Let’s Talk About DEX

October 19, 2021 / Unchained Each day / Laura Shin

Each day Bits ✍️✍️✍️

-

The crypto industry market cap broke $2.6 trillion — a brand recent all-time excessive.

-

The ProShares bitcoin futures ETF started shopping and selling this morning.

-

Fb is hiring 10,000 recent workers to hold its metaverse.

-

Crypto investment funds saw $80 million in inflows for the week ending October 15th.

-

Fitch Ratings warns that stablecoins might additionally affect securities markets.

-

In its quarterly burn, Binance destroyed virtually $640 million of BNB.

-

Société Générale (SocGen) is taking a explore to aquire a cryptocurrency custodian.

-

New York Attorney General Letitia James directed two unregistered crypto lending platforms, in all likelihood Nexo (disclosure: a extinct sponsor of my stamp) and Celsius, to directly quit operations in New York.

-

Interactive Brokers now permits Registered Financial Advisors within the US to change crypto on behalf of their potentialities.

-

Bloomberg ETF analyst Eric Balchunas thinks Valkyrie’s bitcoin futures ETF might additionally delivery this week.

- DraftKings, a sports actions making a wager firm, plans to was a beefy validator on Polygon.

What Function You Meme?

Vacation season is upon us #bitcoin #memepool pic.twitter.com/Bd7qlIFy2X

— Ḿ̷̯a̵̡̽ṱ̵̃t̵̡̄y̸̼͠ ̵͚͋G̶̖͘ 58k (@itsyaboymattyg) October 18, 2021

What’s Poppin’?

dYdX, a derivatives-based mostly entirely mostly cryptocurrency shopping and selling platform, is poppin’.

Recent off an airdrop on September eighth, the protocol, which mixes layer 2 low prices and rating entry to to perpetual futures on the blockchain, has set a blistering walk when it comes to volume. As an instance, beautiful final week, the DEX hit $100 billion in cumulative volume.

dYdX cumulative volume has now passed $100B! 🚀🎉

Yowl out to the whole hedgies🦔 who made this that it’s doubtless you’ll perchance accept as true with

Aug Cumulative Volume: $3.4B

September Cumulative Volume: $17.8B

October Cumulative Volume: $73.9B

Subsequent quit: $1 TRILLION 📈 pic.twitter.com/9yVObK98oa— dYdX (@dYdX) October 13, 2021

Forbes became the first to procure on dYdX’s surge in recognition, declaring that the replace saw over 3x more volume than Coinbase from September Twenty seventh and twenty eighth.

The perpetual replace is additionally crushing decentralized replace rivals. Data from CoinGecko reveals that dYdX has performed $88.89 billion in volume finally of the final 30 days. When put next, volume on all Ethereum DEX’s, including Uniswap, SushiSwap, and 0x, mixed to hit easiest $70 billion finally of the an identical duration, per Dune Analytics.

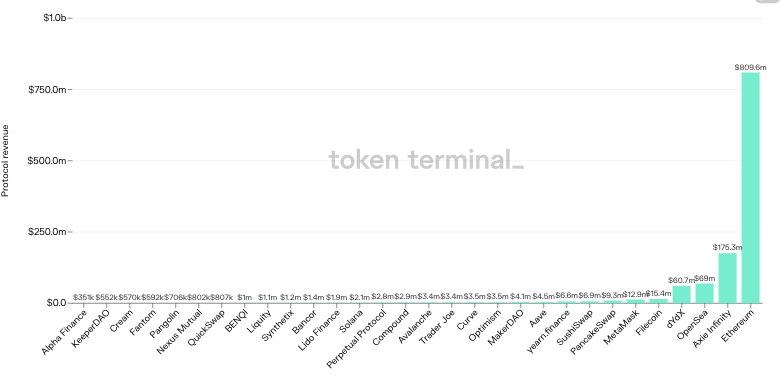

The swell in volume has helped dYdX pull in over $60 million in income — splendid for fifth set amongst all protocols listed on Token Terminal.

Particularly, dYdX’s success comes despite US customers being geoblockedfrom the platform (and airdrop).

Instantaneous Reads

- The Generalist on the draw ahead for NFTs:

- Dove Metrics on Q3 crypto fundraising:

- Handbook Tom Emmer on what he would blueprint in SEC Chair Gary Gensler’s shoes:

On The Pod…

Is the Metaverse Already Here? Two Specialists Disagree

Andrew Steinwold, managing accomplice at Sfermion, and John Egan, CEO at L’Atelier BNP Paribas, discuss about NFTs and debate the characteristics of the metaverse. Show highlights:

- their backgrounds and the device they got into NFTs

- how they every account for the metaverse

- what NFTs deserve to blueprint with the metaverse

- how John and Andrew’s depiction of the metaverse differs

- what John thinks about Fb’s entrance into the metaverse

- whether or no longer 2d Existence is a metaverse sport

- how blockchain skills permits for an delivery metaverse (and why Web2 is “communist”)

- what NFTs currently unlock for the metaverse

- whether or no longer the metaverse will essentially might bag to aloof be skilled through augmented truth

- whether or no longer there will likely be a few metaverses across diversified blockchain platforms

- why John thinks NFT maxis and crypto maxis are destined to clash

- how the metaverse is changing how of us make money

- straightforward the correct strategy to invent the metaverse more accessible

- whether or no longer regulators will power the metaverse to be siloed

- how the metaverse will handle jurisdictional disputes

- what occurs when any individual’s Web3 avatar/identification is stolen within the metaverse

- what John and Andrew predict will happen within the metaverse over the next 6-One year.

E book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Broad Cryptocurrency Craze, is now on hand for pre-justify now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-justify it right now time!

That it’s doubtless you’ll also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com