one more Bitcoin all-time high and, of route, a precipitous 20% tumble following the $58k peak. Diamond palms held, laser eyes meme-ed, and I made a customer look in a Wall Dual carriageway Bets tweet … when you understood what I lawful wrote, you’re formally a crypto nerd 🙂

This week the crypto house in the kill turned into in a plight to delve into the long-awaited Coinbase S-1 submitting, which turned into chock pudgy of all kinds of juicy facts and figures, which we dive into on Unconfirmed with Decrypt’s Jeff Roberts. One finding calls into quiz how neatly Coinbase might be in a plight to diversify its earnings.

There turned into also big info about the Tether versus Fresh York Attorney Total’s Place of commercial investigation, which resulted in an $18.5 million settlement. MicroStrategy and Square both announced Bitcoin purchases to the tune of $1.2 billion. Decentralized substitute volume hit an all-time high on Ethereum, however so did gasoline expenses, that might presumably also merely be why Layer 2 suggestions grabbed about a headlines. Binance’s BNB and Solana’s SOL tokens skyrocketed in fee and so did the yarn round Ethereum killers. Worn finance is persevering with to reckon with the upward thrust of DeFi on the heels of the Gamestop + Robinhood concern. In other info, Ripple moved to a more crypto-friendly order and OKCoin plans to hunch trading on sure Bitcoin forks.

Ensure that to not hasten over Unchained with Charles Cascarilla of Paxos, whose deep info of monetary plumbing and blockchain tech makes him a decision explainer on how the Robinhood debacle might presumably also were averted with technology — and what Paxos is doing about it.

Hear to the Most popular Episode of Unchained

Paxos’s Charles Cascarilla: How Blockchain Tech Would possibly well perhaps perhaps Prevent One more GameStop/Robinhood

Ensure that to not hasten over Unchained with Charles Cascarilla of Paxos, whose deep info of monetary plumbing and blockchain tech makes him a decision explainer on how the Robinhood debacle might presumably also were averted with technology — and what Paxos is doing about it.

Hear to the Most popular Episode of Unconfirmed

Coinbase’s S-1: The Number That Can even merely Acquire the Exchange Anxious

Jeff Roberts, government editor at Decrypt and creator of “King of Crypto: One Startup’s Quest to rob Cryptocurrency Out of Silicon Valley and Onto Wall Dual carriageway” talks about Coinbase going public.

Thanks to our sponsor!

Crypto.com: https://bit.ly/3jzkTAD

Download the Crypto.com app right here: https://crypto.onelink.me/J9Lg/laurashinpodcasttesla

This Week’s Crypto Recordsdata…

Tether Settles With NYAG for $18.5 Million

After an nearly two-year-long investigation, the handing over of 2.5 million paperwork, and USDT increasing from a $2 billion to $35 billion market cap, Bitfinex and Tether agreed to a settlement with the Fresh York Attorney Total’s Place of commercial on Tuesday nearly about the 22-month inquiry into a probable shroud-up of $850 million in losses by Bitfinex. The NYAG will elevate no expenses as fragment of the settlement.

In a tweet thread, Tether claimed to “admit no wrongdoing” and acknowledged that no there had been no finding that “Tether ever issued with out backing.” Tether agreed to pay $18.5 million as fragment of the settlement and can put up quarterly experiences on the composition of Tether’s reserves to the NYAG for 2 years.

Fresh York Attorney Total Letitia James turned into a bit harsher in her description of the settlement. In a observation, she acknowledged, “Bitfinex and Tether unlawfully covered-up massive monetary losses to set their plan going and provide protection to their bottom lines. Tether’s claims that its digital currency turned into fully backed by U.S. bucks the least bit instances turned into a lie.”

Whereas it is too early to determine winners and losers of the Tether vs NYAG saga, it appears to be both facets bought what they wanted: the Fresh York Attorney Total will get to be a quasi-regulator of Tether and Tether is allowed to continue functioning with ultimate a minor shapely. Nonetheless, Tether can’t wait on Fresh York electorate or businesses. Whether or not this finally ends up being worse for Tether or for Fresh York, at display regarded as even handed one of many fiscal capitals of the field — ultimate time will mutter.

The settlement and ensuing transparency must always help get to the underside of false suspicions that issuance of Tether someway artificially inflated the Bitcoin fee. Dan Held, head of growth at Kraken, might presumably also merely were lawful in January when he wrote “Tether FUD [fear, uncertainty, doubt] is overblown.”

BTC falters, Square and MicroStrategy Undeterred

Bitcoin reached a brand sleek all-time high on Sunday at $58,367 and promptly dipped, shedding to below $Forty five,000 by early Tuesday morning, a correction of roughly 20%. However these fee swings seemingly don’t faze companies like MicroStrategy, which announced Tuesday it had added one more $1 billion in BTC to its books, bringing its total funding to 19,452 bitcoins, the much like roughly $4.5 billion. Square also announced a buy mutter of $170 million in BTC this week, bringing its total funding in BTC to roughly 5% of its total property. The firm also reported selling $4.57 billion in bitcoins to clients via CashApp in 2020 and printed that one million clients purchased bitcoin for the first time in January 2021 by myself.

In other institutional info, asset manager Stone Ridge is in conjunction with Bitcoin to its an excellent deal of picks fund, effective April twenty sixth. The fund will possess exposure to BTC via set suggestions on futures contracts.

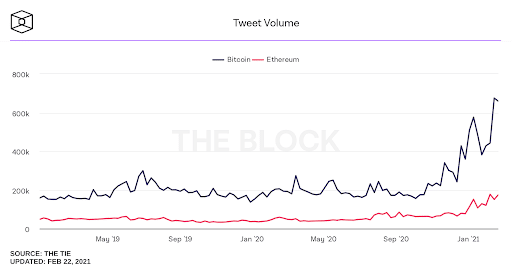

In other bullish info, “Bitcoin” weekly tweet volume hit a sleek high this month.

In Quillette, Alex Gladstein, chief approach officer on the Human Rights Foundation, published an op-ed on how governments might presumably also merely not be in a plight to discontinuance bitcoin on a protocol level and refutes loads of theories on how Bitcoin might be stopped. He says, “There might be a gigantic amount of speculation on the Web about how Bitcoin might be attacked, however few discontinuance to take into legend why it hasn’t already been destroyed. The acknowledge is that there are political and economic incentives for increasingly of us to push the system forward and help its security, and solid political, economic, and technical disincentives that discourage assaults.” In case you’ve got a normie pal pondering Bitcoin might presumably in the future hasten down, that is a mountainous essay to display her or him.

DeFi Roundup

- Decentralized substitute month-to-month volume hit an all-time high at $65 billion on Thursday, lawful 24 days into February, passing final month’s story of $61 billion.

- Realistic ETH gasoline expenses hit a yearly high on Tuesday, with the moderate ERC-20 transaction rate hitting $38.21 basically based fully on BitInfoCharts.com.

- Ethereum layer 2 suggestions had been neatly-liked this week. Layer 2 suggestions function to present diminished gasoline expenses, decrease latency, and better throughput in plight of placing every transaction on the Ethereum blockchain:

- Decentralized derivatives substitute dYdX is originate for trading on Ethereum layer-2 scaling resolution StarkWare. Shopping and selling is at display dinky, though a pudgy public originate is anticipated in about a weeks. The unreal lists BTC/USD and ETH/USD perpetual contracts, lending, and margin trading.

- Andreessen Horowitz (a16z) is investing $25 million into Optimism, a startup centered on scaling the Ethereum network. Optimism began a soft originate of its product in January, partnering with DeFi protocol Synthetix to birth out attempting out its sleek throughput and transaction speed.

Ethereum Killers on the Upswing

With high gasoline expenses on Ethereum being highlighted this week, it is no shock that might presumably-be ETH killers were, neatly, killing it.

BNB, the native token to the Binance Orderly Chain, Binance’s competitor to Ethereum, jumped from $40 to $300 in lawful 20 days and now sits as the third-ultimate cryptocurrency by market cap. PancakeSwap, a cloned Uniswap dapp working on the Binance Orderly Chain, is at display the #1 DEX by decision of wierd wallets and lawful $3 billion in the help of Uniswap in weekly volume. The recent reputation of BNB, on the opposite hand, has raised questions round the centralized nature of the chain and whether or not Binance’s battle of passion in having an Ethereum competitor might presumably possess accounted for its suspension of ETH and Ethereum-basically based fully token withdrawals on Monday.

Solana, one more Ethereum competitor, has seen spectacular growth this week, with the SOL token doubling from $8 to $14 as of press time Thursday. Alameda Review announced a $40 million funding in Oxygen, a DeFi primer brokerage that will originate on decentralized substitute Serum. Sam Bankman-Fried, CEO of FTX and consultant to both Serum and Oxygen, pointed to the rate and decrease rate of the Solana blockchain as reasons for picking it.

Concerns With Worn Monetary Plumbing Highlight Potential in Blockchain

On Wednesday, an outage on the Federal Reserve resulted in settlement disorders for a form of monetary institutions, causing ACH and FedWire delays at crypto exchanges. On the heels of the GameStop debacle, the DTCC, the most critical processor of U.S. stock trades, launched a whitepaper outlining a thought to decrease the settlement of trades from two days to 1, aka T+1. DTCC thinks it will operate this within two years — which, in crypto time, appears to be like an unbelievably mighty distance away. Hear more about how such disorders might be resolved by a blockchain-basically based fully platform much like Paxos Settlement Service, which Paxos CEO Charles Cascarilla discusses on this week’s Unchained.

However blockchain technology continues to intrigue the authorities. Federal Reserve Chair Jerome Powell announced that the Fed might be taking part the general public on the matter of the digital buck later this year.

SEC Commissioner Hester Pierce gave a speech titled “🚀 Atomic Shopping and selling 🚀” — replete with precise rocket emojis — urging federal regulators to “be more proactive in embracing technology.” She specifically cited DeFi shall we sigh, saying, “DeFi’s guarantees of democratization, originate access, transparency, predictability, and systemic resilience are alluring.“ She also neatly-known distributed ledger technology has the functionality to help the hot monetary infrastructure, stating that shortening the technique for settling trades from T+3 to T+1 might presumably also decrease threat associated with originate positions and decrease collateral calls for. She referred to Robinhood CEO Vlad Tenev’s testimony from final week when he called for accurate-time settlement of trades, and acknowledged, “Finally, crypto transactions prefer snappy and effectively with out a central counterparty. Orderly contracts and distributed ledger technology might presumably also operate the total clearing and settlement route of in the equity markets sooner and more atmosphere friendly.”

Fallout From SEC Lawsuit Against Ripple Continues

In light of the SEC’s lawsuit in opposition to enterprise blockchain agency Ripple and two of its executives, Moneygram, a publicly-traded remittance agency, has stopped the utilization of Ripple’s companies. Ripple also made headlines this week by saying a transfer to Wyoming, info that turned into damaged by Wyoming blockchain whisperer and Avanti CEO Caitlin Prolonged.

OKCoin Delists BCH and BSV

Since exchanges operate money on the trading of coins, with out reference to whether or not they’re high- or low-quality coins, they’re usually incentivized to checklist as many property as doubtless. So it turned into horrid when crypto substitute OKCoin announced that trading of two forks of Bitcoin, Bitcoin Cash (BCH) and Bitcoin Satoshi’s Vision (BSV) might be suspended on its platform starting March 1, 2021. Both coins are adaptations on Bitcoin, with a spotlight on bigger block dimension limits and layer 2 suggestions respectively. OKCoin says it is a honest platform and that it believes in allowing its clients to make investments for themselves, however that, according to the very fact that the market caps of both coins are round 1% of Bitcoin’s “the markets possess solid their vote.” One more ingredient that pushed it over the edge turned into the hot decision by Craig Wright, a budge-setter in the BSV neighborhood who has claimed he’s Satoshi Nakamoto, to place in force copyright claims to the Bitcoin whitepaper.

Elephantine Protocols Strikes Again

This Fun Bits is for those of you who be aware the indifferent days of 2016 when the Elephantine Protocols thesis turned into the total rage…

The Elephantine Protocols thesis turned into the speculation that in the crypto model of the bag, protocols and their native tokens might be fee better than applications constructed on top, whereas in the common web, protocols like HTTP and SMTP had been fee nothing, however applications much like Google, Fb, and Amazon that had been constructed on top turned into vastly treasured. Effectively, when you had been questioning how that works out when you examine a seed funding in Coinbase to an funding in Bitcoin on the similar time, a location called Casebitcoin.com has your help. It judges the seed funding in Coinbase to be round September 12, 2012, and says that, assuming a seed valuation of $10 million, Coinbase’s valuation upon going public would must exceed $47 billion to beat Bitcoin’s 250,000% return since then — and the formulation issues are going lawful now, that appears prefer it’s been locked up.

Source credit : unchainedcrypto.com