$2,600 ETH

PLUS: Is Thodex the next Quadriga?

This week changed into tubby of fun headlines, with two exchanges and two cryptocurrencies taking on the stop spots within the recap. A feeble Coinbase govt, who right this moment served because the Performing Comptroller of Currency, will more than likely be becoming a member of Binance.US as its CEO. Coinbase also made headlines after experiences came out documenting appropriate how much inventory its govt crew offered final week. Bitcoin dipped over the weekend as a vitality outage in China diminished the hash payment retaining the community by 1/4th. Ether hit an all-time high on Thursday in anticipation of EIP 1559.

In assorted news, Tidy Labs doubled its valuation in only about a weeks while Digital Sources, CryptoSlam, and Aleo also offered fundraises. Galaxy Digital, who right this moment filed for a bitcoin ETF, is reportedly in talks to win crypto custodian BitGo, who, appropriate final year, declined a $750 million acquisition offer from PayPal. Square and ARK Make investments launched a overview memo on why Bitcoin mining may perchance maybe well potentially promote renewable vitality employ. And, lastly, Dogecoin had an eventful week.

On Unchained, I changed into interviewed by the On Deck Podcaster Fellowship referring to the origins of the Unchained pod, how my background as a journalist ready me for podcasting, and guidelines for aspiring creators. Produce obvious to strive it out — I believed it changed into an delightful commerce of tempo to be a guest on the uncover as a replace of the host. On Unconfirmed, Robbie Ferguson, co-founder and president of Immutable, mentioned the launch of its new layer 2 solution, Immutable X, and how that can maybe well turn out to be the world of blockchain-essentially based video games and NFTs.

Listen to the Most up-to-date Episode of Unchained

Thanks, Forbes: Laura on How the Unchained Podcast Came to Be

In a fun commerce of tempo, I changed into interviewed by the On Deck Podcaster Fellowship referring to the origins of Unchained pod, how my background as a journalist ready me for podcasting, and guidelines for aspiring creators.

Listen to the Most up-to-date Episode of Unconfirmed

Robbie Ferguson, co-founder and president of Immutable, talks about how Immutable is remodeling the NFT commerce by its layer 2 solution, Immutable X, which appropriate launched April 8.

Thank you to our sponsors!

Crypto.com

InterPop

NEAR

This Week’s Crypto News…

Binance.US to Rent Broken-down OCC Chair as CEO

On Might perchance maybe well honest 1st, Brian Brooks will change into the brand new CEO at Binance.US. Brooks right this moment stepped down because the performing head at the Field of job of the Comptroller of the Currency, where he served for the length of the final nine months of the Trump administration. Earlier than becoming a member of the OCC, Brooks changed into the executive good officer at Coinbase, which is arguably essentially the most intelligent competitor to Binance.US’s father or mother firm Binance.

Below his management, the OCC launched steering allowing banks to custody crypto property for purchasers and to employ stablecoins to construct transactions. Whereas his stint at the OCC changed into short, spanning from final Might perchance maybe well honest to January of this year, for the length of that time, he earned the nickname “Crypto Comptroller” on social media.

Binance.US is currently headed by Catherine Coley. Brooks confirmed to CoinDesk that she will depart by early Might perchance maybe well honest.

Meanwhile, at Binance, headed by CEO Changpeng Zhao, the exchange is going by scrutiny from UK regulators over its launch of digital inventory tokens for Tesla and Coinbase. It appears the regulatory space around the tokens, which Binance says “voice a fraction in a inventory company,” is a gray space since Binance doesn’t elaborate whether it is a security or spinoff on its web region. If deemed securities, the exchange would want to post a formal funding prospectus.

Crypto lender BlockFi offered the addition of Christopher Giancarlo, the feeble chairman of the Commodity Futures Trading Commission, to its board of directors. Giancarlo changed into dubbed “Crypto Dad” for his make stronger of crypto for the length of his time at the CFTC.

Brooks and Giancarlo be a part of Brett Redfearn, a top regulator at the SEC hired by Coinbase, and Max Baucus, a feeble senator attributable to Binance, in solidifying the style of crypto corporations bringing in U.S. regulatory veterans to relief navigate U.S. rules.

Coinbase CEO Sells Less Than 2% of His Shares

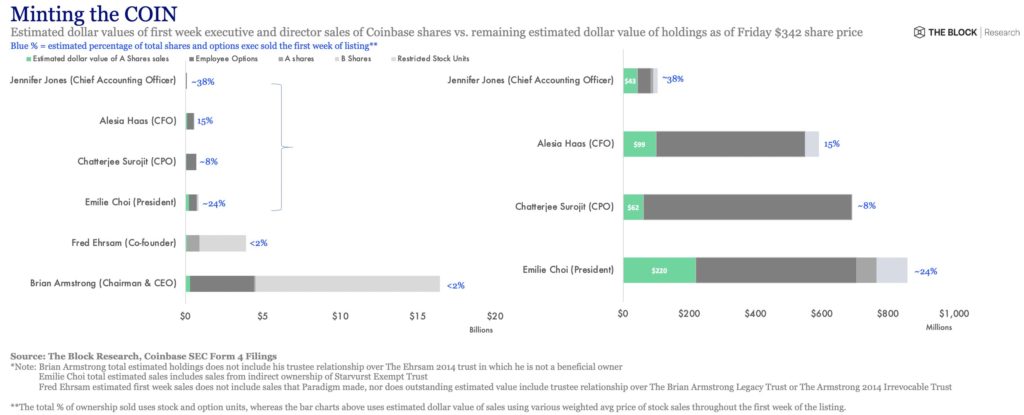

An fallacious but semi-viral tweet made the rounds on Saturday suggesting that Coinbase chief govt officer Brian Armstrong offered 71% of his shares for the length of Coinbase’s remark listing final week. The chart also mistakenly indicated chief financial officer Alesia Haas offered 100% of her shares.

Nonetheless, The Block reported that Armstrong offered no longer up to 2% of his holdings for roughly $290 million while Haas only offered 15% of her shares final week. Chief accounting officer Jennifer Jones led the government crew, selling 38% of her inventory. Whereas seeing high-stage executives offload shares may perchance maybe well even possess regarded chase and even disheartening to COIN homeowners, it will mild were expected. A appropriate away public listing nearly forces insiders to promote on epic of only the firm’s present shares are offered to the public. In the more same outdated initial public offering, new inventory is issued to the public.

Bitcoin Hash Charge Drops and So Does Tag

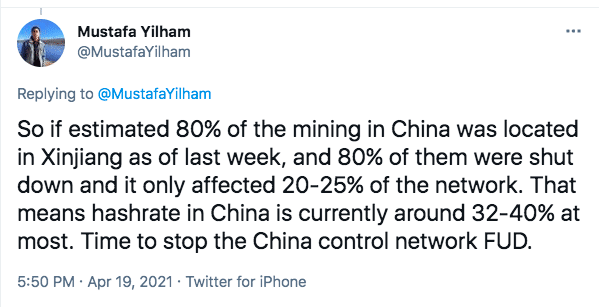

This previous weekend, Bitcoin dipped from $60k to $53k in 12 hours. The dip coincided with a blackout induced by a coal mine explosion in China’s Xinjiang utter, a vital participant in Bitcoin mining. The Bitcoin hash payment, a measure of its computing vitality, dropped 25%.

Mustafa Yilham, vp of global commerce style at Bitcoin miner Bixin, tweeted:

On-chain Bitcoin analyst Willy Woo wrote, “payment and hash payment has constantly been correlated” and tweeted a chart exhibiting the hour-by-hour attach of BTC payment vs. hash payment titillating downward in symmetric style over the weekend.

The Block experiences that, as of Thursday, miners are step by step coming support on-line and accurate-time hash payment data already reveals a 24-hour construct bigger in computing vitality.

Ethereum Reaches Recent All-Time Excessive

Ether broke by $2,600 for the main time on Thursday morning in a rally fueled by speculation that the upcoming adoption of Ethereum Development Proposal 1559, wherein transaction costs will more than likely be burned, will lead to a fall in present.

Cut Spanos, co-founding father of Zap Protocol, suggested CoinDesk that ether will “change into a deflationary asset” which “will reduce the coin present and possess a corresponding attain on the price, creating an enchantment point for investors.” Ether is up 35% this month while Bitcoin is down 8%. The latest surge in ether coincides with Bitcoin market dominance insecure to levels no longer considered since 2018, which changed into the final time Bitcoin market dominance slipped under 50%. On Thursday, Bitcoin’s market cap sat at $1.02 trillion or 48% dominance, while the whole crypto market changed into at $2.13 trillion, and ETH accounted for 14% of whole market fragment.

Tidy Labs Headlines But any other Substantial Week in Crypto Fundraising

- The firm within the support of NBA Top Shot and CryptoKitties, Tidy Labs, is elevating cash at a valuation of $7.5 billion from Coatue Administration. The latest elevate will more than double its most latest spherical, which valued the NFT firm at $2.6 billion in March.

- Digital Asset, an endeavor blockchain firm, offered a $120 million Series D spherical to lengthen its crew by 50% and trace a protocol that can seamlessly possess interaction at some stage in blockchains.

- Aleo, a platform that specialize in zero-data proofs allowing digital parties to possess interaction without sharing underlying data, bought $28 million from a16z, amongst others.

- Brand Cuban, billionaire investor and Shark Tank “shark,” offered an funding in CryptoSlam, an NFT data platform, at an undisclosed sum. (To hear about his NFT funding thesis, take a look at up on his latest appearance on Unchained.)

Losses Might perchance maybe well honest Reach $2 Billion at Regarded as one of Turkey’s Very finest Exchanges as CEO Flees

In echoes of the Quadriga CX fiasco, the Turkish crypto exchange Thodex mentioned it doesn’t possess the energy to continue financially, in line with Bloomberg. Losses at the exchange is also as high as $2 billion, and the 27-year-faded CEO has fled the country. On Wednesday, Thodex halted all transactions. Earlier than shutting down, it changed into trading more than $585 million in crypto each day and had around 400,000 customers. CoinDesk experiences that from an undisclosed utter, CEO Faruk Fatih Ozer has near out in opposition to what he calls a “smear campaign” from clients and the public, explaining the transaction freeze changed into due to 30,000 user accounts being flagged as suspicious. Bloomberg experiences that Ozer has promised to repay all merchants and face justice upon his return to Turkey, that the authorities has blocked the firm’s accounts, and that the police possess raided its headquarters in Istanbul.

Galaxy Digital Is in Talks to Intention BitGo

Mike Novogratz’s Galaxy Digital, a crypto funding firm, is reportedly in evolved discussions to win crypto custodian BitGo. A supply acutely aware of the anxiety mentioned to CoinDesk, “Galaxy doesn’t reside custody, so it is a ways radiant to bring that in-dwelling.” Final year, it changed into PayPal who had passion in BitGo. CoinDesk experiences that the funds huge offered $750 million in cash for BitGo to no avail. PayPal later bought Curv, a BitGo competitor.

Galaxy right this moment made headlines by submitting for a bitcoin-ETF with the SEC final week.

Square and ARK Make investments Imagine Bitcoin Mining Promotes Green Strength

A overview paper launched by Square’s Bitcoin Natty Strength Initiative, with relief from ARK Make investments, lays out a imaginative and prescient for the most effective device bitcoin mining may perchance maybe well lag up the adoption of renewable vitality sources.

It makes the case that Bitcoin miners are vitality patrons with uncommon attributes: they’re regularly grew to alter into on or off at any time and are utterly utter agnostic. Plus, they pay out in a liquid cryptocurrency. The paper calls Bitcoin miners “an vitality buyer of final resort that will more than likely be grew to alter into on or off at a moment’s watch wherever within the world.” It then affords statistics exhibiting that unsubsidized portray voltaic and wind vitality is now about 3-4 cents/kWh and a pair of-5 cents/kWh, respectively, while the average payment for fossil fuels similar to coal or pure gasoline is 5-7 cents/kWh. The paper then describes a anguish in renewable vitality known as “the duck curve,” wherein vitality quiz is most intelligent within the unhurried afternoon and early evening, while portray voltaic vitality is most grand for the length of the day, and wind tends to blow more closely at evening.

Whereas batteries will play a extremely crucial characteristic in storing renewable vitality, the paper suggests that bitcoin miners are “a beautiful complementary technology for renewables and storage.” Doing so would relief more portray voltaic and wind initiatives earn cash, allow more portray voltaic and wind initiatives in places no longer as successfully-connected to the grid, and present the grid readily readily accessible excess vitality for in particular sizzling or frigid, and, due to this truth, vitality-intensive days. Moreover, they add, it may perchance maybe maybe maybe spur “a huge transformation and greening of the bitcoin mining commerce.”

5 Headlines to Spoil Down Dogecoin’s Loopy Week

- The Dogecoin community chosen April twentieth, aka 4/20, as “dogeday,” with plans to send the memetic coin to the moon, or, a minimum of, to 69 cents per coin.

- Dogecoin’s market cap reached $54 billion this week, more than doubling Ethereum’s market cap appropriate twelve months prior.

- Consistent with The Block, institutional merchants are entering into on the Dogecoin payment stream, with some market makers and OTC desks handling million-greenback trades in DOGE.

- A person the utilization of the moniker “Doge community” reportedly donated earnings from her a success Dogecoin funding to a canines refuge in Florida, paying for the whole donation costs of canines ready to be adopted.

- Joe Weisenthal, govt editor at Bloomberg, wrote, in I take into consideration all seriousness, “Dogecoin’s so-known as ‘monetary protection’ will more than likely be higher than Bitcoin’s.”

Fun headlines apart, Dogecoin did no longer are residing up to its hang moon-high expectations for April twentieth, with the coin indubitably shedding ~20% over the 24-hour duration.

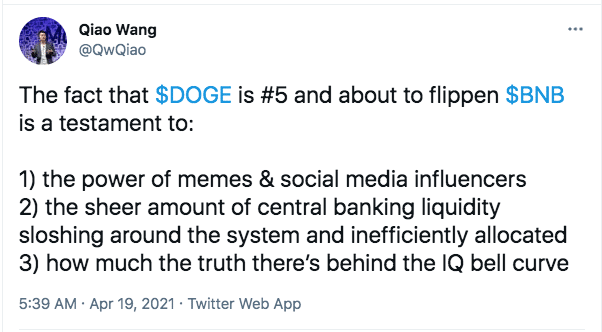

I believed Qiao Wang, feeble co-founding father of Messari, summed up the loopy week in Dogecoin most intelligent:

Disclosure — I honestly ponder Dogecoin’s payment stream changed into appropriate shy of a pump and dump and I indubitably feel sad for the many folk that positively misplaced cash on it. Nonetheless, the price stream, community, and commerce passion resulted in its inclusion in Fun Bits.

Source credit : unchainedcrypto.com