$1T, $40k, $1,200

A file week

Joyful Sleek Year! The crypto market has started 2021 off with a bang, with its entire market cap crossing $1 trillion. Bitcoin continues to rocket to new all-time highs, hitting $40k, while Ethereum is additionally on the pass, reaching prices no longer considered since January of 2018. And in vogue crypto change Coinbase is feeling the burden of file amounts of web visitors.

In assorted news, the OCC says that banks are free to make use of stablecoins for payments and diverse actions, a tall step forward for digital currencies within the mainstream monetary world. Ripple investors and XRP whales continue to react to news of the SEC’s lawsuit against Ripple. And Coinbase has acknowledged they are going to be a part of a16z in court to scenario the SEC’s proposed crypto pockets tips, will maintain to nonetheless they change into law.

Moreover, Vitalik published a recordsdata to rollups on Ethereum that’s a need to-learn for somebody recurring about scalability. And ShapeShift goes DeFi, leaving within the reduction of know-your-buyer rules.

On Unchained, now we maintain a panel on central bank digital currencies, and on Unconfirmed, Frank Chaparro of the Block and I focus on what we mediate will be the immense crypto reviews in 2021, and his predictions for the yr. And within the occasion you missed it preferrred week, we lined the highlights of 2020 on Unchained, and I gave fragment 2 of my holiday AMA.

This Week’s Crypto News…

Entire Crypto Market Cap Reaches $1 Trillion for the First Time

With runt hype in contrast with 2017, the complete market capitalization of cryptocurrencies reached $1 trillion for the first time on Wednesday, with Bitcoin hovering to $37,000 three hours after surpassing a brand new all-time excessive of $36,000. As of press time, the worth breached $40,000 for the first time, a tall milestone for the 12-yr-veteran cryptocurrency. JP Morgan analysts speculate that Bitcoin’s tag might well per chance reach $146,000 over the very prolonged timeframe, with their strategists asserting that the king of crypto is competing with gold for investment flows. Meanwhile, number two crypto Ethereum has surpassed $1,200, a tag stage no longer considered since the preferrred bubble in the starting up put of 2018.

Amid these excessive-flying prices, The Block reports that cryptocurrency exchanges are seeing excessive ranges of visitors, with entire visits in December by myself reached 196 million, up from 79 million a yr prior. Coinbase, which is challenging to be going public later this yr, struggled with connectivity factors for six hours on Wednesday earlier than lastly resolving the distress.

OCC Says Banks Can Use Stablecoins

The Administrative center of the Comptroller of the Forex published an interpretive letter on Monday asserting federally regulated banks might well use stablecoins for payments and diverse actions. They may be able to additionally take part in blockchain networks. Kristin Smith, executive director of the Blockchain Affiliation, tweeted, “the letter states that blockchains maintain the identical fame as assorted global monetary networks, equivalent to SWIFT, ACH and FedWire.”

Ripple and XRP Roundup

The fallout continues for Ripple after the SEC launched it used to be submitting charges against the firm and two executives preferrred month. Tetragon, the lead investor of Ripple’s $200 million Sequence C funding, has filed swimsuit against the firm in light of the SEC’s charges. The criticism seeks to “place in power its contractual appropriate to require Ripple to redeem” its Sequence C preferred inventory — or in undeniable English, give its money reduction. Tetragon is additionally making an strive to freeze Ripple from using any liquid assets unless this payment is made.

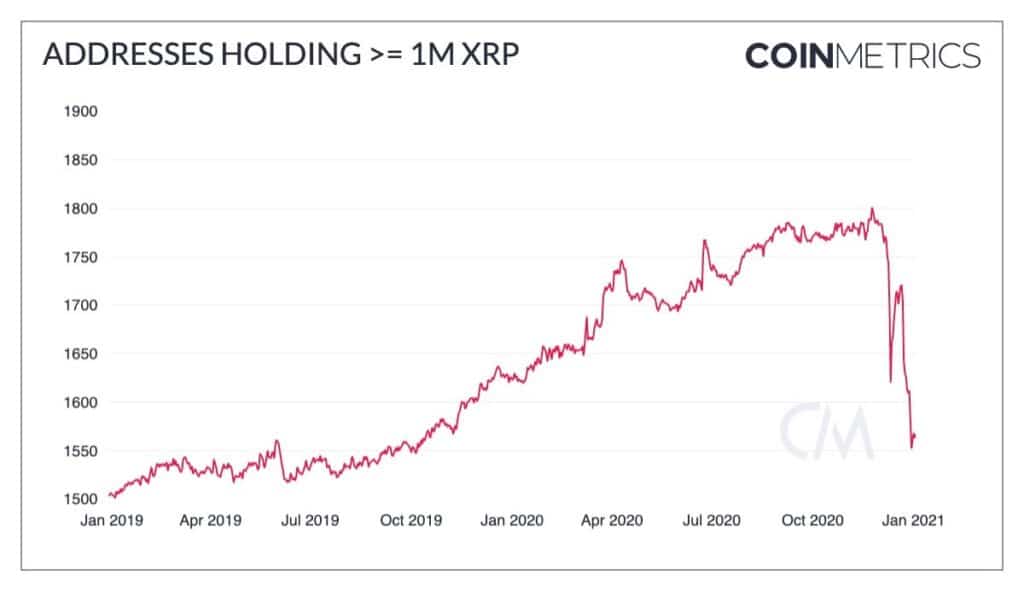

For the explanation that SEC launched the lawsuit, the option of XRP whale addresses has fallen more than 8% as many prominent crypto exchanges maintain delisted or suspended XRP shopping and selling.

Companies to maintain launched delistings and shopping and selling suspensions consist of Coinbase, Crypto.com [disclosure: a sponsor of my shows], Genesis, Blockchain.com and Binance US. Grayscale has additionally removed XRP from its Gigantic Cap Crypto Fund and halted new subscriptions to the Grayscale XRP Have faith. Bitwise has additionally liquidated its blueprint in XRP from its Bitwise 10 Crypto Index Fund.

Coinbase and a16z Prepare Self-discipline to Proposed Crypto Pockets Principles

High crypto change Coinbase and mission capital agency Andreessen Horowitz are planning to scenario in court the Monetary Crimes Enforcement Community’s proposed crypto pockets tips will maintain to nonetheless they change into law. Coinbase CEO Brian Armstrong and a16z’s Kathryn Haun launched their intentions in dual tweets on Monday. Haun, a ragged federal prosecutor, acknowledged the proposed tips by FinCEN to discipline all crypto wallets, at the side of of us who’re self-hosted, to know-your-buyer and reporting necessities would maintain “many foreseeable and unintended negative penalties.”

The guideline is additionally being criticized for ensuing from the rushed direction of wherein it is being notion to be. As Jerry Brito of Coin Center tweeted out, the fashioned unswerving closing date given used to be January 4. On the different hand, on that day, the closing date used to be extended to January 7, with a quiet trade on the web fame. As he tweeted, “Commenters raced to honor the Jan 4 closing date and had been on no account notified of a trade earlier than the pause of that day. Consequently they had been successfully afforded no longer the promised 15 days however handiest 12.” He added, “Severe commenters … might well per chance maintain outdated the 3 further days.” This lends more gas to the competition that the direction of violates the Administrative Procedures Act.

Vitalik Breaks Down Rollups

Scalability has been the immense distress coping with Ethereum — properly, ever since inception — however even more urgently, since 2017. This week, creator Vitalik Buterin published a put up explaining the adaptations between the three valuable forms of layer-2 scaling currently available: channels, Plasma, and rollups, however does a deep dive on rollups to exhibit why they “are poised to be the principle scalability resolution for Ethereum for the foreseeable future.” There might be a detailed explanation of the 2 assorted forms of rollups — Optimistic rollups and ZK rollups — at the side of a chart laying out the tradeoffs between the 2 and how noteworthy scaling it is doubtless you’ll well per chance per chance also search recordsdata from to receive with rollups. Vitalik’s take is, “within the brief timeframe, optimistic rollups are inclined to get out for general-honest EVM computation and ZK rollups are inclined to get out for easy payments, change and diverse application-particular use cases, however within the medium to very prolonged timeframe ZK rollups will get out in all use cases as ZK-SNARK expertise improves.”

ShapeShift Goes Full DeFi

ShapeShift CEO Erik Voorhees launched on Wednesday that the shopping and selling platform “has integrated decentralized change protocols and is sunsetting its 6+ yr industry of shopping and selling with possibilities.” The trade skill that ShapeShift customers will no longer be required to provide private figuring out recordsdata to make use of its services and products. In its put, it has integrated with dexes at the side of Uniswap, Balancer, Curve, Bancor, Kyber, 0x and half of a dozen assorted dexes. Voorhees says this would well enable Shapeshift derive entry to to more jurisdictions, since the firm will no longer be an intermediary.

The Block’s 2020 Year in Review

The Block published its yearly evaluate, highlighting what it calls “ten developments that solidified the vogue forward for cryptocurrencies in 2020.” The recap begins with, obviously, the ideal myth of the yr — Bitcoin — noting its entire market worth crossed $500 billion. The emergence of stablecoins as critical infrastructure and the upward thrust of DeFi are additionally lined, retail and service provider derive entry to by Sq. and PayPal, and more. It’s a appropriate, entire peek at the precious developments of preferrred yr, and ends on law, which I mediate we’ll expect is a immense driver of reports this yr.

XRP Military Storms SEC

Meander away it to Crypto Twitter to make a mashup of immense news from the crypto world — the SEC’s lawsuit against Ripple — and the particular world, on this case, the mob that stormed Capitol Hill on Wednesday.

Smol ting tweeted — obviously in all caps — “BREAKING NEWS: $XRP ARMY HAS STORMED SEC HEADQUARTERS”

Source credit : unchainedcrypto.com