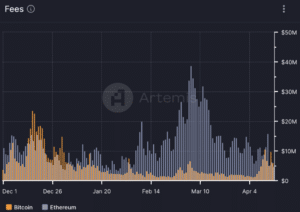

Movement Over Ethereum, Bitcoin Has Been Catching Up in Daily Bills Generated

Since 2021, Ethereum has usually led layer 1 blockchain networks in terms of on every day basis charges generated, nonetheless Bitcoin has lately been giving Ethereum a escape for its cash.

On Monday, crypto users paid $9.8 million in complete charges on Bitcoin and $6.4 million on Ethereum, while on Tuesday, Bitcoin generated $6 million in charges, in comparison to $4.8 million for Ethereum, per blockchain analytics firm Artemis.

Bitcoin has led Ethereum in on every day basis charges generated for 27 days since 2021, and of those 27 days, 23 of them happened between December and now, highlighting rising charges and heightened question to transact on the oldest blockchain community, data from onchain statistics firm Token Terminal reveals.

In accordance with an April 16 show from blockchain analytics firm Nansen, the elevated amount of charges users were paying to transact on Bitcoin is a favorable brand that charges will wait on as an ongoing and effective motivation for miners to uphold the protection of the Bitcoin blockchain community.

“With Bitcoin experiencing its fourth halving, which is in a subject to diminish block rewards to true kind 3.125 BTC per block, I’m optimistic relating to the capacity for onchain actions that generate transaction charges which is in a subject to proceed to incentivize miners to stable and decentralize the community,” wrote Walk Li, Nansen’s product advertising supervisor.

Read more: Bitcoin Miners Diversify Their Earnings Streams as Halving Nears

The Driving Forces In the support of Bitcoin’s Bills

The amount of charges Bitcoin generates would no longer fully near from straightforward BTC transfers. Li infamous that Bitcoin’s lately elevated rate revenue moreover arises from onchain actions equivalent to minting Ordinals non-fungible tokens (NFTs) and trading BRC-20 tokens.

No longer handiest has NFT trading quantity on Bitcoin exceeded that of Ethereum all by the final 24-hour, 7-day, and 30-day lessons, per NFT substitute data aggregator CryptoSlam, nonetheless Bitcoin is in fourth region for all-time NFT gross sales quantity, within the support of Ethereum, Solana, and Ronin.

“That is grand interested in that Ordinals, the unusual NFT traditional on Bitcoin, was as soon as handiest launched on the start up of 2023,” wrote Li, as Ethereum, Solana, and Ronin have had a multi-year head start up with NFTs.

Additionally, of the pinnacle 10 NFT collections ranked by market cap, three belong to the Bitcoin ecosystem—namely, Bitcoin Puppets, Bitcoin Wizards, and Rune Pups, per CoinGecko.

Bitcoin moreover generates rate revenue from crypto users trading BRC-20 tokens. As an example, Unisat, a decentralized commerce unusual for trading BRC-20 memecoins, had 24-hour trading quantity of $10 million.

Taking a survey forward, Runes, a protocol that hasn’t rolled out its mainnet but, targets to be “an enchancment over the BRC-20 tokens on fable of it doesn’t form pointless data that clogs the blockchain, it’s fair of exterior data, doesn’t need its have unusual token, works with the Lightning community, and presents better privacy,” wrote Li.

Read More: What Are Runes?

“Bitcoin’s marketplace for fungible tokens is miniature in comparison to Ethereum and Solana (gape screenshot below), nonetheless with Runes, Bitcoin might well end this gap,” Li added.

At the time of newsletter, the price of BTC has decreased 3.7% within the past 24 hours to round $60,1000.

Source credit : unchainedcrypto.com