SBF Claims FTX Had $8B Before Financial peril, Says CZ’s Tweets Were a ‘Focused Assault’ on Alameda

Worn FTX CEO Sam Bankman-Fried has resurfaced on Substack, making a chain of claims regarding the declare of FTX and Alameda’s balance sheet prior to it filed for monetary peril.

In a weblog put up on Thursday, Bankman-Fried acknowledged that FTX had roughly $8 billion fee of resources of “varying liquidity” when he handed over the reins to John Ray III after the crypto commerce filed for monetary peril.

He also claimed that, at the time, FTX US had over $350 million in money previous customer balances.

“It’s ridiculous that FTX US customers haven’t been made complete and gotten their funds aid but,” acknowledged Bankman-Fried.

In step with him, FTX’s monetary peril became a consequence of the contagion that spread from Alameda’s insolvency, which in itself became the end result of an assault from Binance CEO Changpeng Zhao.

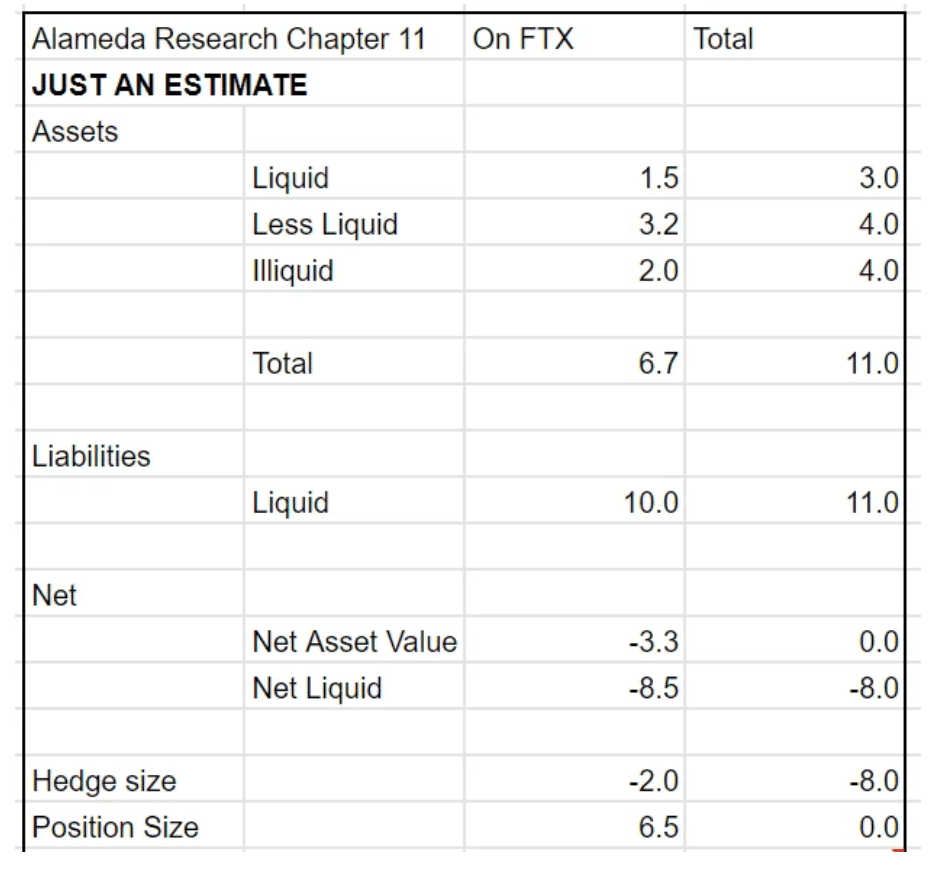

In 2021, each and every Alameda and FTX had been legitimately profitable companies “making billions,” he acknowledged. On the time, he estimated that Alameda became managing around $100 billion with around $8 billion fee of receive borrowing. He believes that of these borrowed funds, $1 billion became paid as hobby to lenders, $3 billion became historic to aquire out Binance’s stake in FTX and $4 billion became historic to fund endeavor investments.

“In that context, the ~$8b illiquid region (with tens of billions of greenbacks of accessible credit rating/margin from third celebration lenders) looked life like and now not very unhealthy,” he acknowledged.

He attributed a chain of market events in 2022, including LUNA’s implosion, Three Arrows Capital and a assortment of crypto lenders declaring monetary peril as the cause leisurely Alameda’s liquidity declining from $20 billion to $2 billion.

The FTX founder alleged that a tweet from Binance’s Zhao in November, saying the crypto commerce became liquidating the entirety of its FTT region, became what one way or the other led to Alameda’s smash. Zhao’s tweet followed a Nov.2 sage from CoinDesk, revealing that Alameda’s balance sheet largely comprised of illiquid FTT – FTX’s native commerce token.

In Bankman-Fried’s fetch out about, Zhao’s tweet became now not in actuality a response to these revelations, but rather a “focused assault on resources held by Alameda.”

“By November tenth, 2022, Alameda’s balance sheet had ideal ~$8b of (ideal semi-liquid) resources left, versus roughly the equal ~$8b of liquid liabilities,” acknowledged Bankman-Fried, sharing his breakdown of the firm’s balance sheet.

“And a disappear on the monetary institution required quick liquidity—liquidity that Alameda no longer had.”

As Alameda became illiquid, so too did FTX, thanks to Alameda’s originate margin region on the commerce, he claimed.

Bankman-Fried’s model of events is a stark distinction to what Alameda CEO Caroline Ellison had to claim in her responsible plea final month. In a Dec. 19 hearing, Ellison acknowledged Alameda became granted an monumental line of credit rating on FTX, without being required to put up collateral or pay margin calls.

She acknowledged that FTX’s loans to Alameda had been financed with the commerce’s person funds, and that herself and Bankman-Fried had misled buyers with monetary statements that hid the extent of Alameda’s borrowings on FTX.

Source credit : unchainedcrypto.com