$41 Trillion in AUM

And an passion in crypto

There modified into once a flood of crypto headlines this week sparked by Tesla’s announcement Monday of a $1.5 billion buck bitcoin place. Tesla’s announcement modified into once followed by bitcoin’s sign ripping thru an $8k candle on its manner to hitting but every other all time high at $forty eight,200 before drifting aid all of the manner down to the mid-$40,000 vary. This modified into once not an altogether gorgeous buy by Tesla as CEO Elon Musk has been very energetic on Crypto Twitter… As he tweeted:

While Tesla’s bitcoin buy led to many experiences, equivalent to CNBC’s Jim Cramer advocating for bitcoin, and speculation concerning which institution(s) would be next, like the RBC Capital Markets analysis document pointing in direction of Apple as the next big company to circulation into bitcoin, the comfort of the crypto world persevered at a frenetic tempo. As an illustration, these bulletins are on the reducing room floor of the news cycle: Invoice Miller of the Miller Opportunity Belief plans to speculate $300 million in bitcoin thru the Grayscale BTC Belief, the Mayor of Miami, in an interview with Forbes, laid out plans for town to develop into a step by step crypto-pleasant, and Nigeria launched a letter declaring utilizing cryptographic resources to be illegal and Binance suspended deposits there. Crypto not veritably fails to disappoint, nonetheless on tale of the Tesla investment, this week felt like a pivotal second.

Hear to the Most up-to-date Episode of Unchained

Lyn Alden and Raoul Friend: Is Ethereum a Upright Investment?

On this week’s episode of Unchained, Lyn Alden, CEO and founder of Lyn Alden Investment Programs, and Raoul Friend, CEO & cofounder of Accurate Vision Community & Global Macro Investor, debate about whether ETH is a apt investment, and focus on their views on GameStop. This episode is getting a ton of response on Twitter and YouTube, so ensure not to omit it.

Hear to the Most up-to-date Episode of Unconfirmed

Michael Moro on Tesla’s BTC Aquire and the Novel Genesis Treasury

On Unconfirmed this week, I spoke with Michael Moro, CEO of Genesis, about Tesla’s buy of bitcoin, how and when Genesis started seeing passion from corporations acquire, and how it came to launch Genesis Treasury. Plus, he unearths what Genesis is awaiting from the institutional world in 2021.

Thank you to our sponsors!

Crypto.com

The Sun Commerce

This Week’s Crypto News…

Gargantuan Banks and Credit rating Card Giants Continue Swiping Precise on Crypto

Bank of Novel York Mellon, the nation’s oldest financial institution and a custodian of $41 trillion in resources, is making a circulation into crypto. Based on the Wall Avenue Journal, the financial institution will defend, switch, and whisper bitcoin and other cryptos on behalf of its clients. “We’re initiating with the anchor in this space, which is custody,” Mike Demissie, head of developed choices at BNY Mellon, told CoinDesk. “Then it comes all of the manner down to what our clients need from us. So as that’s not factual safekeeping of these resources, they are seeking to leverage them for lending capabilities, they are seeking to leverage them for collateral. Then we’re moreover looking at issuing digital resources, like tokenized securities, accurate resources.” BNY is the principle noteworthy U.S.-basically based custodian to liberate a belief for storing crypto as it would possibly perhaps maybe any other asset. Even though BNY declined to issue which crypto-native corporations it’s miles utilizing to variety out its resolution, it did verify that the financial institution is relying on outside partners.

Mastercard announced it’ll offer its retailers the option to acquire funds in pick out cryptocurrencies later this year. The company philosophy in direction of cryptocurrency is easy: “it’s about preference,” Mastercard Vice President for Blockchain and Digital Asset Products, Raj Dhamodharan, wrote in a weblog put up. Mastercard will not be attempting to stress shoppers or corporations into utilizing crypto, he stated. Rather, they are right here to “enable potentialities, retailers, and corporations to circulation digital cost… nonetheless they need.” Dhamodharan later highlighted the four key objects Mastercard is in the hunt for in its crypto asset preference course of: particular person safety, strict compliance protocols, adherence to native regulations, and particular person query. Based on CoinDesk, Mastercard previously interacted with crypto thru partnerships with Wirex and Uphold, nonetheless these capabilities had been factual for funds, not settlements. This would possibly perhaps maybe maybe also be the principle time Mastercard will be accepting crypto funds without converting it to fiat for retailers.

As ETH Futures Commence, Analysts Advise Ethereum’s Future Appears Bright

CME Community, the arena’s finest derivatives marketplace, launched an ETH futures product on Monday. In an interview with The Block, Tim McCourt, CME’s managing director and global head of equity products, stated ETH contracts had been traded roughly 388 instances to the tune of roughly 19,400 ETH, or $33 million. McCourt stated, “The response to Ether has been overwhelming.” Based on CME, each contract is made up of 50 ETH and priced in U.S. dollars, with the minimum alternate measurement being 5 contracts. The enthusiasm about ETH futures spilled over into the price of ether, which roared past $1,800 on Tuesday, over triple its sign when the CME futures had been announced in mid-December. It modified into once restful trading around there as of press time.

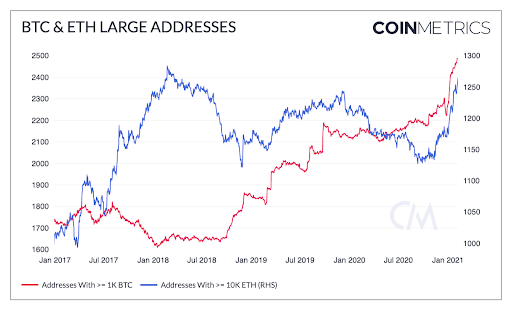

On-chain prognosis and anecdotal evidence signifies institutional passion is deciding on up in ether. Coin Metrics reported on Monday that the series of Ethereum whale addresses is increasing at a price an a lot like that of Bitcoin whale addresses.

Additionally, Ethereum 2.0 reached a milestone indicating a bullish future: over 3 million ETH is now staked on the community.

Qiao Wang, co-founder of Messari Learn, tweeted that “the earliest venerable financial institutions that equipped BTC are already looking at ETH, if not equipped already. And rightfully so. The most extinct crypto community + future of finance + a doable deflationary monetary protection fable web it extraordinarily compelling.” He initiatives the price of ETH will be between $5k-$20k by the cease of this bull mosey.

Bitfinex Repays Tether Ahead of Schedule

Closing Friday, crypto alternate (and sister company to Tether) Bitfinex announced that it had repaid a $550 million loan to Tether. In a commentary on its websites, Bitfinex stated, “All passion due on the loan has been paid. The loan has now been repaid early and in corpulent and the road of credit has been cancelled.”

Based on The Block, “Tether [initially] opened a credit line price $900 million for Bitfinex, of which $750 million modified into once extinct by the alternate” because Bitfinex modified into once looking non everlasting profit 2018. On the moment, Bitfinex misplaced entry to $850 million in buyer and company funds when they had been seized by a rate processor, Crypto Capital.

Bitfinex repaid two installments of $200 million on the loan in 2019 and 2020, leaving the balance at $550 million, which they paid off this week. This modified into once the third and final installment of funds to cease out the loan, which modified into once due in November 2021.

The financial lifeline has been heavily scrutinized since April 2019 when the Novel York Lawyer Total’s Dwelling of job alleged Bitfinex extinct Tether’s loan to secretly quilt the alternate’s shortfall.

In other stablecoin news, Tether’s market cap at this time crossed the $30 billion attach.

DeFi Roundup

- The St. Louis Fed launched a DeFi analysis paper final Friday, which concluded that whereas DeFi is restful “a arena of interest market with obvious risks… it moreover has attention-grabbing properties by manner of efficiency, transparency, accessibility, and composability.” The paper modified into once written by Fabian Schar, a professor for dispensed ledger technologies on the University of Basel.

- DeFi protocol Yearn utilized its treasury to pay aid victims of the $11 million flash loan assault final week. Based on the yearn.finance Twitter tale, this act of kindness “modified into once performed as a one-off celebration of going thru the DeFi rite of passage.”

- Europe’s finest telecommunications company by income, Deutsche Telekom, is now one among the principle recordsdata services to Chainlink, in preserving with CoinDesk. Chainlink, a DeFi oracle provider, provides luminous contracts with recordsdata from the accurate world, which manner Deutsche is providing energetic recordsdata pork up for DeFi.

MEV Is Changing into a Voice on Ethereum

A most modern analysis document by Paradigm on Miner Extractable Price, aka MEV, highlighted the aptitude pitfalls that extend with permitting miners to arbitrarily consist of, exclude, and reorder transactions within blocks they possess. Paradigm defines MEV as “the measure of profit a miner can web thru their potential to arbitrarily consist of, exclude, or re-give an explanation for transactions one day of the blocks they possess.” The document signifies that whereas most miners must not exploiting this unprejudiced now, one day of the final three months, Paradigm says, “a exiguous nonetheless indispensable nick of the hashrate has been noticed exploiting MEV themselves, income-sharing with merchants quite than permitting permissionless price auctions, and promoting entry to deepest reminiscence swimming pools.” Paradigm believes miners will pursue great extra uncommon forms of MEV, presumably even colluding, which would possibly perhaps maybe maybe cease up harming customers and Ethereum, making a originate of invisible tax on the protocol and encouraging consensus instability. Additionally, Paradigm says MEV would possibly perhaps maybe moreover moreover be considered on Bitcoin, despite the fact that it’s miles less of a whisper there.

Crypto Quickly Hits:

- Twitter’s CFO is pondering in conjunction with BTC to the corporate’s balance sheet as nicely as paying workers and distributors in the digital currency

- Uber would possibly perhaps maybe maybe settle for cost in Bitcoin, nonetheless has no plans to buy it as a reserve asset

- CoinDesk reports that Amazon is hiring for a brand fresh digital asset-basically based challenge in Mexico

- Treasury Secretary Janet Yellen spoke publicly on cryptocurrency for the third time announcing “I stare the promise of these fresh technologies, nonetheless I moreover stare the truth: Cryptocurrencies enjoy been extinct to launder the profits of on-line drug traffickers; they’ve been a tool to finance terrorism.”

- Within the oddest news of the week, actress Lindsay Lohan equipped a crypto collectible on Rarible for $17,000, which modified into once flipped for $50,000 one hour later

German Police Stymied When Attempting to Rob $81 Million in Bitcoin

Reuters at this time reported that German prosecutors enjoy confiscated from a bitcoin miner a stash of 1,700 bitcoin, price about $81 million, as of press time. On the opposite hand, all they enjoy is his hardware pockets. What they don’t enjoy is the actual person’s password to liberate it.

The bitcoin miner modified into once sentenced to 2 years in detention center for installing bitcoin mining tool on people’s computer systems without asking permission, which is how he built his stack of 1,700 BTC. He already served his time and maintained his silence referring to the password one day of, whereas the police many instances tried to crack the code.

As Alex Gladstein of the Human Rights Foundation tweeted

Source credit : unchainedcrypto.com