This Chain Is January’s Freshest L1

January 25, 2022 / Unchained Day to day / Laura Shin

Day to day Bits ✍️✍️✍️

-

The Biden administration intends to free up an govt expose about crypto in February.

-

JPMorgan Streak shut down the narrative of Hayden Adams, the founder of Uniswap.

-

A trojan horse on OpenSea resulted in one Bored Ape Yacht Membership being soldfor $1,700 in Ethereum (the most up-to-date tag flooring for a Bored Ape NFT is 80+ ETH, or extra than $200,000).

-

Coinbase and Robinhood fleet traded at an all-time low on Monday.

-

Digital asset investment products noticed an inflow of $14 million final week.

-

Polymarket, a crypto predictions market that recently settled with the CFTC (and disclosure: a former sponsor), relaunched its platform with a US geoblock in place of residing.

-

Congressman Patrick McHenry wrote a letter pronouncing regulators are overstepping their bounds when it comes to digital assets.

-

Coinbase employed a former SEC respectable as its senior public policy manager; the exchange also launched a free tax center.

- Varied crypto YouTube channels hang been hacked the outdated day by an altcoin ad.

At the present time in Crypto Adoption…

-

Harbor Customized Adoption, a US-primarily primarily based real property constructing company, will procure BTC for its real property properties.

- Financial institution of The USA thinks a US CBDC may perhaps perhaps perhaps perhaps aid motivate the buck’s supremacy.

The $$$ Nook…

-

Blockchain Founders Fund raised $75 million for a new web3-primarily primarily based fund.

What Lift out You Meme?

What’s Poppin’?

Fantom’s TVL Is Coming for BSC

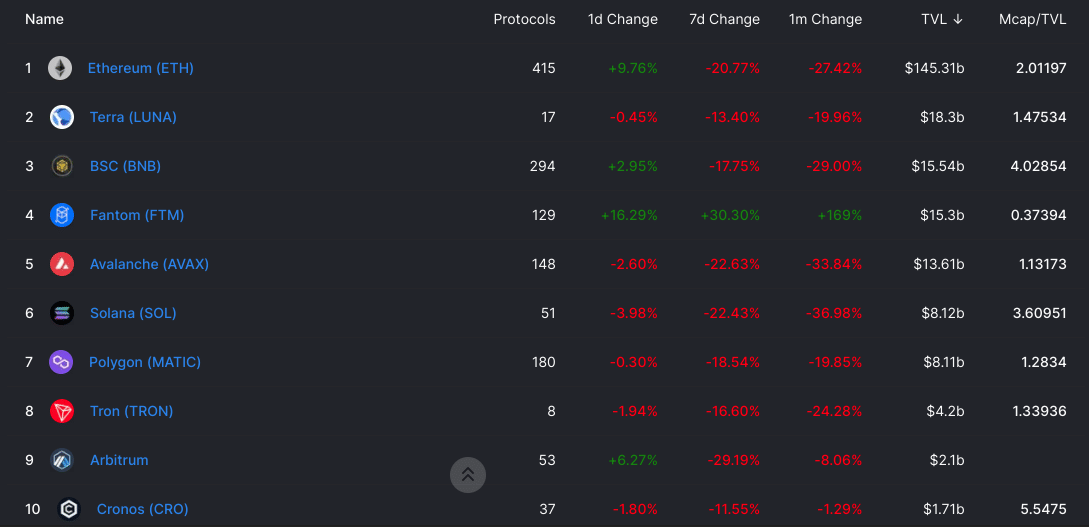

In accordance to DeFi Llama, roughly $246 billion worth of crypto assets are locked into DeFi protocols. Mighty fancy the general crypto market, entire worth locked (TVL), the amount in tokens secured by a order chain or utility, has taken a success in most up-to-date weeks and currently sits about 23% off the gradual-December all-time high of $321 billion.

Fantom, a at ease contract blockchain (or layer 1), has bucked that constructing. All through a month-prolonged length in which Avalanche and Solana skilled a 30%+ decline in TVL and Ethereum, Terra, and Binance Dapper Chain misplaced 20%+ in TVL, Fantom’s TVL increased a whopping 169%. At $15.21 billion, Fantom is currently jockeying with Binance Dapper Chain ($15.5 billion) for third-largest chain by TVL.

Value locked into Fantom is unfold across 129 capabilities. On the assorted hand, most efficient 26 protocols motivate extra than $100 million in assets. Correct below half of of Fantom’s TVL (47%) is deposited into Multichain, and yet some other $4 billion+ is locked into OxDAO.

Recordsdata from CoinMarketCap reveals that FTM, Fantom’s native token, is up 5.95% over the previous 30 days, coinciding with its exploding in TVL. On the assorted hand, the token is down over 24% within the previous seven days (as of 6:30 pm ET on Monday), although TVL is up 30%. Here is important, as it appears to be like to be Fantom’s token tag is lagging within the support of its market cap. As an illustration, every assorted high 5 chain by TVL trades at a a couple of of its TVL (e.g., Ethereum has a $290 million market cap with $145 million in TVL). Fantom, on the assorted hand, is most efficient trading at accurate over one-third of its TVL (perhaps on account of the bearish sentiment within the crypto market).

Instructed Reads

-

Delphi Digital on the final week in crypto:

-

@Laine_sa_ on Solana liquidations:

-

Messari’s Mason Nystrom on getting a job in web3:

On The Pod…

SyndicateDAO Is Launching Web3 Investment Golf equipment. Would perhaps well well also They Disrupt VCs?

Will Papper and Ian Lee, the two co-founders of Syndicate, join Unchained to divulge the free up of Syndicate’s new product: Web3 Investment Golf equipment, an innovation they mediate may perhaps perhaps perhaps perhaps conclude up disrupting the web2 investment world, along with the general enterprise capital industrial. As an illustration, with Web3 Investment Golf equipment, users will doubtless be ready to expose an Ethereum pockets address into an investing DAO with accurate just a few clicks, switch funds without going through banks, and organize a cap-desk straight away on-chain. Say issues:

-

what differentiates a Web3 Investment Membership membership from a favorite investment membership

-

what on-chain tools Syndicate has constructed for Web3 Investment Golf equipment

-

how Web3 Investment Golf equipment work within existing guidelines

-

how Ian and Will met and what inspired them to form Syndicate

-

whether or no longer Syndicate plans to decentralize

-

why Will and Ian mediate investment DAOs will disrupt the enterprise capital industrial

-

why enterprise capital companies invested in Syndicate, an organization constructed to disrupt them

-

what Will learned from constructing Scurry Gold (AGLD), the governance token for Loot

-

what plans Syndicate has for 2022

Guide Update

My e-book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Immense Cryptocurrency Craze, is now available for pre-expose now.

The e-book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-expose it in the present day time!

You furthermore mght have to aquire it right here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com