MakerDAO 🤝Valid World Sources

July 6, 2022 / Unchained Each day / Laura Shin

Each day Bits✍️✍️✍️

- Crypto broker Voyager Digital filed for Chapter 11 financial trouble after struggling large losses from its exposure to 3AC.

- Nexo (disclosure: a primitive sponsor) announced its plans to raze Vauld, some of the crypto lenders that halted withdrawals.

- Crypto platform Bullish brushed apart several workers amid the market turmoil.

- Crypto change Bitstamp will initiate charging a price to indolent customers.

- Bitmain, a hardware mining producer, started selling a original Ethereum ASIC miner on the present time.

- Twister Cash’s governance proposal to diversify its portfolio into ETH did no longer pass.

At present in Crypto Adoption…

- The Bank of England called for stricter crypto regulations.

- Virtu Monetary, some of the former finance world’s valuable market maker, is hiring a weekend crypto seller.

- Vincenzo Sospiri Racing, a racing crew backed by Lamborghini, announced that it will initiate using non-fungible tokens (NFTs) to certify and authenticate manufacturing facility automobile parts.

The $$$ Corner…

- Two primitive executives at VCs in Asia launched a original web3 funding agency.

- Bitcoin Miner TeraWulf took a $50 million mortgage to speculate in knowledge heart infrastructure.

What Accomplish You Meme?

What’s Poppin’?

MakerDAO to Integrate With an American Bank

By Juan Aranovich

MakerDAO is voting on whether or no longer to provide a DAI vault price $100 million to Huntingdon Valley Bank. MakerDAO is the organization unhurried the DeFi protocol Maker, which is accountable for the issuance of the stablecoin DAI.

Huntingdon Valley Bank is a 151-year-former lender basically based in Pennsylvania, and has $500 million in resources.

The governance proposal went are residing on Monday, and would perchance be closed by Thursday. If it passes, HVB would gain a mortgage participation facility with a 100 million DAI debt ceiling. With these funds, HVB will watch to enhance the growth of both its present businesses and original ones as successfully.

In change, the financial institution would post proper-world resources as collateral. These resources would possibly perchance almost definitely almost definitely almost definitely be a portfolio of diverse loans, including:

- Industrial Valid Estate Loans

- Industrial & Industrial Loans

- Executive Guaranteed or Affiliated Loans

- User Loans

- Residential Valid Estate Loans

- Capital Name Line

What’s in it for Maker? For starters, they’d gain yield, both mounted and variable. Second, it would possibly perchance probably almost definitely perchance serve Maker diversify its portfolio. Lastly, it would possibly perchance probably almost definitely perchance mean a step additional towards integration with former markets. This final point is vital: Maker would possibly perchance almost definitely almost definitely almost definitely be enabling proper-world resources to gain their manner into DeFi.

This proposal came lovely in some unspecified time in the future after one other crucial governance proposal became passed, whereby the community determined to allocate $500 million to a portfolio of treasury bills and funding grade company bonds.

On a linked display, Celsius repaid one other $40 million of its debt to Maker (this memoir became covered in the outdated day’s newsletter). As of press time, Celsius’s liquidation keep dropped to ~$2,700 per BTC.

Suggested Reads

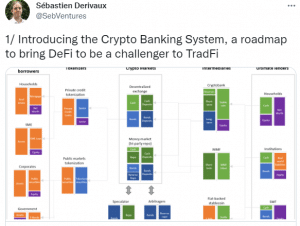

1) Sébastien Derivaux on DeFi sturdy TradFi:

2) Glassnode on BTC HODLers and “Vacationers”:

3) Nansen on the causes unhurried stETH “de-peg”:

On The Pod…

In the Most trendy Crypto Market Meltdown, What Characteristic Did Lido’s stETH Play?

Hasu, strategic consultant to Lido, and Tarun Chitra, founding father of Gauntlet, ticket all the pieces about staked ETH, aka stETH, how it would possibly perchance probably almost definitely almost definitely almost definitely also quiet be priced, Lido’s market dominance, and so much extra. Trace highlights:

- the design of Lido, what stETH is, and what its advantages are

- whether or no longer Ethereum’s lack of delegated proof of stake contributes to the want for stETH

- why stETH is just not any longer mispriced and why it doesn’t necessarily have to be price 1 ETH

- the inherent dangers linked with stETH

- how there became no longer adequate liquidity to address the whole liquidations, especially in computerized vaults on, for example, Instadapp

- how computerized market makers work and what Curve’s amplification ingredient is

- whether or no longer 3AC and Celsius had a considerable impact on the stETH/ETH “de-peg”

- how does the Merge affect the liquidity of stETH

- Hasu’s and Tarun’s level of confidence that the Merge will happen this year and whether or no longer it would perchance be a success

- what will happen to the price of stETH after the redemptions are enabled

- why Lido has completed this kind of level of dominance

- how Lido decreases the price of staking and helps fortify the safety of the Ethereum blockchain

- whether or no longer there would possibly perchance be going to be a “winner snatch all” in the liquid staking derivatives market

- how liquidity fragmentation can trigger the system to explode

- why LDO tokenholders would possibly perchance almost definitely almost definitely almost definitely also no longer own the identical incentives as ETH tokenholders

- what’s the Lido’s original twin governance model and what’s it looking out for to gain

- whether or no longer Lido would possibly perchance almost definitely almost definitely almost definitely also quiet self restrict its market dominance

- how Lido coordinates validators and the design of the LDO token on this coordination

- what are the classes to be realized from the stETH issue

- how governance is a licensed responsibility to DeFi protocols

E book Update

My e book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Ample Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now out there!

You would possibly perchance almost definitely almost definitely almost definitely also aquire it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com