3AC’s Biggest Creditor Is…

July 19, 2022 / Unchained Every single day / Laura Shin

Every single day Bits✍️✍️✍️

- Snapshot added a “shielded balloting” goal to permit DAO contributors to vote privately.

- The Dutch central bank fined Binance $3.4 million for working internal the Netherlands without authorization.

- Lido, a DeFi staking service, is launching liquid staking on Ethereum layer 2 networks.

- Coinbase has been authorized to goal in Italy.

- Crypto alternate Gemini accomplished a 2nd spherical of layoffs honest seven weeks after reducing 10% of its personnel.

- Month-to-month NFT trading quantity fell 74% between May well honest and June.

- BlockFi is offering employee buyouts by a “voluntary separation program.”

At this time time in Crypto Adoption…

- The US Treasury will be originate to permitting non-banks to subject stablecoins.

- Christie’s launched a project fund to put money into web3 innovation.

- Time President Keith Grossman is bullish on NFTs however thinks the discover NFT must quiet “go from the lexicon,” in accordance with CNBC.

The $$$ Corner…

- Modular Capital, a web3 hedge fund, raised $20 million.

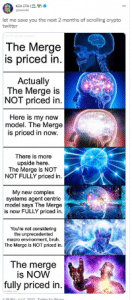

What Attain You Meme?

What’s Poppin’?

3AC Owes Billions to These Collectors

Teneo, the company spearheading the liquidation of Three Arrows Capital (3AC), revealed extra than one honest filings outlining the extent of 3AC’s prominent loans and asking authorities in Singapore to acknowledge the liquidation complaints.

In conserving with the paperwork received by The Block, that are no longer accessible on-line, 3AC owes 27 firms roughly $3.5 billion. Severely, Genesis Asia Pacific Pte Ltd., a subsidiary of Digital Forex Neighborhood, is the largest creditor listed, having loaned $2.3 billion to 3AC. Other inviting creditors looking out for to stare their funds returned through the honest job encompass Celsius Network, CoinList, and FalconX, which each and each and each lent between $35 million to $75 million in tokens to 3AC. (Interestingly, creditors additionally encompass 3AC co-founder Zhu Su, who’s inquiring for $5 million, and Chen Kelly, the partner of 3AC co-founder Kyle Davies, who’s looking out for $65 million.)

In conserving with every other document from The Block, it looks to be that these forms of elevated creditors are banding together to invent a committee, including Digital Forex Neighborhood, Voyager, CoinList, Blockchain.com, and Matrixport as contributors.

The filings additionally gave extra insight into the mismanagement of funds from 3AC. As an illustration, in a thread summarizing the paperwork (which is linked to in instantaneous reads) crypto legislation knowledgeable Wassielawyer renowned that the 3AC co-founders put a down price on a broad luxury yacht while at the identical time seemingly “defaulting on their lenders.”

This contemporary recordsdata comes about two and half of weeks after 3AC filed for Chapter 15 financial pain in Original York. As of now, it does no longer appear the whereabouts of both Zhu Su or Kyle Davies is identified.

In fact helpful Reads

1) Wassielawyer on 3AC

2) @marceaueth on how Rocket Pool would possibly perhaps scale

3) Li Jin and Michael Mignano on technical standards and innovation

On The Pod…

Bitcoin in El Salvador: Why Would Cypherpunks Make stronger Government-Mandated Bitcoin Adoption?

Nelson Rauda, Salvadoran journalist for El Faro, involves focus on the affect of Bitcoin in El Salvador, the wants of Salvadoran of us, Bitcoin City and the Bitcoin Bond, and heaps extra. Expose highlights:

- Nelson’s narrative and how he started overlaying BTC

- what extra or much less flesh presser and president Nayib Bukele became as soon as before BTC

- what the financial reality became as soon as for Salvadoran of us before the implementation of BTC

- the explanations for the excessive charges of unbanked of us in El Salvador

- how Bukele changed the monetary policy with what Rauda says became as soon as very puny dialogue

- why Rauda believes the BTC legislation is now not any longer meant for Salvadorans, however as a change is a PR stunt

- how of us reacted after the announcement of BTC as honest soft, and how it resembled the dollarization of the financial system in 2001

- how Nelson did no longer even perceive BTC for the time being of the announcement and how he says there became as soon as no longer an effort from the authorities to coach the population

- whether BTC became as soon as profitable in attracting investments and tourism, and how there’s no laborious recordsdata about it

- why Nelson believes Bukele became as soon as looking out for to conceal the scandals when he adopted BTC

- whether BTC has been venerable as a PR stunt

- why bitcoiners are alive to in an authoritarian authorities adopting BTC as honest soft

- how Bukele would possibly perhaps well be undermining his occupy authority by adopting BTC, a invent of money that’s no longer managed by a remark

- whether the Chivo pockets is a surveillance machine

- why Nelson believes BTC does no longer signify a solution for the wants of moderate Salvadoran of us

- whether the $30 buck initial gift to download the BTC pockets became as soon as viewed as honest every other subsidy

- the remark of Bitcoin City and how Nelson believes it represents the most spectacular PR stunt from Bukele’s administration

- how the costly costs of electrical energy in El Salvador invent the country no longer the very top place for mining

- the significance of Bitcoin Sea toddle

- what the BTC bond is, what Bukele tried to form with it, and why it has been postponed

- whether El Salvador will default on its debt and what the affect of the BTC ticket has on the nationwide funds and on how Salvadorans discover Bitcoin

- how Nelson believes of us in El Salvador quit no longer to find political freedom and how it contradicts the narrative of financial freedom that BTC targets to present

- what Nelson thinks about Bitcoin and whether governments must quiet undertake it as honest soft

E book Update

My guide, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Mighty Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now accessible!

You need to always purchase it here: http://bit.ly/cryptopians

Source credit : unchainedcrypto.com